Singapore's property tax revenue expected to increase by S$600m due to higher home valuations

Private properties and HDB blocks in Singapore (File photo: CNA/Jeremy Long)

This audio is generated by an AI tool.

SINGAPORE: Singapore's residential property tax revenue for 2024 is expected to be around S$600 million (US$446 million) higher than what was collected in 2023, said Second Minister for Finance Chee Hong Tat on Tuesday (Feb 6).

Around two-thirds of the increase is contributed by non-owner occupied properties, he added.

Mr Chee was responding to parliamentary questions by Leader of the Opposition and Workers' Party chief Pritam Singh, who asked how much additional property taxes the government expects to collect in 2024, following the announcement in November last year that such taxes for most homes would go up again.

In a follow-up question, Mr Singh also asked Mr Chee to clarify the difference between the additional S$600 million expected and an estimate given at Budget 2022, when Finance Minister Lawrence Wong said Singapore’s property tax revenue was projected to go up by about S$380 million after a two-step hike to the tax rate.

Mr Chee, who is also Transport Minister, said the higher than expected tax collection for 2024 was largely due to higher annual values (AV), that arose as a result of higher market rentals for residential properties.

Property tax is calculated based on AV, which is the estimated annual rent of the property.

Mr Chee explained that the Inland Revenue Authority of Singapore (IRAS) takes reference from rental transactions for similar properties in the year, and also takes into account a property's location, age, land and floor area, improvement works done as well as features like swimming pools.

For 2024, most owner-occupied residential properties saw their AV increase by more than 20 per cent, he said.

Mr Chee pointed out that taxes on owner-occupied properties are lower and there are rebates to cushion the impact for such owners.

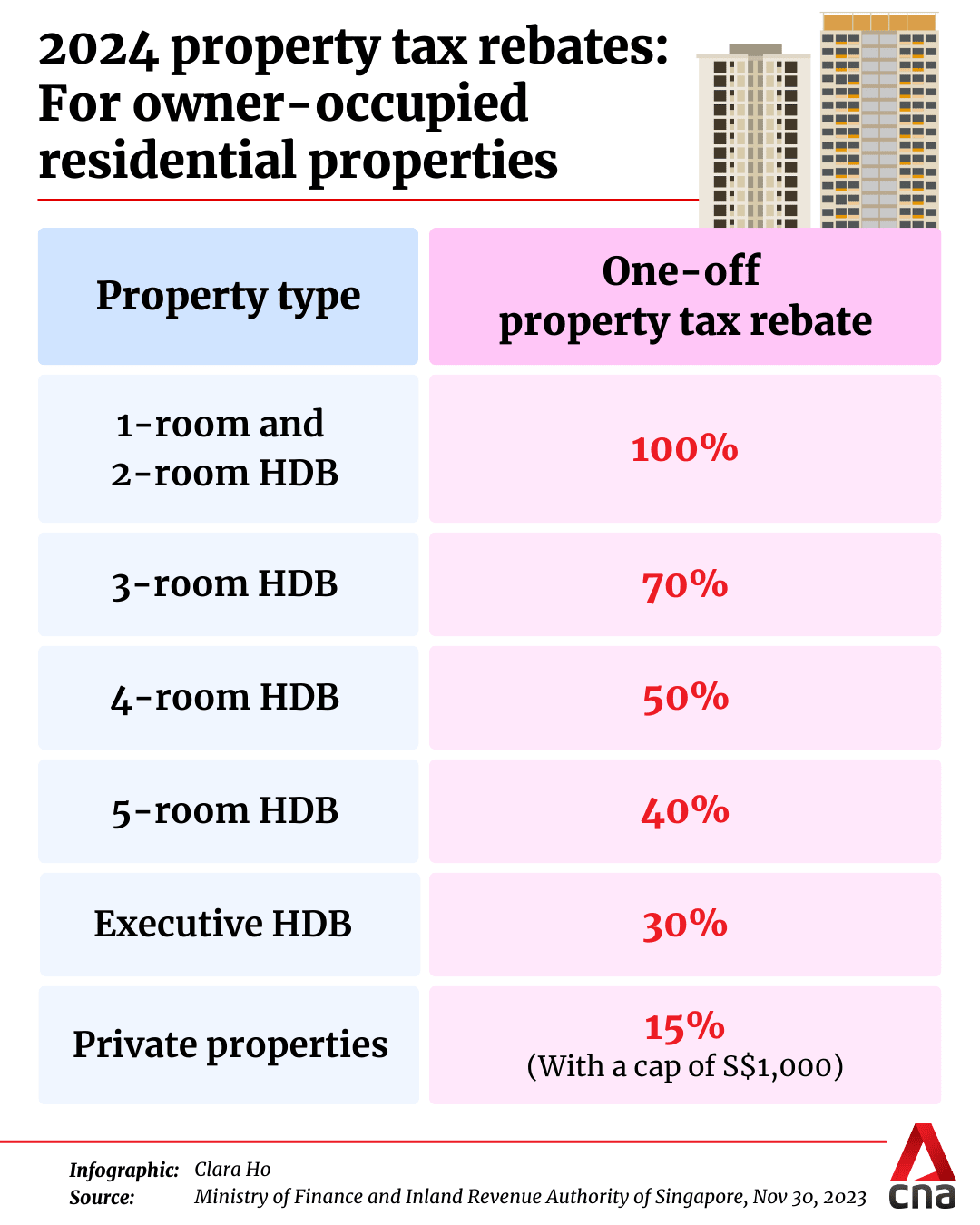

In November, the Ministry of Finance (MOF) and IRAS said the government will give a one-off rebate of up to 100 per cent on owner-occupied properties.

This ranges from 100 per cent for one and two-room Housing Board flats, to 15 per cent (capped at S$1,000) for private property owners.

"With the rebate, owner-occupiers of HDB one- and two-room flats continue to pay no property tax," said Mr Chee.

"For owner-occupiers of other HDB flat types, the average (property tax) increase is less than S$3 per month.

"For half of private property owner-occupiers, their increase in (property tax) is less than S$15 per month."

Other MPs also asked about future property rebates and voiced concerns from their retired residents living in private properties, about the "hefty" increase in taxes for them.

Mr Chee said that the government was prepared to consider if future rebates are needed when it reviews these issues.

"We are open to exploring whether there are other ways to help seniors and retirees who are staying in private properties who may need a bit more time to pay for their property taxes by installment," he added.