Budget 2024: 6 key takeaways, from CPF changes to more CDC vouchers and less property tax

Deputy Prime Minister Lawrence Wong delivering the Budget 2024 speech in parliament on Feb 16, 2024.

This audio is generated by an AI tool.

SINGAPORE: Deputy Prime Minister Lawrence Wong on Friday (Feb 16) announced several financial measures to help both Singaporeans and businesses in his Budget speech.

These included more payouts to alleviate cost-of-living concerns, moves to make preschools more affordable and a new SkillsFuture Level-Up Programme to help mid-career workers.

Here are six key takeaways from the Budget speech:

1. Financial aid

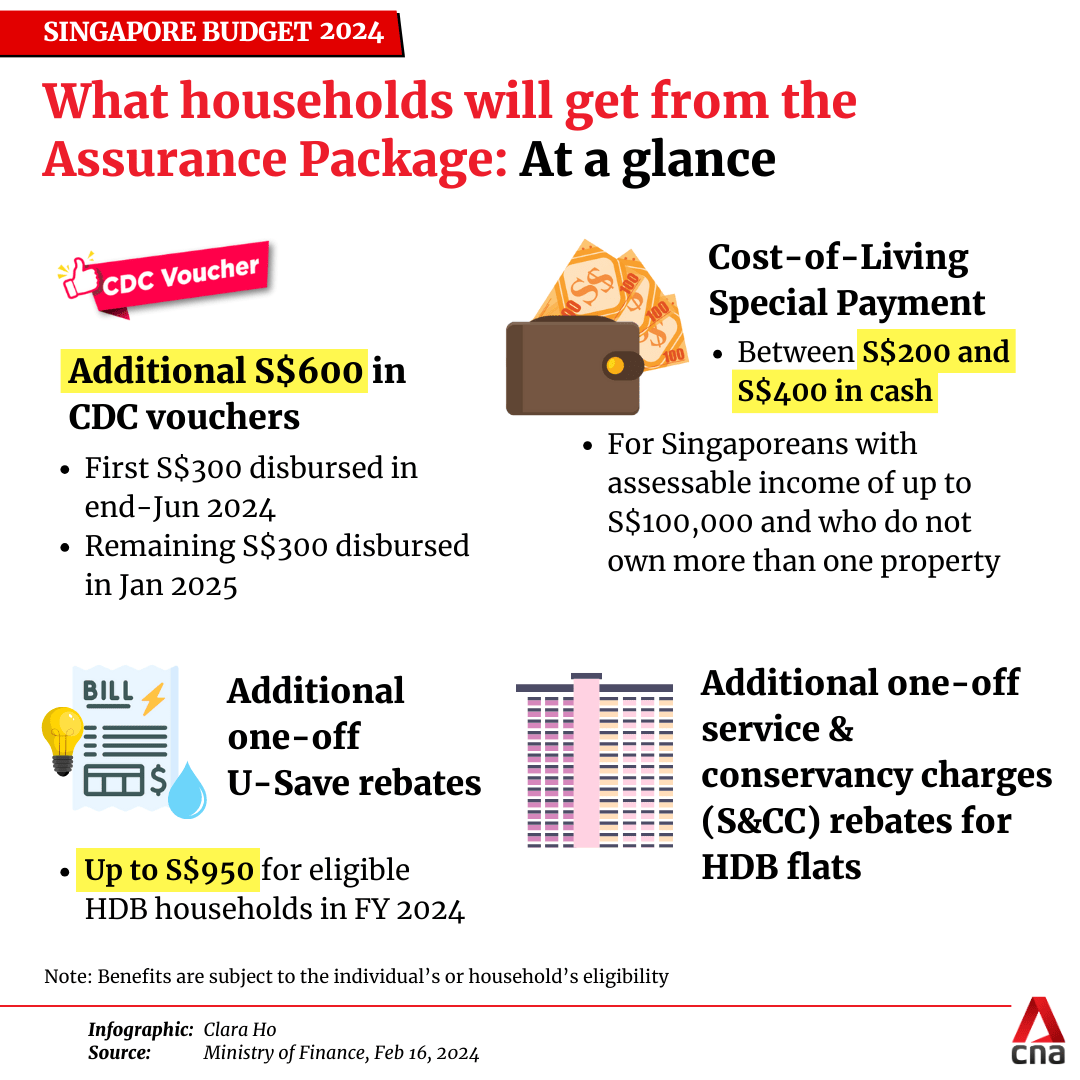

Singaporeans will get more government payouts such as Community Development Council (CDC) vouchers.

All households will receive another S$600 in CDC vouchers. Half of this will be given out at the end of June and the other half in January 2025.

Adult Singaporeans who live in Singapore, do not own more than one property and have assessable incomes of up to S$100,000 will receive between S$200 and S$400 in a cost-of-living “special payment”.

Those aged between 21 and 50 will receive a one-time MediSave bonus of between S$100 and S$300 in December.

All past and present national servicemen, including those enlisting by Dec 31, 2024, will receive S$200 in LifeSG credits in November.

A personal income tax rebate of 50 per cent will kick in, in the year of assessment 2024. This will be capped at S$200 to mainly benefit middle-income workers.

And low-wage workers who earn S$3,000 a month or less will qualify for the Workfare Income Supplement Scheme from January 2025. The scheme provides cash payouts and Central Provident Fund (CPF) top-ups as an incentive to keep working and saving for retirement. The current qualifying monthly salary is S$2,500.

2. Supporting families

Mr Wong also announced a raft of measures to make preschools more affordable, especially for lower-income households.

Monthly full-day childcare fee caps in government-supported preschools will be lowered in 2025, with another move to lower fee caps the following year.

Children from lower-income families, including those with non-working mothers, will receive the higher subsidies currently given to children with working mothers.

Lower-income families with young children will also get more help through new ComLink+ Progress Packages, including top-ups to a Child Development Account if they ensure a child’s preschool enrolment and regular attendance.

Families in ComLink+ can also receive financial top-ups when they make progress on long-term goals while working with family coaches.

Separately, to help families of children with special needs, the government will reduce the maximum monthly fees at special education schools to S$90 – down from S$150 currently.

Fee caps at all special student care centres will also be lowered to reduce families' out-of-pocket expenses.

More couples who have already booked Build-to-Order flats, but are waiting for them to be completed, will be able to rent a Housing Board flat in the open market. The government will provide a Parenthood Provisional Housing Scheme (Open Market) voucher for one year.

Measures to make preschools more affordable in Singapore were announced by Deputy Prime Minister and Finance Minister Lawrence Wong on Friday (Feb 16), during his #Budget2024 speech in Parliament. The monthly childcare fee caps in Government-supported preschools will be reduced in 2025 to S$640 for Anchor Operators and S$680 for Partner Operators.

3. SkillsFuture measures

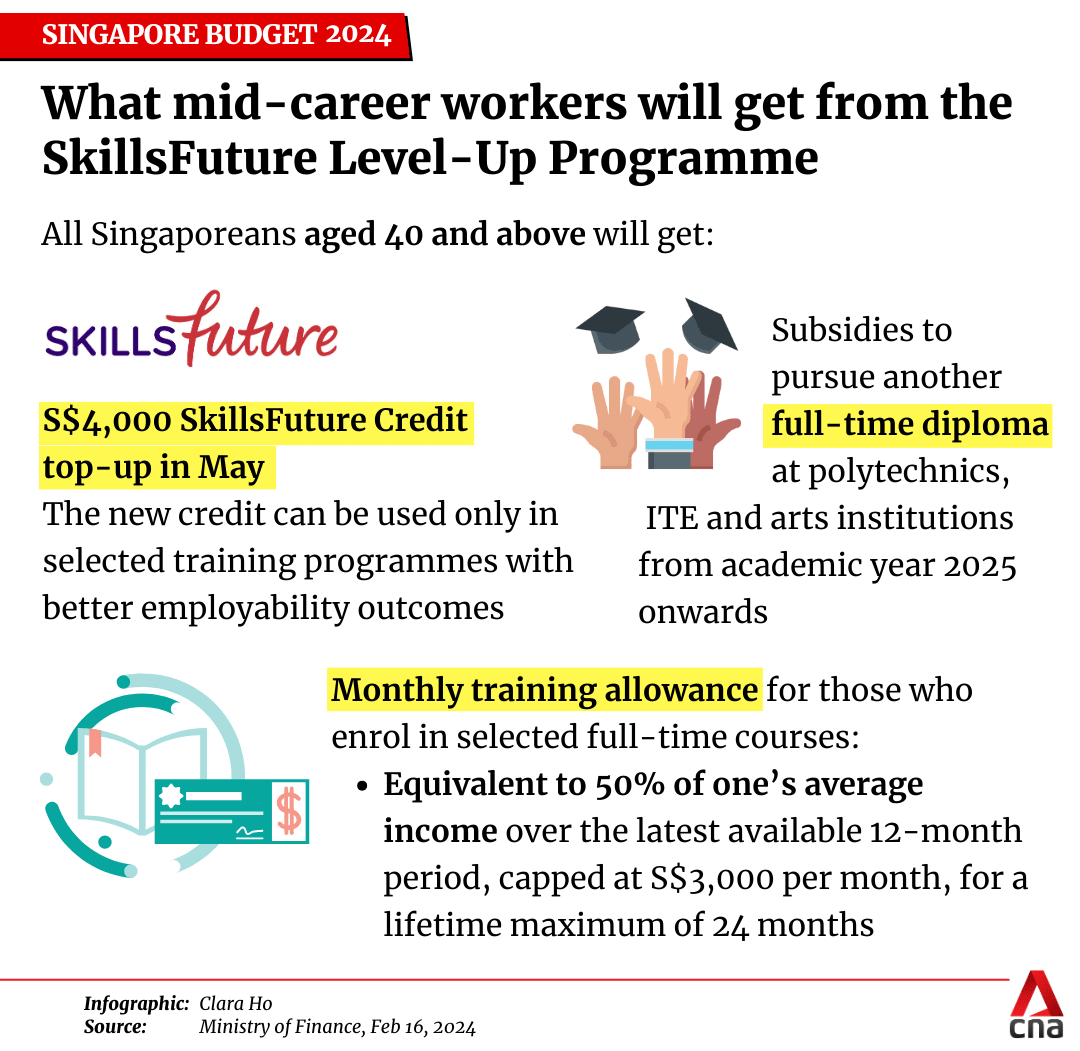

Mr Wong introduced some moves to boost the national SkillsFuture movement.

A new Level-Up Programme will be introduced to better support mid-career workers – that is, Singaporeans aged 40 or above. These are what they will receive:

- S$4,000 more in SkillsFuture credit in May, to be used for selected training programmes. Younger Singaporeans will get the top-up when they turn 40

- Subsidies to pursue another full-time diploma at polytechnics, Institute of Technical Education (ITE) and arts institutions from the 2025 academic year

- Monthly training allowances for selected full-time courses, capped at S$3,000 a month

As for retrenched workers, the government is working out the parameters of a new temporary financial support scheme to help them while they undergo training or look for another job. More details about the scheme will be revealed later this year.

4. CPF changes

CPF members aged 55 or above can get bigger monthly payouts from next year onwards, because they will be able to put more money into their Retirement Accounts.

The Enhanced Retirement Sum, which is the maximum amount that CPF members can put into their Retirement Accounts to receive payouts, will be increased from three times to four times the Basic Retirement Sum.

The Special Account will be closed for those 55 years old and above, with savings in the account transferred to the Retirement Account up to the Full Retirement Sum, which is two times the basic sum. Remaining savings will be transferred to the Ordinary Account.

Seniors above the age of 70 will also be eligible for dollar-for-dollar matching for cash top-ups to their CPF accounts from next year onwards, under the Matched Retirement Savings Scheme.

CPF contribution rates for older workers will also increase as planned. The rate for workers aged 55 to 65 will rise by 1.5 percentage points next year.

The CPF contribution rates for those aged 55 to 65 will increase by a further 1.5 percentage points in 2025, announced Deputy Prime Minister and Finance Minister Lawrence Wong in his #Budget2024 speech on Friday (Feb 16). He also announced an increase in the Enhanced Retirement Sum from next year.

5. Property-related taxes

Some home owners will pay less property tax when the annual value (AV) bands for owner-occupied properties are raised next year, assuming no change in their AV and before any rebate.

From Jan 1, 2025, the lowest AV band threshold will be raised from S$8,000 to S$12,000. The highest threshold will increase from over S$100,000 to over S$140,000. Corresponding adjustments will be made to bands in between.

This means home owners can expect to pay the same or lower property taxes at each band, assuming no change in their AVs and before any rebate.

Meanwhile, from Friday onwards, single Singaporeans aged 55 and above will also be able to get a refund of the additional buyer’s stamp duty (ABSD) paid on a second property. This is if they sell their first property within six months.

To address concerns about the cost of living, there will be a personal income tax rebate of 50 per cent for the Year of Assessment 2024, capped at S$200. Also, the annual value (AV) bands of owner-occupier residential property tax rates will be raised. Deputy Prime Minister and Finance Minister Lawrence Wong detailed the changes in his #Budget2024 speech in Parliament on Friday (Feb 16).

6. Ageing well

To help seniors age actively and stay socially connected, the government will set aside S$3.5 billion over the next decade for initiatives under Age Well SG.

Seniors can enjoy “silver upgrades” in the form of therapeutic gardens and barrier-free ramps in their estates, along with senior-friendly home fittings and bus stops with senior-friendly features.

More details about the Majulah Package were also announced. Singaporeans born in 1973 or earlier will receive at least one form of CPF top-up.

Editor's note: This article has been corrected to remove a reference to GST vouchers being handed out as part of this year's Budget. In fact, the GST Voucher Fund is being raised. We apologise for the error.