Commentary: Thinking of buying your first flat? Here’s why 2024 may be a good time

A view of a Build-to-Order public housing project located in Bidadari estate.

The property market is known to move in cycles, and it is crucial for potential buyers to determine the best time to enter the market. As we move into 2024, signs suggest that this year might offer an opportune moment for first-timers to purchase a Housing and Development Board (HDB) flat.

By acquiring the right information, conducting thorough research, and financial planning, even a novice can make the right choice when purchasing their first home.

For most Singaporeans, purchasing a new flat directly from the Government is the norm. About 78 per cent of resident households live in HDB flats, reported the Department of Statistics in 2022, while 17 per cent reside in condominiums and apartments, and 5 per cent in landed properties.

Among first-time home buyers, the most popular property type is a BTO flat (31 per cent), followed by an HDB resale flat (25 per cent), reported PropertyGuru in September 2023.

OUT OF THE WOODS

During the Covid-19 pandemic, however, the buying process was immensely challenging for many young couples looking to purchase their first properties. Approximately 40 per cent of under-construction Build-To-Order (BTO) projects were delayed by supply chain disruptions and manpower shortages, causing complications for many families.

The prolonged delays meant many couples had to wait a long time before they could collect the keys to their dream homes. Others had to postpone their wedding events and family planning; some resorted to renting properties in the interim.

During this time, demand for BTO flats was still high, and many projects were oversubscribed, creating a backlog of applicants. Many wound up turning to the secondary market to purchase resale flats, which caused a surge in HDB resale prices island-wide.

However, with the Government ramping up the supply of new BTO flats post-Covid, wait times have been shortened from an average of four to six years to around three to four years. As a result, the backlog of BTO applicants has been cleared — which, combined with favourable conditions created by new policy changes, means that first-time buyers now have a higher chance of securing a new flat.

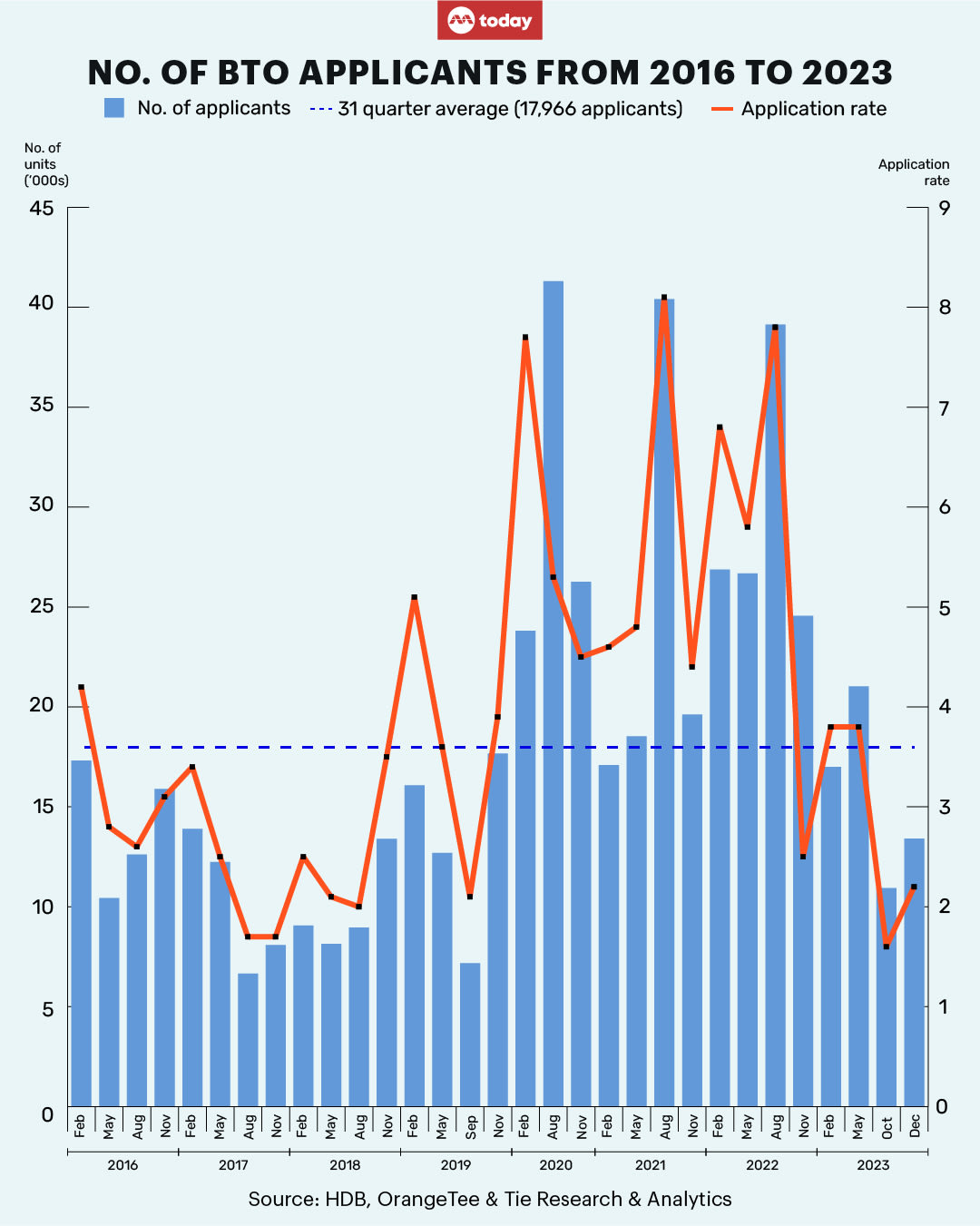

The overall application rates for BTO flats dropped from 4.6 in February 2021 to around 2.2 in December 2023 (see Chart: No. of BTO applicants from 2016 to 2023).

During the December BTO exercise, the number of applicants had similarly decreased from the past two-year average of 23,804 applicants to 13,411.

BETTER ODDS FOR FIRST-TIMERS

First-time buyers have a better chance of obtaining a new flat on their first attempt due to the non-selection penalty, which has recently come into effect. The tightened rules discourage less serious buyers from applying and ensure a more efficient allocation for those who need a flat urgently.

The penalty works as such: If a first-time BTO applicant does not select a unit when given the opportunity to do so, they will be considered a second-time buyer for the next 12 months. This means that within this period, the choices available to them are drastically pared down in any subsequent applications — only 5 per cent of four-room and larger flats are reserved for second-time buyers, while at least 95 per cent of flats are reserved for first-timers.

Moreover, if a second-time buyer does not choose a BTO flat when invited to do so, they will have to wait one year before they can apply for a flat.

Eligible first-time buyers can also take advantage of new schemes, such as the new First-Timer (Parents and Married Couples) priority category, which helps young families with children to own a home quickly.

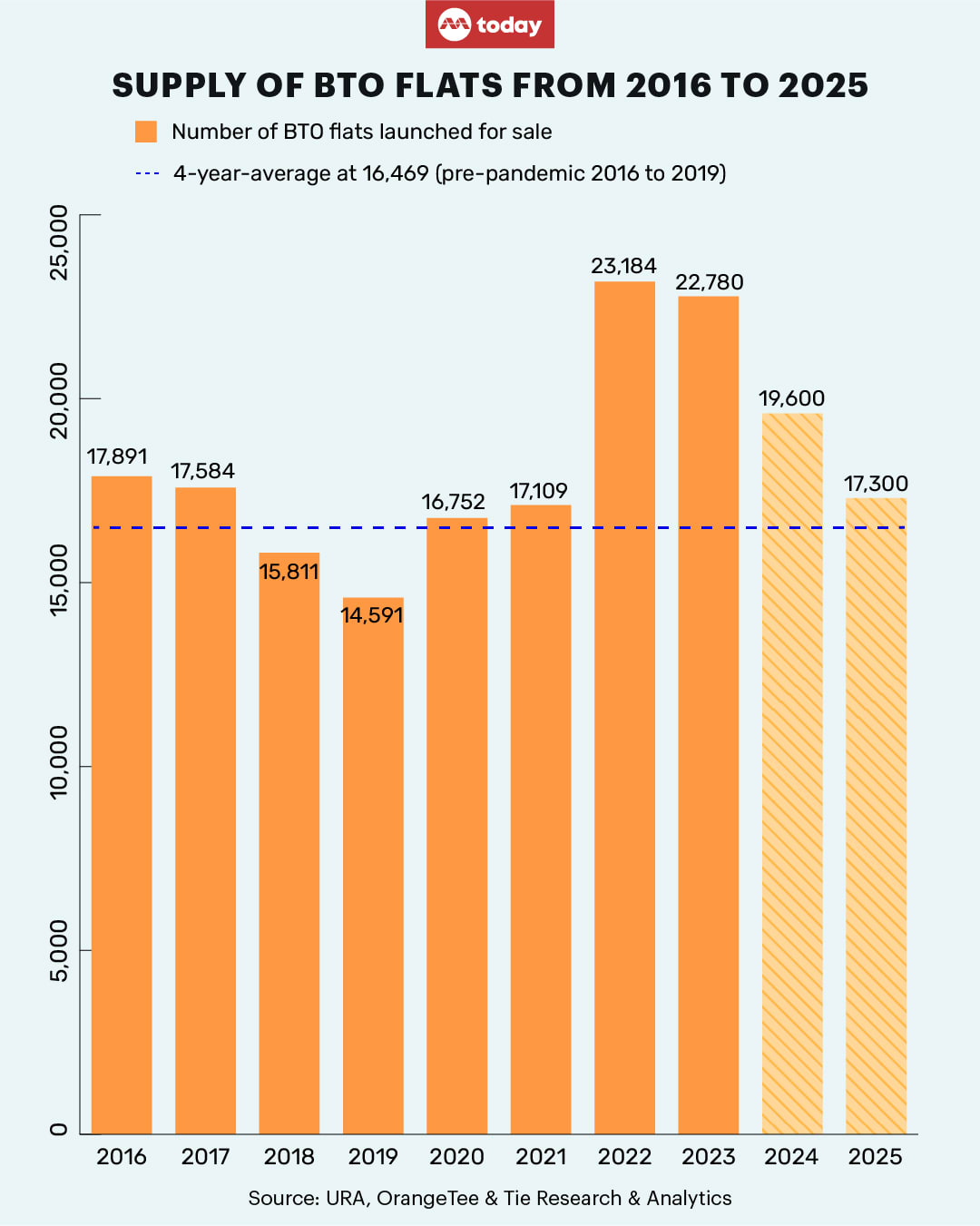

Despite the recent increase in BTO supply, it’s also worth noting that the pace of sales launches might slow down this year.

To meet its supply target of 100,000 flats from 2021 to 2025, the Government has already launched around 63,000 new flats from 2021 to 2023, with an average of 21,000 flats released each year.

Another 19,600 homes will be launched in 2024, while 17,300 units will be launched in 2025 (see Chart: Supply of BTO flats from 2016 to 2025). These numbers are lower than the past three-year annual average of 21,000 units.

RESALE PRICES STABILISED

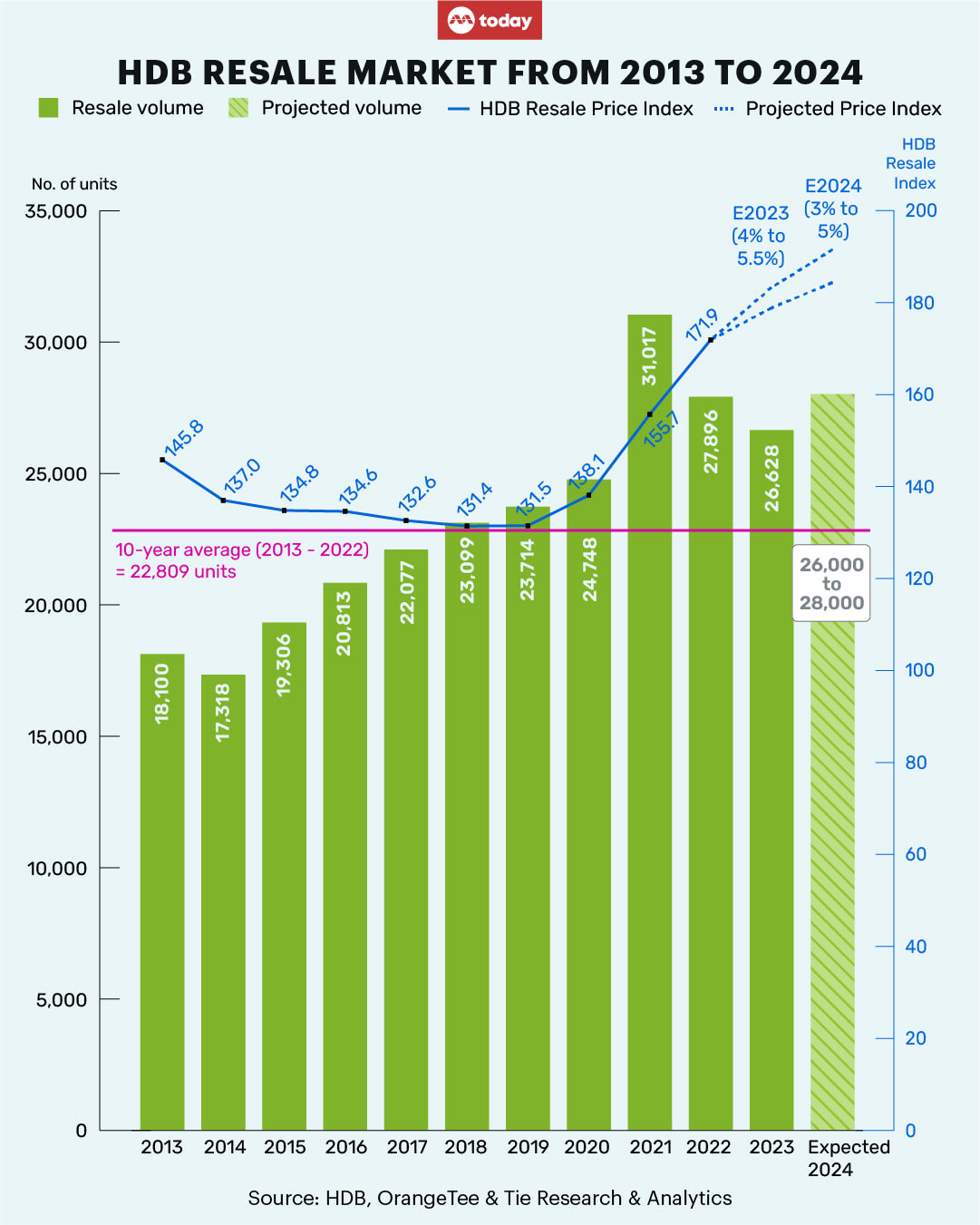

As demand stabilises, prices of resale flats may experience a more moderate growth in 2024. The cooling measures implemented in September 2022 slowed the pace of price growth for the entirety of 2023. Other contributing factors included declining sales and buyers resisting further price hikes due to inflationary concerns.

The resale price growth has decreased from a high of 12.7 per cent in 2021 to 10.4 per cent in 2022, dropping further to 4.8 per cent in 2023. In the last quarter, price growths were generally lower or muted in most towns, indicating that more sellers were willing to accept lower price offers.

For the whole of 2024, price growth will likely continue to stabilise, with a modest increment of around 3 to 5 per cent. The anticipated slowdown spells good news for buyers eyeing a resale unit.

However, the supply of resale flats is also expected to decrease.

The number of flats that have reached their five-year minimum occupation period (MOP) has gone down from 30,920 units in 2022 to 15,549 units in 2023. The supply of MOP flats is expected to dip further in 2024 to 11,952 units, resulting in fewer units available for resale.

Those considering the purchase of a resale flat may want to take note of the dwindling supply. While buyers should not rush into a decision, they should also not miss an opportunity when it shows up.

ABOUT THE AUTHOR:

Christine Sun is the senior vice-president of research and analytics at OrangeTee & Tie.