Budget 2024: CPF Enhanced Retirement Sum to increase; Special Account to be closed for those 55 and above

CPF members aged 55 and above can receive estimated monthly payouts of up to S$3,330.

The Central Provident Fund (CPF) building in Bishan. (File photo: TODAY)

This audio is generated by an AI tool.

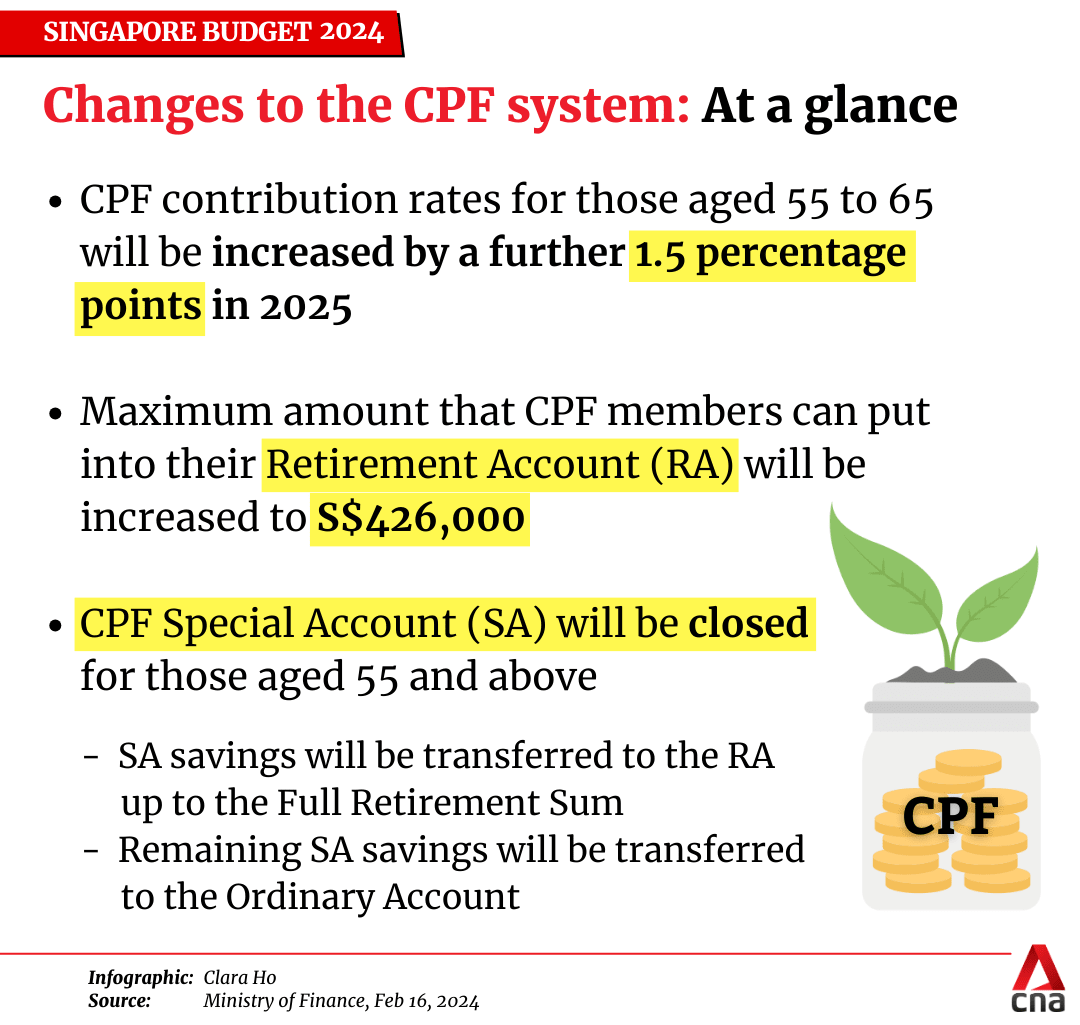

SINGAPORE: Central Provident Fund (CPF) members aged at least 55 will no longer have a Special Account from 2025 onwards, but they will be able to put more money into their Retirement Accounts, said Deputy Prime Minister Lawrence Wong in his Budget speech on Friday (Feb 16).

These moves are meant to better support the retirement needs of seniors in Singapore, he added.

The Enhanced Retirement Sum is the maximum amount that CPF members can put into their Retirement Accounts to receive payouts. It is currently set at three times the Basic Retirement Sum (BRS), but will be increased to four times the BRS next year.

“This will allow more members aged 55 and above to fully commit their accumulated CPF savings to receive higher payouts, should they wish to do so,” he said.

WHAT IT MEANS

Having more money in a CPF Retirement Account translates to bigger monthly payouts. According to the Ministry of Finance, a CPF member with three times the Basic Retirement Sum in 2025 can have an estimated monthly payout of S$2,530 (US$1,880).

By comparison, a member with four times the BRS next year - or S$426,000 - can receive an estimated monthly payout of S$3,330.

CPF members can voluntarily top up their Retirement Accounts by transferring savings from their Ordinary Account or by making cash top-ups.

Meanwhile, the closure of Special Accounts means that savings in the account will be transferred to the Retirement Account up to the Full Retirement Sum, which is two times the basic sum.

“The remaining (Special Account) savings will be transferred to the Ordinary Account. Of course, members can voluntarily transfer these OA savings to the RA at any time, up to the revised (Enhanced Retirement Sum), to earn higher interest and to receive higher retirement payouts,” said Mr Wong.

In response to CNA queries, the CPF Board said on Saturday that with the increase in Enhanced Retirement Sum to four times of the prevailing BRS, more than 99 per cent of the roughly 1.4 million members aged 55 and above will be able to transfer all their Special Account savings to their Retirement Accounts.

WHY IT MATTERS

Savings in the Ordinary Account earn 2.5 per cent per annum, compared to around 4 per cent per annum for the Retirement Account and Special Account.

But some Special Account savings can be withdrawn on demand when the CPF member turns 55.

“As a principle, only savings that cannot be withdrawn on demand should earn the long-term interest rate, and savings that can be withdrawn on demand should earn the short-term interest rate,” the Ministry of Finance said.

In 2022, Member of Parliament Melvin Yong (PAP-Radin Mas) asked the Manpower Ministry about “Special Account shielding” where members prevent their savings from being transferred to the Retirement Account.

That is done by investing money from the Special Account, then liquidating it shortly after.

At the time, the Manpower Ministry said only 2 per cent of CPF members did that. It also said it would monitor the trend and take action if necessary.

OTHER ANNOUNCEMENTS FOR SENIORS

Mr Wong also announced on Friday that the qualifying per capita household income threshold for the Silver Support Scheme will be raised from S$1,800 to S$2,300 next year.

Quarterly payments will be increased by 20 per cent to keep pace with inflation.

The Silver Support Scheme is for seniors who had low incomes during their working years and have less family support.

From 2025, seniors above the age of 70 will also be eligible for dollar-for-dollar matching for cash top-ups to their CPF accounts, under the Matched Retirement Savings Scheme.

“This will enable more Singaporeans to meet their retirement needs, with the help from their families, with employers and the community,” said Mr Wong.

Currently, the scheme applies only for Singaporeans aged 55 to 70.

He added that the annual matching cap will be increased from S$600 to S$2,000, with a lifetime matching cap of S$20,000. But tax relief for CPF cash top-ups will be removed because the matching grant is “already a significant benefit extended by the government”.

CPF contribution rates for older workers will also increase as planned, Mr Wong said. The rate for workers aged 55 to 65 will rise by 1.5 percentage points next year.

Employers can receive a CPF Transition offset to cover half of the increase in employer contributions to cushion business costs.