HDB to introduce new Plus flats in rehaul of public housing classification

Plus flats, which will come with tighter resale conditions, are expected to be in locations near MRT stations or town centres.

An MRT train against a backdrop of HDB blocks. (File photo: CNA/Jeremy Long)

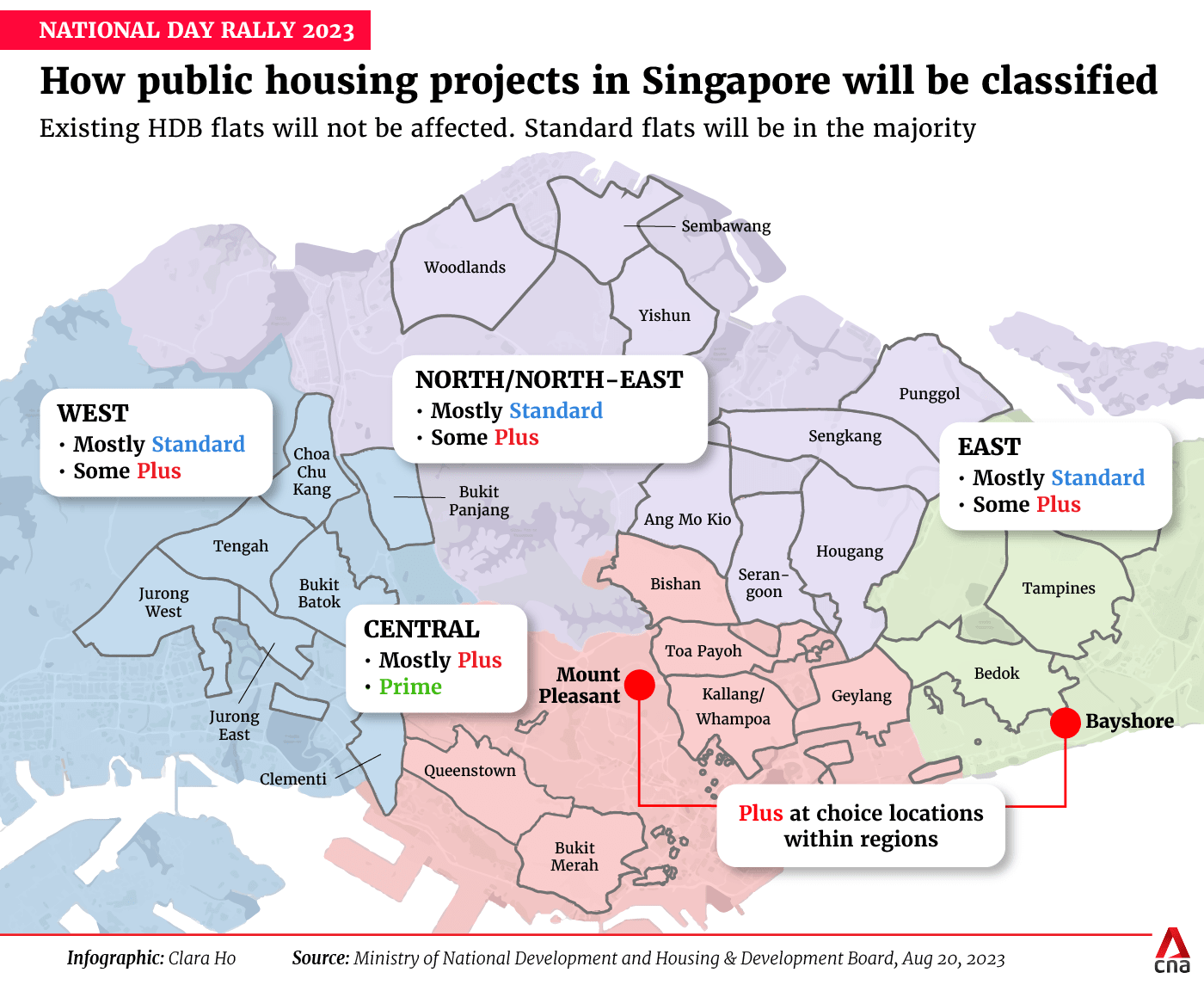

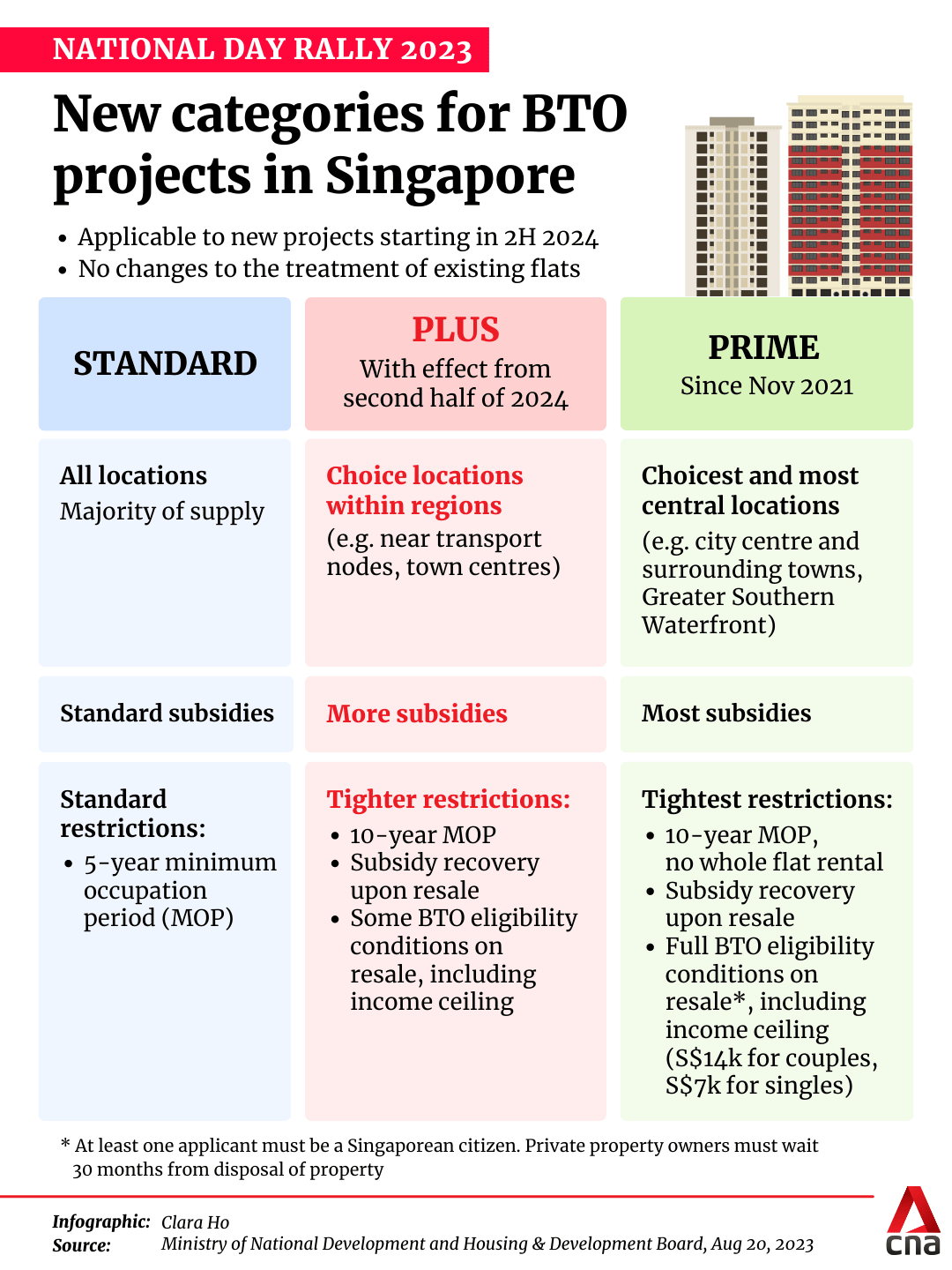

- New HDB flats will be classified as Standard, Plus or Prime and there will be no more differentiation by mature or non-mature estates

- Plus flats will have a 10-year minimum occupation period. On resale, owners have to pay back part of the HDB subsidies

SINGAPORE: New Housing and Development Board (HDB) flats in “choicer locations” in each region will be classed in a new Plus category, which will come with tighter resale conditions and more subsidies.

With this, the Housing Board will do away with the decades-old labels of mature and non-mature estates, and replace them with a new classification system.

From the second half of 2024, Build-to-Order (BTO) projects will be classed Standard, Plus or Prime, with different resale conditions attached to each housing type. The new categories will not apply to existing flats or flat owners, or to flats already booked.

This major change was among a number of housing announcements made by Prime Minister Lee Hsien Loong at the National Day Rally on Sunday (Aug 20), along with a relaxation in the conditions for singles to buy HDB flats.

With little undeveloped land left to build new towns and estates, HDB will build more flats within or near to existing estates, Mr Lee said.

These will often be more centrally located, such as the upcoming 5,000-flat development at Mount Pleasant, where the Police Academy used to be. New projects like these – nestled in older, more developed areas with a lot more amenities – will be more popular, and will naturally cost more, he said.

A second reason for the reclassification is that the line between mature and non-mature estates is blurring, and some projects in non-mature estates are even more popular than projects in mature estates.

“It shows that buyers are discerning – you know when you see a good deal, and what matters to you are the specific attributes of the project, rather than whether we call it mature or non-mature,” Mr Lee said.

NEW PLUS FLATS

The new Plus flats will be in “choicer locations” within each region, such as near MRT stations and town centres. One example is the upcoming Bayshore project near East Coast Park which is close to two MRT stations, a future shopping mall and Siglap Community Club.

They will have a 10-year minimum occupation period and Plus flat owners will have to return to HDB a portion of the resale price that is reflective of extra subsidies they receive, if they choose to sell the flat.

The longer minimum occupation period will favour buyers who are planning to stay there for the longer term, and discourage those who may be thinking of flipping the property and moving out as soon as they can, said Mr Lee.

“This will help mitigate windfall gains and ensure equity with other flat owners who do not enjoy these additional subsidies,” said MND and HDB.

Mr Lee said that developments like Central Weave in Ang Mo Kio posed a dilemma for HDB. The BTO project made headlines for its high prices ranging from S$713,000 to S$877,000 (US$525,000 to US$645,000) for the five-room and 3-Gen flats, before grants.

Even then, these flats were heavily discounted off their true market value, said Mr Lee. And despite the high price, they were heavily oversubscribed, with more than 17 applicants for every flat.

“If we price them higher, we will shrink the windfall gains and we will reduce the lottery effect. This will moderate demand ... but there will be 'sticker shock' – these flats will become so expensive that they are unaffordable to most families,” said Mr Lee.

In addition, the precinct can become a "higher-income enclave" if only those near HDB’s income ceiling of S$14,000 can afford them.

“But if HDB prices such flats lower … we exacerbate the lottery effect, because the potential windfall gains will be even richer. Even more families will try for these flats,” said Mr Lee.

This is why HDB is introducing the Plus category - the stricter sale conditions will help moderate the selling price, he said. If Central Weave had been sold as a Plus project, it would have been priced lower, he added.

Plus flats will also have tighter resale conditions, including an income ceiling for resale buyers, but the details have yet to be announced. The clawback for Plus flats is expected to be lower than for Prime flats as the additional subsidies should typically be less.

Standard flats will come with the same subsidies and restrictions currently applied to all BTO flats, which means a five-year minimum occupation period and standard subsidies. MND and HDB said that these flats will continue to form the bulk of the housing supply.

Flats in Prime BTO projects, located in the central region, will have the same conditions as flats under the current Prime Location Housing scheme, which was introduced in November 2021.

These conditions include a 10-year minimum occupation period and a clawback clause so the first owners have to pay back part of the subsidies when they sell the flat. They can also only sell the flat to buyers who meet BTO eligibility conditions, including an income ceiling of S$14,000 for couples or families and S$7,000 for singles.

The resale conditions will moderate resale prices and help to maintain a better social mix in the longer term, said Mr Lee.

MND said that the changes reflect feedback from people during Forward Singapore engagements, many of whom have said that they want public housing to be primarily for owner occupation, rather than investment.

Another change is that singles will be able to apply for two-room Flexi BTO flats in all locations, instead of only in non-mature estates, as is the case now. In the resale market, they will be able to buy a Standard or Plus flat of any size, as well as two-room Prime flats. Currently, singles cannot buy a Prime Location Housing resale flat.

The reclassification of BTO projects, a major structural change, should affect the way flats are allocated but the details have yet to be announced.

The ministry will continue to get feedback from Singaporeans in the coming months and said that it welcomes views on these changes.

MND and HDB said that it will take more than 10 years before Plus flats are available in the resale market. It will monitor the impact of these measures on the resale market and review them, if necessary.

Mr Lee also promised to keep HDB flat prices affordable and said that the government will gradually provide more housing grants, especially grants that are means-tested, like the Enhanced Housing Grant.

“This way, lower- and middle-income households will get the most support to own their homes, there will always be an HDB flat to meet every budget and we can maintain a good social mix in every town and region,” he said.