Property tax to go up for most homes again in 2024; government will give one-off rebate of up to 100%

Owner-occupiers of one-room and two-room HDB flats will continue not having to pay property tax in 2024.

This audio is generated by an AI tool.

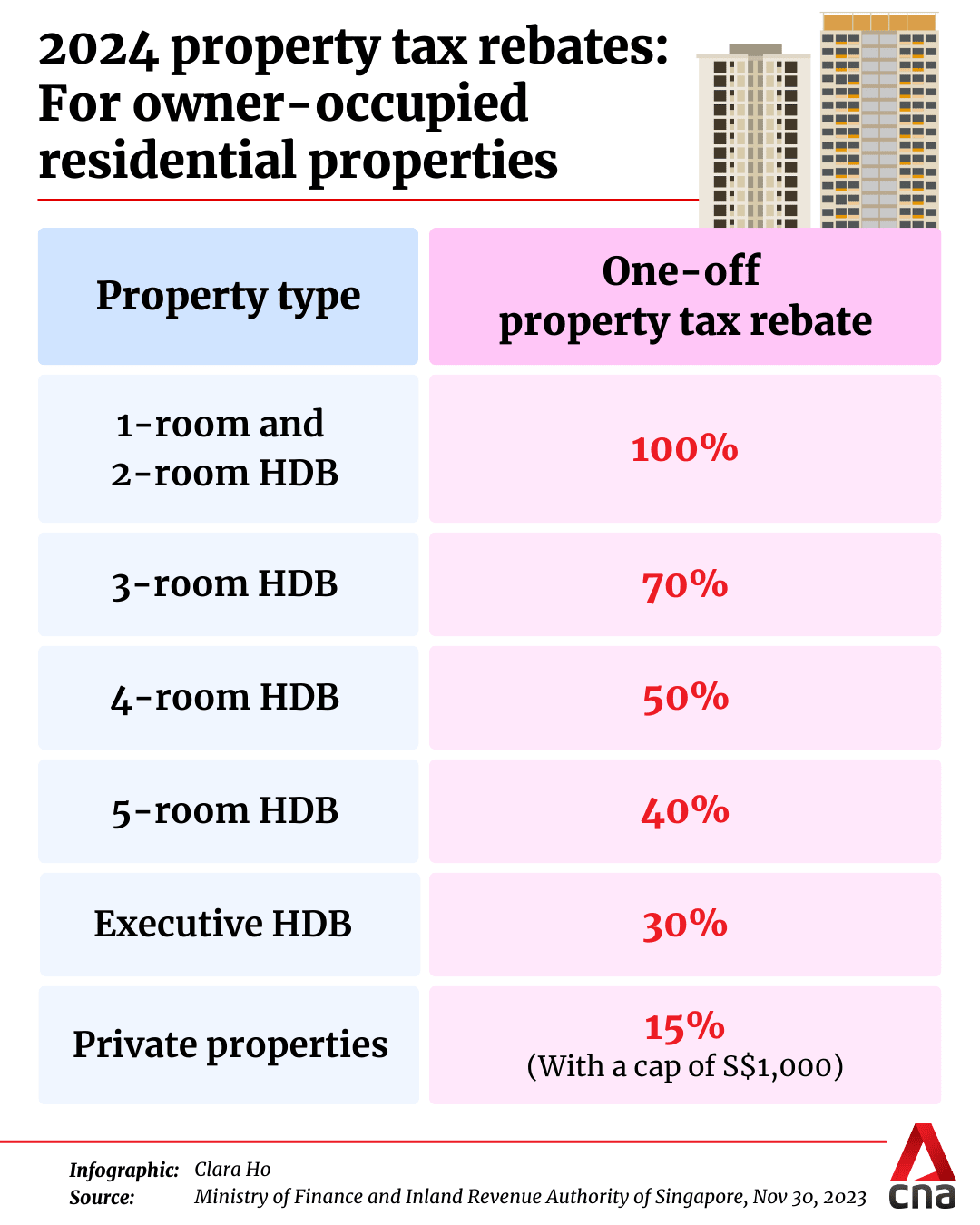

SINGAPORE: With property taxes for most homes set to rise once more next year, the government will provide a one-off rebate of up to 100 per cent to cushion the impact on affected property owners amid cost-of-living concerns.

The rise in taxes involve both Housing Board (HDB) flats and private properties.

Property taxes will go up as market rents and annual values for most residential properties have risen, while property tax rates have also increased for higher-value private residential properties, said the Ministry of Finance (MOF) and the Inland Revenue Authority of Singapore (IRAS) on Thursday (Nov 30).

The one-off rebate of up to 100 per cent applies to all owner-occupied residential properties.

The rebate will be tiered “to ensure that our property tax regime remains progressive, and those with greater means pay their fair share of taxes”, said MOF and IRAS.

Property taxes for most homes similarly went up in 2023 following a yearly review of properties’ annual values, which are used to compute the tax payable by property owners. The government provided a one-off 60 per cent rebate for all owner-occupied properties then, up to a maximum of S$60 (US$45).

The annual values of HDB flats and most private residential properties will increase with effect from Jan 1, 2024 to reflect the rise in market rents, said MOF and IRAS.

As announced in Budget 2022, the second and final step of the property tax rate increase will also take effect then. This will affect only non-owner-occupied residential properties, as well as owner-occupied residential properties with an annual value of more than S$30,000.

HDB flats that are occupied by their owners will not be affected. Owner-occupied residential properties will continue to have lower property tax rates than residential properties which are rented out, said MOF and IRAS.

A property’s annual value is the estimated gross annual rent if it were to be rented out – excluding furniture, furnishings and maintenance fees.

Annual value is calculated based on market rentals of similar or comparable properties, not on the actual rental income received.

Property size, the condition of the property, location and other relevant physical attributes are also taken into account when determining annual values.

WHAT IS THE TAX PAYABLE?

With the rebate, owner-occupiers of one-room and two-room HDB flats will continue not having to pay property tax in 2024, said MOF and IRAS.

For owner-occupiers in other HDB flat types, the rebate will be automatically offset against any property tax payable, with an average tax increase of less than S$3 per month in 2024.

| HDB Flat Type | Average Property Tax Payable in 2024 (After Rebate) | Average Increase in Property Tax Payable (After Rebate) |

|---|---|---|

| 3-room flat | S$4.10 per month | S$1.50 per month |

| 4-room flat | S$12.80 per month | S$2.40 per month |

| 5-room flat | S$17.90 per month | S$4.30 per month |

| Executive HDB | S$22.30 per month | S$6.30 per month |

As for owner-occupiers of private properties, the rebate will similarly be automatically offset against any property tax payable.

Property tax for the bottom half of private property owner-occupiers will increase by less than S$15 a month, while the tax increase will be higher for those with higher-value properties.

With the increase in property tax, the government also announced on Thursday that it will increase the annual value thresholds used across social support schemes – such as MediShield Life premium subsidies – from Jan 1, 2024. This is to ensure that Singaporeans with greater needs continue to receive support.

The annual value of an individual's or household's residential property may be used as an indicator of means, along with criteria such as income.

REMINDER TO PAY TAX

IRAS also reminded all property owners to pay their property tax for 2024 by Jan 31. Those facing financial difficulties can approach IRAS to discuss a suitable payment plan before that.

Property owners can also appeal for a longer payment plan through the “Apply for payment plan” e-service at myTax Portal using their Singpass accounts.

A 5 per cent penalty will be imposed for those who fail to pay or have not arranged to pay their taxes via GIRO instalments by the due date.

Property owners will receive their property tax bills before the end of December.