MediShield Life insurance coverage, claim limits to be reviewed amid rising healthcare costs

Singapore will also extend subsidy coverage to more diagnostic services and drugs at community hospitals, starting from the fourth quarter of this year.

This audio is generated by an AI tool.

SINGAPORE: The MediShield Life insurance plan is being reviewed to ensure healthcare remains accessible and affordable amid rising costs, Health Minister Ong Ye Kung announced on Wednesday (Mar 6).

During his ministry's budget debate in parliament, Mr Ong pointed out that a major factor for rising healthcare cost is that people in Singapore are getting older, and are hence more likely to fall seriously ill.

He added that with technological advancement, new treatments may work better but often cost more. Inflation has also gone up around the world in recent years, and that has also affected healthcare costs too.

In Singapore, MediShield Life is administered by the Central Provident Fund (CPF) Board and helps to pay for large hospital bills and selected costly outpatient treatments. It was designed such that nine out of 10 subsidised bills are adequately covered, said Mr Ong as he detailed his ministry's spending plans in parliament.

However, this benchmark is being "eroded" as hospital bills are getting "larger and larger", he added.

Bill sizes have grown by 5 per cent annually in public hospitals, and by 7 per cent annually in private hospitals over the last few years.

As a result, the proportion of subsidised bills adequately covered by MediShield Life has come down to around eight out of 10 and this is expected to continue to slip further, said Mr Ong.

As such, a MediShield Life Council - set up to review the administration of the plan - will look at refreshing current claim limits for inpatient and day surgery treatments, to cover nine in 10 subsidised bills.

MOH will also review MediSave limits in tandem, to ensure the two CPF schemes collectively provide better coverage for medical bills.

MediSave is a national medical savings scheme that helps people set aside part of their income to meet healthcare needs.

The Ministry of Health (MOH) envisages a "fairly significant" increase in the claim limits, said Mr Ong.

For example, for an episode involving angioplasty where a stent is placed to open a blocked artery, as well as a few nights of stay at the intensive care unit, the claim limits may need to double. "This will reduce out-of-pocket costs significantly," he added.

The Government will expand hospital capacity and catch up for the time lost due to the COVID-19 pandemic, said Health Minister Ong Ye Kung. Outlining the strategies in Parliament on Wednesday (Mar 6), he said the Government intends to add another 4,000 beds by 2030 and should see new capacity coming on stream every year from now to 2030. It opened about 640 new acute and community hospital beds since June last year. They make up over 11,000 public hospital beds. In 2024 and 2025, Woodlands Health will commission up to 700 beds. In 2026, Sengkang General Hospital and Outram Community Hospital are expected to expand by about 350 beds by converting non-clinical spaces into hospital wards. In 2027, the Elective Care Centre at Singapore General Hospital (SGH) is expected to open with 300 beds. In 2028 and 2029, the redeveloped Alexandra Hospital is expected to open progressively. In 2029 and 2030, the new Eastern General Hospital Campus is expected to open progressively. In the early 2030s, the Government hopes to see the completion of a new regional public hospital. It has just completed one in the North - Woodlands Health - and is building another in the East, as well as expanding SGH in the central region. The next new public hospital will be in the West in Tengah Town, to be run by the National University Health System cluster. Mr Ong warned against being trapped in the mindset of “building hospitals” when thinking about capacity. There is potential to better anchor care outside of hospitals and in the community, he said. To facilitate appropriate transfers from acute hospitals to community settings, the Government will provide more funding to community hospitals. From the fourth quarter of this year, more diagnostic services like CT and MRI scans and relevant drugs will be subsidised at community hospitals. It will also align the community hospital subsidy framework to the acute hospital subsidy framework so that patients receive the same subsidy rate of 50 per cent to 80 per cent throughout their inpatient stay. Secondly, the Government will make Mobile Inpatient Care at Home (MIC@Home) a mainstream service in public healthcare institutions from April. The hospitals intend to price MIC@Home similar to or lower than a normal ward. Patients will be supported by subsidies, MediShield Life and MediSave - no different from a physical inpatient stay. The Government will further expand the capacity of MIC@Home from 100 in 2023 to 300 in 2024, with the potential to scale up further later. Thirdly, the Government will encourage telehealth. By the second half of this year, it will expand MediSave coverage to telehealth consults for preventive care services. Turning to concerns over rising healthcare costs, Mr Ong said Singapore has weaved together a more robust way of paying for healthcare, comprising subsidies, MediSave, MediShield Life and MediFund. The Government will be conducting a comprehensive review of MediShield Life, which aims to cover nine out of 10 subsidised bills. However, this nine in 10 benchmark is being eroded because the size of hospital bills is getting even bigger, said Mr Ong. As a result, the proportion of subsidised bills adequately covered by MediShield Life has come down to around eight out of 10 and is expected to continue to slip. The Ministry of Health has tasked the MediShield Life Council to look at ways to give Singaporeans greater assurance against large bills by increasing how much a patient can claim for surgeries and hospital stays. Mr Ong said it envisages a “fairly significant” increase in the claim limits. Secondly, it should explore enhancing outpatient coverage by raising the claim limits for treatments such as kidney dialysis to reduce out-of-pocket expenses for patients. The Council will also explore extending coverage to more types of outpatient care. Thirdly, the Council has to consider expanding MediShield Life coverage to new groundbreaking treatments, specifically Cell, Tissue and Gene Therapy Products. The Council will complete its review in the second half of this year. Mr Ong said while the Government addresses these immediate concerns, it should not lose sight of the long-term and strategic direction of healthcare - to continue to “build health and not just treat illnesses”. This strategy is crystalised around Healthier SG. Since it was launched in July last year, 2.4 million Singapore residents aged 40 have been invited to participate in the initiative. As of last month, 765,000 have enrolled with a family doctor of their choice. Of these, 60 per cent are enrolled with GPs and the remaining with polyclinics. To enhance Healthier SG, the Government will expand the range of health protocols to cover more conditions. It will also improve the health plans to start giving more specific advice, such as recommending aerobic exercise three times a week instead of “exercise more”.

The council will also consider extending MediShield Life coverage to more types of outpatient and home-based care, as well as improving coverage of treatments already included in the scheme, such as dialysis.

The Mobile Inpatient Care-at-Home or MIC@Home is one home-based care service which will be covered by MediShield Life and other schemes and subsidies from Apr 1.

The council will also explore how MediShield Life coverage can be expanded to cell, tissue and gene therapy product (CTGTP) treatments.

CTGTPs are intended for therapeutic, preventive, palliative or diagnostic purposes.

"Medical science is advancing rapidly, and CTGTPs have the potential to revolutionise healthcare and deliver effective treatment of previously incurable diseases," said Mr Ong.

However, while the technology is promising and advancing fast, it is nascent and very expensive, he added. "It could cost anything from a few hundred thousand dollars to a few million dollars, per treatment."

Mr Ong said: "We want to start including CTGTPs under MediShield Life coverage. But we need to put in place safeguards to ensure that financing of CTGTPs is sustainable."

For instance, this will mean extending MediShield Life coverage only to treatments that are assessed to be safe, clinically effective and cost-effective. "This is a significant step to help all Singaporean patients, regardless of their income levels, have access to cost-effective, novel, state-of-the-art therapies."

These proposed changes will better protect subsidised patients against major health episodes, said Mr Ong, adding that MediShield Life premiums will inevitably go up.

“The last time we reviewed the scheme, premiums went up by 25 per cent on average,” Mr Ong pointed out.

“But rest assured that we will do the necessary to ensure that as far as possible, premiums can be paid fully by MediSave.”

For example, the ministry will consider enhancing premium subsidies, or MediSave top-ups for specific groups.

“We may have to use more MediSave for small hospital bills so that MediShield Life can better focus on big hospital bills, and that way, we moderate premium increases,” Mr Ong said.

“No one will lose MediShield Life coverage due to a genuine inability to afford premiums,” he added.

The MediShield Life Council is expected to finalise its recommendations in the second half of the year.

SUBSIDIES AT COMMUNITY HOSPITALS

To support care continuity between acute and community hospitals, MOH will expand subsidy coverage to more diagnostic services and drugs at the latter.

This will be rolled out in phases, starting with diagnostic services in the fourth quarter of this year. This includes computed tomography or CT brain scans of stroke patients for follow-up monitoring.

Patients at community hospitals undergoing sub-acute or rehabilitative care will benefit from this, said MOH.

Coverage for drugs supported under the Medication Assistance Fund - which provides subsidies for high-cost drugs that are clinically proven and cost-effective - will also be rolled out in the first half of 2025.

Drugs often used for the management of chronic conditions at community hospitals would be included, such as Linagliptin for diabetes management and Rivaroxaban for the prevention of stroke and systemic embolism in patients with atrial fibrillation, said MOH in response to media queries.

The Health Ministry said more than 5,000 community hospital patients will benefit from the expanded scope of subsidised drugs annually.

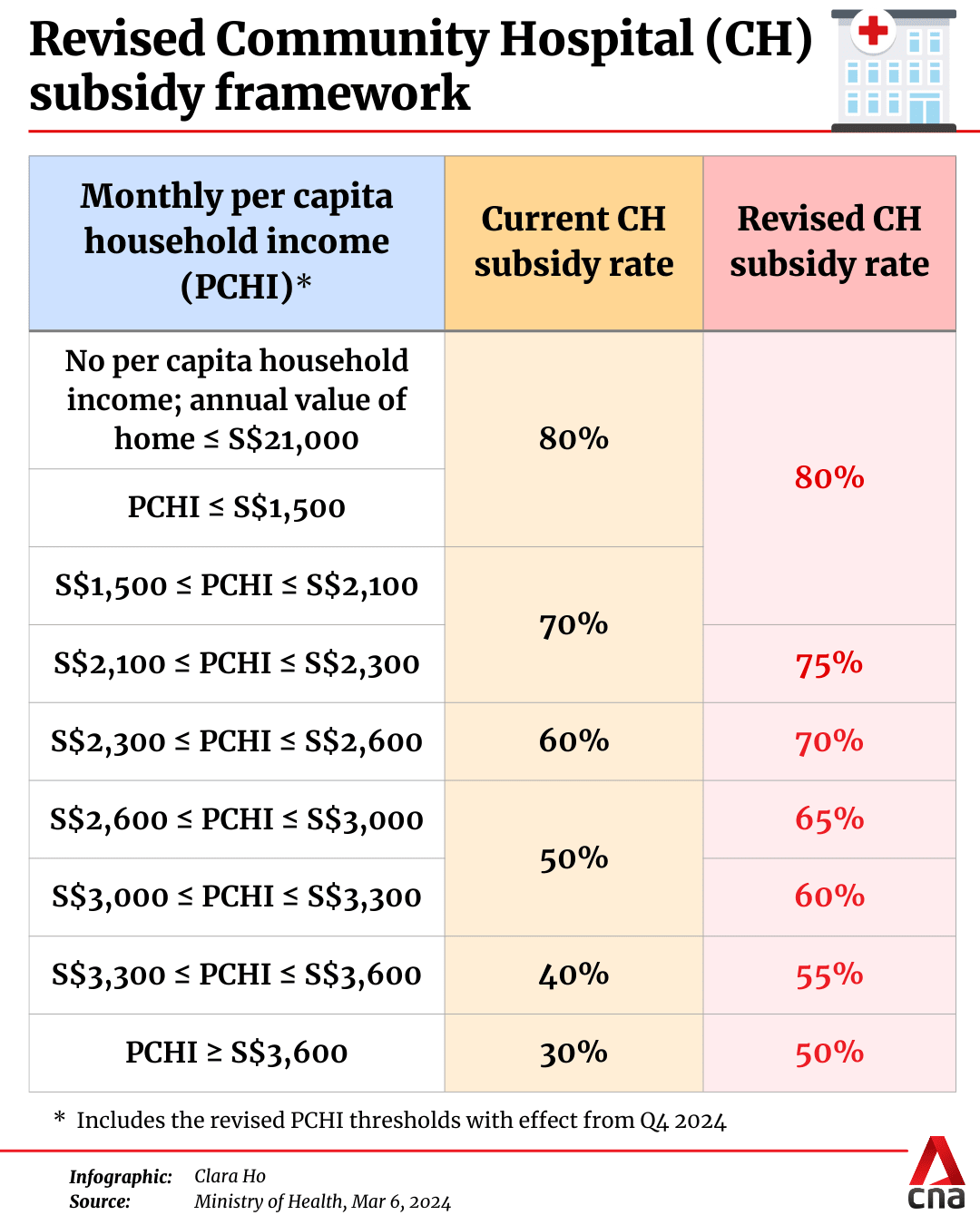

MOH will also align the community hospital subsidy framework with that of acute hospitals. For instance, community hospital patients with a monthly per capita household income of more than S$3,600 will see their subsidy rate raised from 30 to 50 per cent.

This will be implemented from the fourth quarter of this year.