CNA Explains: How will the closure of CPF Special Accounts affect those 55 and older?

What exactly was announced by Deputy Prime Minister Lawrence Wong at Budget 2024, and why did the government move to address what experts are calling a CPF "anomaly"?

Senior citizens in Singapore watch a checkers game. (File photo: AFP/ROSLAN RAHMAN)

This audio is generated by an AI tool.

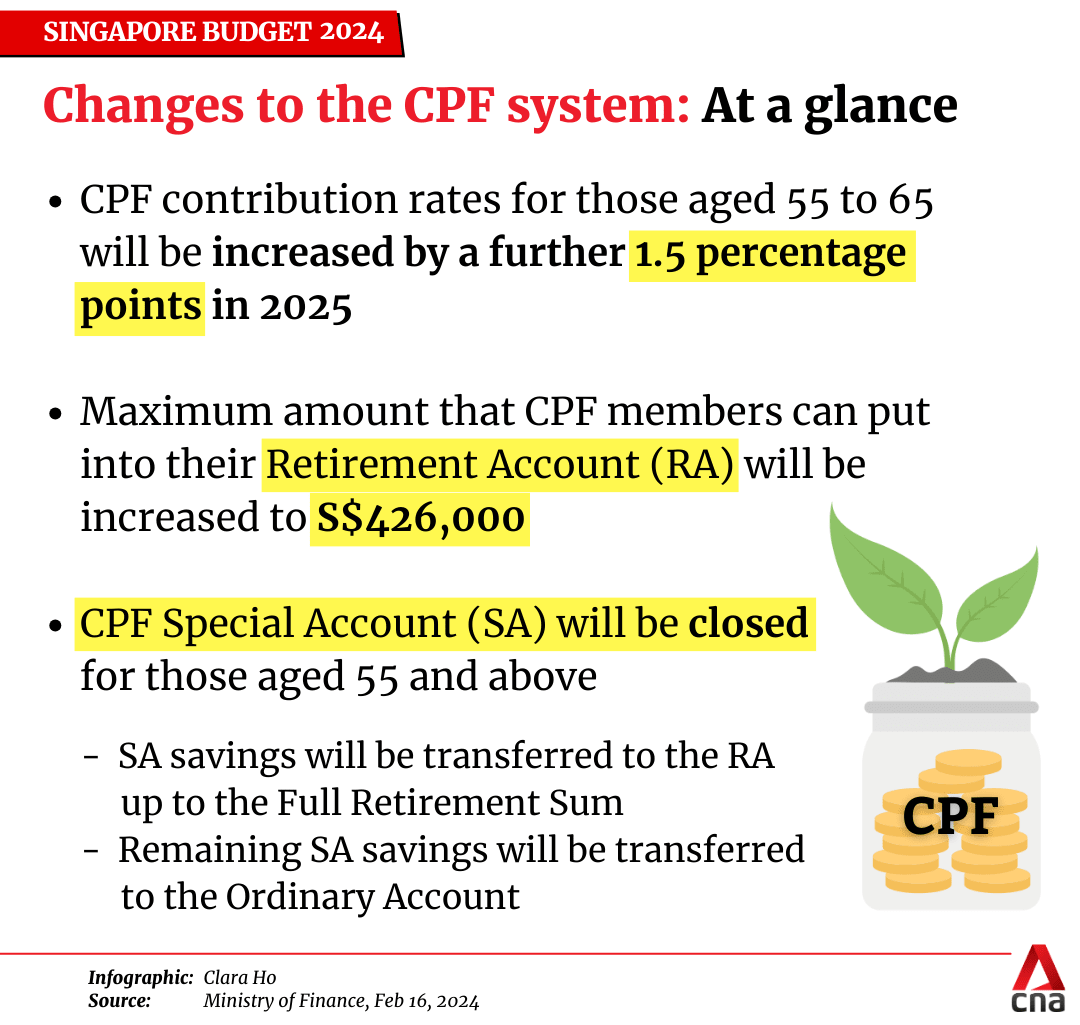

SINGAPORE: A slew of changes to the Central Provident Fund (CPF) system - a savings plan for Singaporeans - was announced at Budget 2024 on Friday (Feb 16).

And among them, the decision to close Special Accounts - meant for retirement savings and investments - for those aged 55 and older drew strong reactions online.

Some complained about lower interest rates of the Ordinary Account - typically used for housing and education - and restrictions on withdrawing savings.

Others however pointed out that funds in Retirement Accounts earn the same interest rates as in Special Accounts.

How will the closure work?

When CPF members reach the age of 55, their savings are transferred to a newly created Retirement Account. The amount transferred can go up to what’s known as the Full Retirement Sum - which is two times the Basic Sum as calculated with reference to Singapore's Household Expenditure Survey.

The Full Retirement Sum provides an ideal point of reference as to how much one needs in retirement.

Savings from Special Accounts are transferred first, followed by funds from Ordinary Accounts.

But from 2025, Special Accounts will be closed for those at least 55 years old.

If there’s still money in a Special Account at this point, it will be transferred to the Retirement Account.

Both the Special Account and Retirement Account currently earn 4.08 per cent interest per annum. The Ordinary Account earns 2.5 per cent per annum.

For those who are still working, the share of their CPF contributions which would normally be deposited in the Special Account will go into the Retirement Account instead.

If the Full Retirement Sum has already been reached in the Retirement Account, funds that would usually be in the Special Account will be diverted to the Ordinary Account.

Why is the government doing this?

The Ministry of Finance said savings in the Special Account, some of which can be withdrawn anytime for members aged 55 and older, should not be earning a higher interest rate.

“As a principle, only savings that cannot be withdrawn on demand should earn the long-term interest rate, and savings that can be withdrawn on demand should earn the short-term interest rate,” said the ministry.

This view was echoed by economist Akshar Saxena from Nanyang Technological University.

“They wanted to align the trade-off between liquidity and the market return you get,” he told CNA.

“Traditionally, in bank accounts, if you have a fixed deposit account – which … you cannot withdraw from – you will get the highest amount of return.”

“In the (Special Account) there was this anomaly where you could withdraw the amount for your cash after (reaching the Full Retirement Sum), you could invest it, but you’re still getting very high returns,” Assistant Professor Saxena said.

“By now closing that, I think that anomaly has been removed.”

Who’s affected, and how?

One group to be impacted is CPF members who have already saved the Full Retirement Sum. Their Special Account funds and any new contributions will be channelled to their Ordinary Accounts, where they can withdraw any amount on demand. But as pointed out, they will earn lower interest rates than if their Special Accounts remained open.

One alternative is to use savings from the Ordinary Account to top up their Retirement Accounts to the Enhanced Retirement Sum – the maximum amount allowed – to earn higher interest rates, though withdrawals will be limited.

CPF Board said on Saturday that more than 99 per cent of members aged 55 and older will be able to transfer all their Special Account savings to their Retirement Accounts when the Enhanced Retirement Sum is raised to four times the Basic Sum next year.

Mr Alfred Chia, chief executive officer of the SingCapital financial advisory, noted that such a transfer is "irreversible".

Transfers to the Retirement Account will increase monthly payouts in future, but members born 1958 and after can only withdraw up to 20 per cent of their Retirement Account savings after they turn 65. This amount includes S$5,000 which they can withdraw from the age of 55.

“For members who had enjoyed higher interest in (Special Accounts) with the flexibility of ‘on-demand withdrawal’, they will have to recalibrate their saving strategies,” said Mr Chia.

Another group of people affected would be those who invest their Special Account savings. After these accounts are closed, any proceeds will be paid to the Retirement Account, or Ordinary Account if the Full Retirement Sum has been reached.

And a small group who invest to prevent their Special Account savings from being transferred to the Retirement Account - a practice known as Special Account “shielding” - will also be affected.

These people typically liquidate their investments shortly after turning 55, to retain funds in their Special Accounts to enjoy the flexibility and higher interest rates.

“It only benefitted a very small segment of the population; very high-income individuals. It wasn’t really a policy intent,” said Associate Professor Walter Theseira of the Singapore University of Social Sciences.

“Removing this loophole is probably a good thing.”