Budget 2024: S$3.5 billion to be set aside over next decade to help elderly age well

This audio is generated by an AI tool.

SINGAPORE: The government will set aside S$3.5 billion over the next decade for initiatives under Age Well SG, a national programme to help seniors to age actively, stay socially connected, and be cared for within their own communities, said Finance Minister Lawrence Wong in his Budget speech on Friday (Feb 16).

These include “silver upgrades” to residential estates in the form of therapeutic gardens and barrier-free ramps, as well as senior-friendly home fittings to help people live more independently and safely.

Other plans are improvements to commuter infrastructure for seniors’ mobility and safety in the form of more sheltered linkways, bus stops with senior-friendly features, as well as safer and more pedestrian-friendly roads. For seniors with care needs, the government will develop more assisted living options and better home care arrangements, added Mr Wong.

Age Well SG was announced by Prime Minister Lee Hsien Loong at his National Day Rally speech last year and is led by the health, transport and national development ministries.

“Preventive care is especially important for seniors. Loneliness can do great harm to a senior,” said Mr Wong. “They need to stay active and socially connected.”

Last year, it was announced that around S$800 million will go towards enhancing active ageing centres from the 2024 financial year through to FY2028 as part of Age Well SG.

Mr Wong explained that seniors can look forward to a wider range of programmes at these centres, from physical exercises to volunteering opportunities.

The Government’s “suite of investments” in education, housing, retirement and healthcare speaks to its “steadfast commitment” to address the needs of families and seniors, through every stage of life, he added.

“Through these investments, we will provide more assurance to all Singaporeans – to set minds at ease, improve lives and well-being, and ensure Singapore remains home truly for all of us,” Mr Wong said.

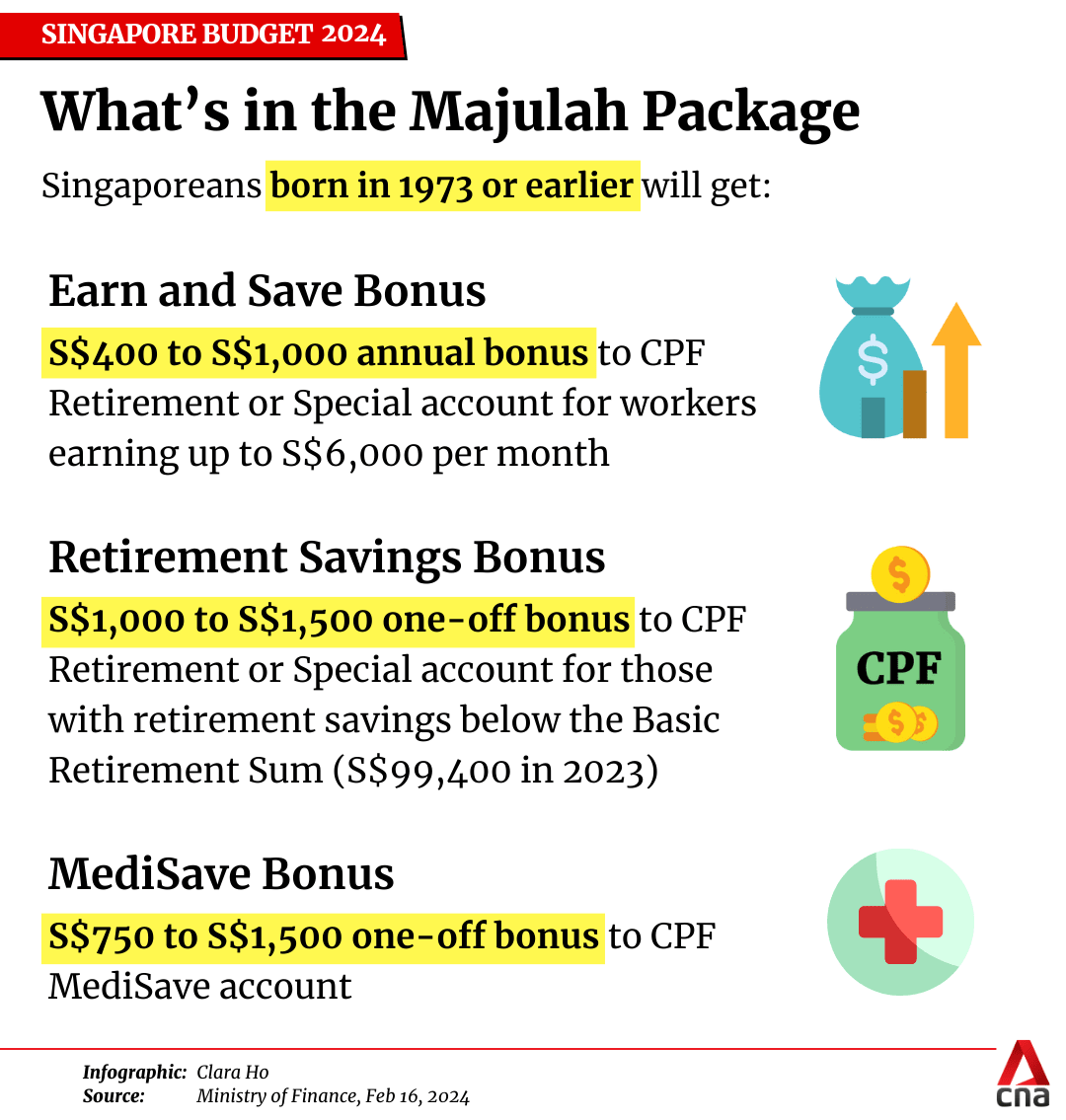

MORE DETAILS ON MAJULAH PACKAGE

Mr Wong also provided more details on the Majulah Package which was also announced by Mr Lee at his 2023 National Day Rally speech.

Singaporeans born in 1973 or earlier are eligible for CPF top-ups under the package. It consists of three components, an annual Earn and Save Bonus (ESB) for working seniors, a one-time Retirement Savings Bonus (RSB) for those who have not met the CPF Basic Retirement Sum and a one-time MediSave Bonus (MSB).

Elaborating on the components, the Finance Minister said that all Singaporeans born in 1973 or earlier will receive at least one form of CFP top-up.

According to the Ministry of Finance, those who work and have an average monthly income of between S$500 and S$6000, live in a residence with annual value of S$25,000 and below, and own not more than one property are eligible for the ESB.

The ESB will be tired by an individual’s average monthly income, with those earning between S$500 and S$2500 receiving the maximum bonus of S$1000. The first annual ESB will be credited to their CPF Retirement Account or Special Account in March next year.

Eligibility for the ESB will be assessed annually based on whether the individual has met the criteria in the previous year.

To receive the one-time RSB, individuals must have CPF retirement savings below the 2023 Basic Retirement Sum of S$99,400 as at end of 2022. They must also live in a residence with annual value of S$25,000 and below and own not more than one property as at end of last year.

The RSB will be tired by one’s CPF retirement savings, with those who have less than S$60,000 receiving the maximum of S$1,500. The RSB will be credited to their CPF Retirement Account or Special Account in December this year.

All Singaporeans born in 1973 or earlier will receive the MSB, which will be credited to CPF Medisave accounts in December this year.

The MSB will be tired based on one’s year of birth, the annual value of their residence, and whether they own more than one property as at end of last year. The maximum amount one can receive is S$1,500, higher than the previously announced $1,000.

The package will benefit about 1.6 million Singaporeans, at a total lifetime cost of S$8.2 billion, said Mr Wong.

To honour this commitment without “burdening” future generations, S$7.5 billion will be set aside in a new fund, the Majulah Package Fund. This will be enough to cover the lifetime cost of the package after accounting for investment income of the fund, he added.