The Big Read: After the hype and crash, can NFTs get a new lease of life?

(Illustration: TODAY/Nurjannah Suhaimi)

This audio is generated by an AI tool.

- Non-fungible tokens (NFTs) have risen and fallen quickly in value over the span of two years

- The rise was driven by various factors such as easy money due to low interest rates while the collapse of some cryptocurrency exchanges was a reason for NFTs' decline

- However, with fewer speculators today, there are suggestions that NFTs could be making a comeback

- Industry players are cautiously hoping that NFT prices will rise again, albeit to less extremes

- They also express confidence in the wide applicability of the technology beyond that as an investment vehicle

SINGAPORE: Within just two years, the world had seen the value and trading volume of non-fungible tokens (NFTs) rising rapidly, before tumbling almost just as quickly.

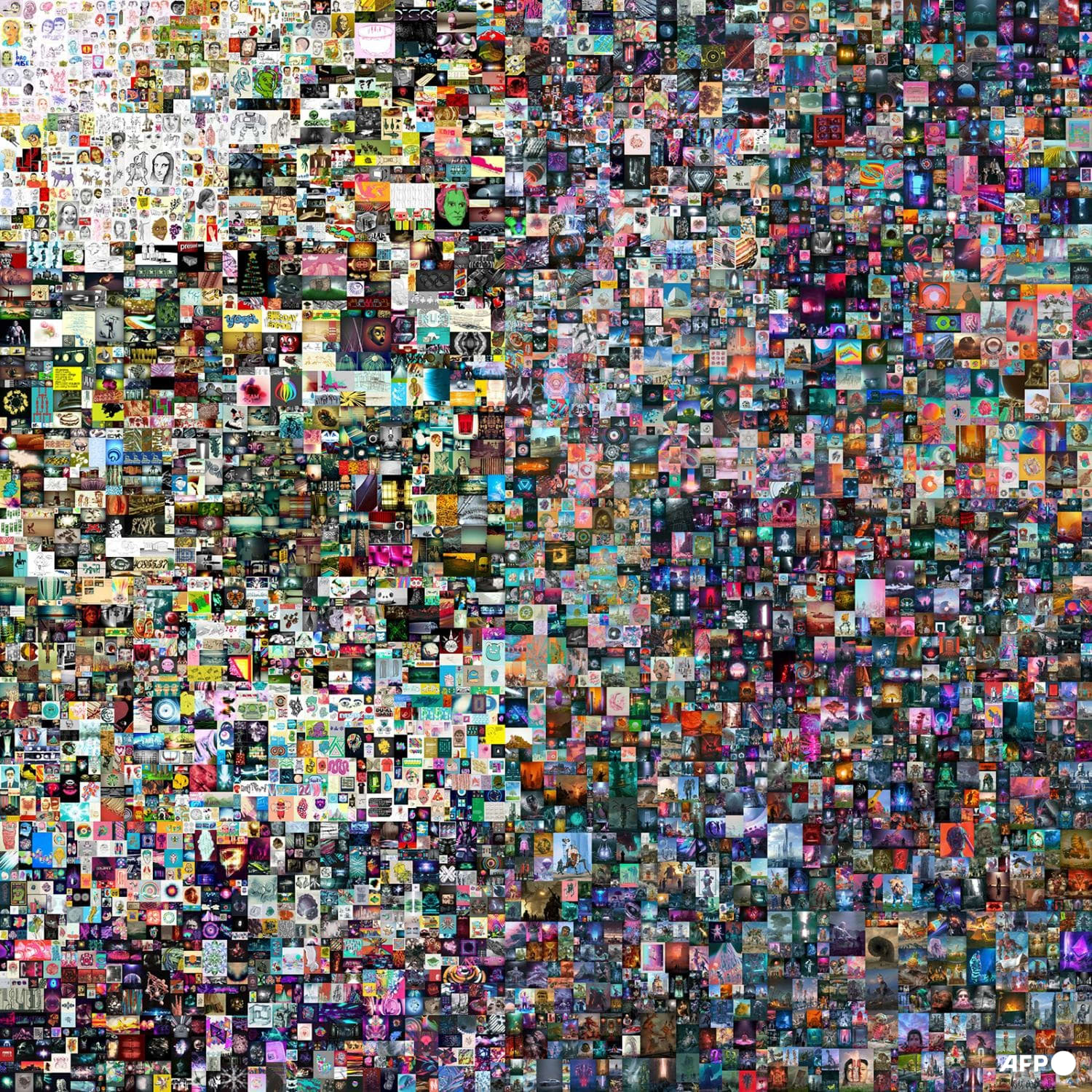

Among the notable developments at the early stages of the bull run was when Christie’s auction house in March 2021 sold an NFT of a digital collage by artist Beeple for US$69.3 million (S$92.9 million) worth of cryptocurrency - the highest price for an NFT at that time - to a Singapore-based investor.

Barely months later in September, a team of Singaporeans which included then third-year Nanyang Technological University (NTU) student Marc Yap, made headlines for selling all 3,876 units of their NFT digital trading cards, dubbed the Dark Zodiac collection, in an hour.

While these digital cards fetched a lower price of about S$1.4 million in cryptocurrency, which was split among the project partners, it still surprised Mr Yap, who was experimenting with NFTs for his first time.

“I really didn’t expect such a good outcome … I thought it had about 40 to 50 per cent chance of succeeding,” said Mr Yap, who was the design director for the project.

Amid the craze, companies such as Nike, Coca Cola, McDonald's also hopped onto the bandwagon, in a bid to find new ways to attract younger consumers.

But the bubble burst within months.

Mr Yap, now 29, told TODAY that his involvement in NFTs soon after Dark Zodiac was not as fruitful and resulted in “a couple of thousands (of dollars) in losses”, somewhat reflective of the market’s change in fortune.

Trading volume for NFTs plunged to US$11.8 billion in 2023, down from US$26.3 billion the year before, according to an industry report by independent cryptocurrency data aggregator CoinGecko.

Another report by crypto news site dappGambl in September last year found that of 73,257 NFT collections it analysed, 69,795 of them have a market cap of 0 Ether (ETH) - referring to the cryptocurrency commonly used to transact such tokens.

This downturn resulted in many media reports comparing it to the Dutch “tulip mania” of the 1630s. Back then, prices of tulip bulbs soared over a few years to the point where they equalled that of a mansion, according to some estimates, before crashing.

When prices of NFTs crashed, some celebrities such as Justin Bieber, Madonna, Paris Hilton and Jimmy Fallon who were seen as promoters fuelling the craze, were named in a class action suit by investors claiming they were misled into buying the collectibles by the celebrities.

For NFTs, the factors behind the fall in prices from their stratospheric levels were aplenty, from the crash of cryptocurrencies, which are used to buy these digital tokens, to the cooling down of the initial euphoria, business experts and industry players told TODAY.

But there may still be life yet in NFTs, with media reports in recent months discussing their possible resurgence.

For example, recent reports from business publication Forbes and crypto industry news site Coindesk highlighted that major companies and brands are experimenting with NFTs as digital collectibles, while buyers of some NFTs are also given real-world products or benefits.

Meanwhile, a museum in Paris sold two Van Gogh-inspired NFTs for US$2.5 million in October 2023, about a year after the end of the NFTs’ bull run.

Last year, a fast-food restaurant and a magazine in Singapore were giving away NFTs as part of their brand experience, also after the bull run.

TODAY’s interviews with those familiar or involved with NFTs reflected a sense of measured confidence in these tokens’ future.

While prices might not reach the lofty heights seen in 2021 or 2022, these tokens could still see an appreciation in value, especially among the projects that have managed to survive the bear market and are backed by teams with active plans on providing value to token holders.

It is also helpful that some speculators who had jumped in amid the initial novelty and hype of NFTs have been “flushed out”, said some industry players. A reduction in speculative activities would further stabilise NFTs in the long run, they added.

Beyond trading, the technology underpinning NFTs can have widespread use too, the industry players said, not least in the digital art space.

VALUE DOWN, BUT HOPES UP FOR SOME TRADERS

Mr Bobby Lim, who has been investing in cryptocurrencies since about 2018, said he was exposed to investing in NFTs in early 2020 at the suggestion of his friend, who said that “a lot of people have earned a lot of money from this”.

Despite some early success, the 30-year-old said his NFT collection now has seen S$10,000 in actual loss. This is on top of S$20,000 of paper loss from NFT assets which have depreciated in value, but he is still holding on to.

For 30-year-old Gautham Rajadanran, he began trading NFTs in November 2021. As of now, he has just “broken even” on his investments.

While little data on NFT trading activities among Singaporeans is available, those involved in the market generally observed that a noticeable number of people in their network had left since the end of the bull run, after suffering losses from the crypto and NFT downturn.

“About six in 10 of my friends have left the space completely, after experiencing some losses,” said Mr Lim.

Mr Clement Chia, co-founder of Imaginary Ones company and NFT project, said there was a silver lining to the crash.

“A lot of bad projects actually got flushed out of the system. People that were here just to cash grab, they're out of the system,” he said.

Money Talks: Are NFTs worth the hype?

What are NFTs, crypto and blockchain

Non-fungible tokens (NFTs) are unique tokens that exist on a decentralised, digital public ledger called a blockchain.

NFTs cannot be replicated or changed, but can be transferred and therefore sellable and tradable.

One would typically need to use a digital currency called cryptocurrency to buy an NFT.

Here are some of the key high and low points of the NFT market in recent years:

- The first tweet from Twitter co-founder Jack Dorsey that read "just setting up my twttr" was sold for US$2.9 million as an NFT on Mar 5, 2021

- A digital collage by artist Beeple, dubbed “Everydays: The First 5000 days”, was sold for US$69.3 million the same month

- A collection of interactive NFTs called the Merge sold for US$91.8 million in December 2021

- Artists were also throwing money on NFTs. For example, Justin Bieber bought Bored Ape NFT in January 2022 for about US$1.3 million

- Weekly trading volume for NFTs regularly exceeded US$750 million from August 2021 to April 2022

- However, from June to May 2022, the weekly volumes never went above US$277 million

- In December 2022, a class action lawsuit was filed against various celebrities including Madonna, Justin Bieber and others for allegedly promoting Bored Ape Yatch Club NFTs

Both Mr Lim and Mr Gautham are still holding on to some NFTs, along with the hope that the value of these assets will rise high enough to generate returns.

They pointed to how creators of some NFT collections have survived the bear market and actively rolled out plans to provide real benefits to token holders, as well as the entry of brands and personalities into the scene after the bull run, as factors driving their hopes of an NFT comeback.

For instance, Mr Lim’s last NFT purchase was in late 2022 - from the Donald Trump digital trading card collection. That series was launched in December that year, with 45,000 units up for grabs and sold out within a day.

In 2023, the former United States president, who has set his sights on returning to the Oval Office next year, doubled down on his involvement in NFTs by launching yet another set of trading cards.

Mr Lim believes that when it comes to NFTs, “where there’s a lot of attention, that’s where the value will be”.

“So whenever Trump wins an election in a state, for example, that’s where the attention will go to, and the price will naturally correlate,” he said.

Three months ago on Oct 26, 2023, for example, the floor price of the NFT was 0.11189 ETH. As of Friday (Jan 26), the floor price was 0.30499 ETH (S$923.49).

Mr Lim said improving macroeconomic conditions, such as the expected cuts in interest rates by the US Federal Reserve and the reigning in of inflation globally, would improve overall investor sentiments, too.

LOCAL BRANDS, COMMUNITIES STILL THRIVING

Singapore brick-and-mortar brands, too, are getting involved in NFTs. Most of these businesses use NFTs as a marketing tool, with some having jumped on the bandwagon at the height of the hype.

Fashion brand Love, Bonito collaborated with a digital artist in January 2022 to launch an NFT dubbed Tiger Bloom, with part of the funds raised channelled to charity.

Post-hype, Vogue Singapore magazine launched Love Chain NFTs in February 2023, which gave holders access to its metaverse.

McDonald’s Singapore launched free NFTs of its Grimace characters in August 2023, promising exclusive perks for holders, without giving details.

Ms Bhavna Monga from EY-Parthenon, the global strategy consulting arm of professional services firm EY, said: “Some consumer products and retail businesses are looking to explore the usage of NFTs as a means to engage an increasingly digital-oriented customer base. Some enterprises integrate NFTs into their marketing strategy, while others design business models around them.”

“This heightened involvement has the potential to make NFTs more mainstream,” added Ms Bhavna, who is partner for financial services strategy and transactions at the firm.

Agreeing, Mr Jaye Foo, a council member of the Bored Ape Singapore Club, a community of NFT enthusiasts that support the Bored Ape NFT collection, added: “These traditional Web 2.0 brands have a large following.

"And so naturally, if you think of the following for these brands buying into their NFTs, it will help grow the NFT market, but it's going to take time.”

Web 2.0 refers to the current iteration of the internet, while web 3.0 refers to a future one characterised by greater openness and decentralisation.

At the same time, NFT-native brands are also creating “phygital” offerings, where a physical product or experience comes with a related NFT in the digital space.

In Singapore, NFT collection Imaginary Ones was sold out four minutes after it was launched in April 2022, with a price range of 0.6 ETH to 1.5 ETH.

As of Friday, the floor price is 1.19 ETH.

Mr Chia said this was in part due to how Imaginary Ones continued to build itself up even during the bearish market period, by forming collaborations with major brands like fashion designer Hugo Boss and hotel group Shangri-La, and launching games.

“So now that the bull is somewhat coming back, people start to realise that the projects that have stayed throughout and build themselves up during this time - they start to appreciate these projects more, and that contributes to the price.”

At the international level, Pudgy Penguin, launched in July 2021 for 0.03 ETH, is another example of an NFT that has grown its value despite the market fluctuation. Its floor price on Friday morning was 18.53 ETH.

Mr Colby Lim, who is part of the Singapore Community's Core Pudgy Penguin contributor team - essentially a group of people who help plan events relating to the NFT - pointed to the efforts put into building the brand equity for the NFT.

For example, the project launched plushies in giant stores all over the US and managed to sell over US$500,000 worth of the toys on the first two days. There is also the Pudgy World metaverse that NFT holders can access.

“(With the toy launch, for example), I can kind of put a number to how popular this Pudgy Penguin is,” said Mr Lim, who is also lead trader for spot over-the-counter at crypto firm blockchain.com.

This is in contrast to the situation at the early part of the NFT frenzy, where some tokens have nothing to show for their value and are purely driven by speculation, he said.

“Some go up to seven figures, with celebrities just jumping into it purely based on the notion that they have money to throw, and they can just anyhow spent seven figures on it.”

DOES BURST BUBBLE INDICATE A BAD INVESTMENT?

While NFTs may yet stage a comeback sans the irrational exuberance, what caused their meteoric rise and dramatic fall as investors’ choice picks?

The COVID-19 pandemic and the availability of funds due to low interest rates had a part to play, according to industry players and experts.

Assistant professor in finance from the National University of Singapore (NUS) Ben Charoenwong said: “The easy money gave people more liquidity to take risks, driving up returns, which then drove even more interest.”

With most parts of the world under COVID-19 lockdowns around 2021, it gave people “more time” to trade NFTs while “initial speculators and high returns attracted others to it”, he added.

Associate Professor Deng Xin from NTU's Nanyang Business School said: “Besides the speculative nature, the overwhelming number of new projects and tokens made the NFT market oversaturated, which diluted the uniqueness and value of individual NFTs.”

The collapse of some cryptocurrency exchanges, along with the value of main cryptocurrencies around 2021 and 2022, also had spillover impacts on NFTs, said industry players.

This is due to the fact that NFTs are transacted using cryptocurrencies, and the crypto-winter also resulted in an overall bearish sentiment hanging over investors’ heads.

US billionaire Bill Gates in June 2022 dismissed NFTs (along with cryptocurrencies) as “100 per cent based on Greater Fool theory”, which refers to the idea that an asset’s price is not driven by fundamental values but by the anticipation that another “greater fool” would be willing to buy it from the current owner at a higher price.

“This is the characteristic of asset bubble logic, and when greater fools run out and there are no new market participants capable of entering and taking on the assets at high prices, then the bubble bursts,” said Asst Prof Charoenwong of NUS.

He said that while such a phenomenon exists “in many different assets”, they are typically found in markets for new technologies or products, and when uninformed traders are able to enter the market.

“It may be because there's no clear benchmark or framework with which to view the product. But in the meantime, as they are learning, the excitement of innovation also seems alluring. In this sense, there are many ‘greater fools’ who can pile into the new technology,” he added.

The industry players acknowledged there have been some bad actors during the heyday of NFT trading including scammers. Dubbed a “rug pull”, such bad acting developers would promote a project such as a new coin or NFT release and then disappear with investors’ money.

Mr Foo believes strongly in empowering people who are new to NFTs or Web 3.0 in general to prevent them from being victim to such malicious activities. To this end, he is currently developing a tool called Wush, which would as “a comprehensive search engine, directory, and aggregator” that can help individuals navigate this relatively new digital domain.

Past price performance notwithstanding, industry observers and players are cautiously optimistic about NFTs’ prospects as investments.

Ms Bhavna of EY-Parthenon says that an increased corporate interest, expanded use cases for NFTs and greater regulatory clarity might drive future growth in the demand for NFTs.

“Regulators, like those in Hong Kong and the European Union, are beginning to create and refine frameworks to address concerns surrounding digital assets, such as intellectual property rights, consumer protection, and fraud protection. This provides clarity and fosters trust for both consumers and businesses,” she said.

Then-Senior Minister Tharman Shanmugaratnam, in a parliamentary reply in February 2022, said that the Monetary Authority of Singapore (MAS) does not currently regulate NFTs given the nature of their underlying assets, typically tokenising digital art and other collectibles.

However, the authority “looks through” the underlying characteristics of the token to determine if it is to be regulated.

“Should an NFT have the characteristics of a capital markets product under the Securities and Futures Act, it will be subject to MAS’ regulatory requirements.”

He reiterated MAS’ oft-repeated caution that investment in digital tokens, including NFTs, are not suitable for retail investors.

“For NFTs in particular, their perceived uniqueness, combined with speculative demand, has served to inflate prices. This potentially puts investors at risk of outsized losses should speculative fervour abate.”

Separately, MAS previously announced the tightening of a slew of regulations in the cryptocurrency space, to be rolled out gradually from the second half of this year.

Industry players said that regulations on the cryptocurrency space may also have a positive spillover impact on NFTs, given that the digital currencies are used to buy these tokens.

Asst Prof Charoenwong added that cleaning up the cryptocurrency market overall to help get rid of the money laundering activities and providing clear guidelines for the purchase and sale of NFTs using fiat money through “compliant means” will help build a framework that can help make the NFT market “long-term viable”.

VALUE BEYOND INVESTMENT

If there is one thing that all who spoke to TODAY agreed on, it is the applicability of NFTs and its underlying technology beyond investments.

NFTs have a unique digital signature that exists on a public ledger called a blockchain, which keeps a record of all the transactions relating to the NFT without the risk of tampering.

This digital signature means that every NFT is unique, with no two being alike, thus allowing someone to establish ownership of almost anything, from digital art images to videos as well as cars and real estate.

Another example of an application is the "fractionalisation" of physical art, to make it possible to invest in fine art with limited funds. To do this, an expensive piece of art can be tokenised into many NFTs, with each NFT representing partial ownership of the art piece.

ARC Community, a members-only social club, requires prospective members to buy an NFT that costs 3ETH to gain access to its network of high flyers.

Its deputy chief executive officer Gabriel Yang said: “For ARC, we have always seen the use of NFTs not as a speculative tool but a genuine, tangible innovation that helps us reimagine the new kind of private membership club we are building.

“The NFTs also serve as a form of personal identification and a form of social representation in the digital space. Members who hold that NFT are able to showcase their membership publicly and build connections with fellow members as well as with the desired community brand they are associated with (in this case, ARC).”

Ms Tryphena Ellaces Tay, co-founder of non-profit community SG NFT Creators, said her involvement in NFTs had been mainly driven by creative reasons.

“While I may not have been an active trader, I derived pleasure from immersing myself in the intricacies of (NFT) project white papers and experimenting with their websites,” said Ms Tay.

A project white paper covers all the key information necessary to plan a project's ecosystem.

“The allure of the NFT space lies in its promising future, driven by technology that prioritises flexibility and privacy over speculative value. Beyond the recent industry fluctuations, the underlying NFT technology is empowering individuals to securely manage their digital assets and creative works,” added Ms Tay.

Mr Foo of Bored Ape Singapore Club believes that NFTs will find its way into many various aspects of one’s daily life in the future.

“Because of the blockchain technology behind it … there's just so many use cases for NFTs, let's say, use as your identity document like an IC, or passport, or key card to open your home, or as membership cards,” he said.

NFTs can provide more secure access to sensitive identity information, providing higher level of security and reducing the need for traditional username and password authentication, for example.

Asst Prof Charoenwong said that there will always be value for the decentralised nature of NFTs, which allows for “anonymous and unfettered access to the assets and some online communities”.

“So I think NFTs will have some future. However, I would expect it to be much smaller than we think, and definitely much smaller than what the sentiment was in 2021.”

This article was originally published in TODAY.