CNA Explains: What's the Gini coefficient and what does it say about inequality in Singapore?

The gap between Singapore's richest and poorest is at its smallest in more than two decades, according to the Gini coefficient.

People eating at Singapore's Tiong Bahru Market in February 2021. (File photo: iStock)

This audio is generated by an AI tool.

SINGAPORE: Income inequality in Singapore has declined to its lowest level in over two decades, said Deputy Prime Minister Lawrence Wong during his Budget speech last Friday (Feb 16).

This is measured by the Gini coefficient, said Mr Wong, who is also Finance Minister.

CNA looks at how to understand this metric and what goes into calculating Singapore's figure.

What's the Gini coefficient? And why should we care?

The Gini coefficient is a statistical measure that paints a picture of the gap between the richest and poorest in a country’s income or wealth distribution.

It's represented by a figure between 0 and 1, with 0 being perfect equality and 1 being perfect inequality.

A higher value thus indicates greater disparity between a country’s richest and poorest.

The Gini coefficient can help nudge countries to come up with policies giving lower-income citizens the boost they need. The figure can also help countries set a goal in narrowing the income gap.

How is it calculated in Singapore?

The Singapore Department of Statistics (SingStat) puts together the Gini coefficient based on three scales.

These are "equivalised" household income from work based on a modified Organisation for Economic Cooperation and Development or OECD scale; equivalised household income from work based on square root scale; and household income from work per household member.

Equivalisation refers to an economics method of accounting for household size and composition.

Singapore's Gini coefficient is typically reported based on the third scale of household income from work per household member.

Looking at income per member – rather than total income – gives a more accurate picture of the inequality that exists between households. The idea is that household needs increase with additional members, and looking at income per member accounts for these differing household sizes when measuring nationwide inequality.

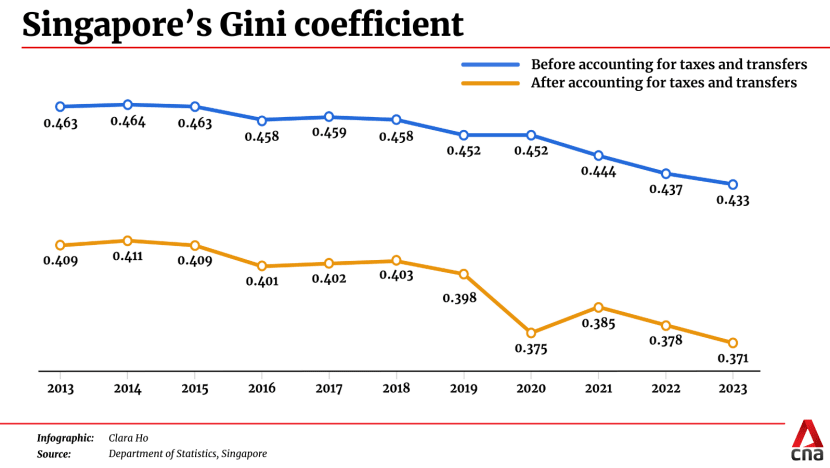

Every year, SingStat reports two figures for the Gini coefficient.

One is the figure before accounting for government transfers and taxes, and the other is after taking these into account.

In 2023, Singapore’s Gini coefficient was 0.433 before government transfers and taxes. After adjusting for government transfers and taxes, the figure was 0.371.

“This reflected the redistributive effect of government transfers and taxes,” said SingStat in a report on key household income trends.

Government transfers include support measures like utility bill rebates and CDC vouchers.

And there were more of these last year compared with 2022, to help cope with high inflation and an increase in the Goods and Services Tax (GST).

Resident households, including those with no employed person, received S$6,371 per household member on average from government schemes – up from S$5,859 in 2022.

Median monthly income per household member also increased from S$3,287 in 2022 to S$3,500 in 2023.

How does Singapore's Gini coefficient compare with other countries'?

Each country's Gini coefficient is calculated differently.

Different countries also have different definitions for household income.

In Singapore, this excludes non-work sources of money – think stocks or rent collected from a second property.

But in countries such as Japan and Finland, household income includes the value of goods produced for own consumption, as an element of self-employed income.

Population coverage is also key. In larger countries, retrieving income data from every single household may be less possible than in Singapore. As a result, their Gini coefficient may not be reflective of the entire population.

On top of all this, different countries have varying personal income tax rates. Japan's national income tax rates are capped at 45 per cent of taxable income, while Finland's lowest personal income tax rate on record was 49 per cent in 2012.

Singapore residents have their personal income tax capped at 24 per cent from 2024 – up from 22 per cent previously.

What's Singapore doing to reduce inequality?

Singapore’s Gini coefficient in 2023 was at its lowest since 2000 – both before and after accounting for government transfers and taxes.

Over the last decade, Singapore has “made progress in uplifting lower-wage workers and reducing disparities in wages”, Mr Wong noted in his Budget speech.

He described Workfare and the Progressive Wage Model as key strategies here, and announced measures to improve them.

Enhancements to Workfare

The government will enhance the Workfare Income Supplement Scheme - which provides lower-wage citizens with cash payouts - from January 2025.

Workers who earn S$3,000 a month or less will be eligible, up from the current income cap of S$2,500.

This higher income cap will also apply to the Workfare Skills Support scheme, which encourages lower-wage workers to go for training.

Those eligible for the Workfare Income Supplement Scheme will also receive bigger payouts.

People with disabilities and workers above 60 years old will receive up to S$4,900 per year, up from S$4,200 currently.

Increase in local qualifying salary

Companies that hire foreign workers will need to pay locals more to keep pace with wage growth.

From Jul 1, the local qualifying salary will be raised from S$1,400 to S$1,600 for full-time workers. Minimum hourly rates for part-time workers will increase from S$9 to S$10.50.

A company’s foreign worker quota computation will depend on the number of local workers being paid the new qualifying salary.

Boost to Progressive Wage Credit Scheme

For employers who pay their lower-income workers more, the government will co-fund up to 50 per cent of wage increases for 2024.

This figure was originally set to taper to 30 per cent this year, after the government co-funded up to 75 per cent of wage increases in 2022 and 2023.

In 2025 and 2026, the wage ceiling for employers to qualify for co-funding will also be raised – from S$2,500 currently to S$3,000.

To provide these enhancements, the government will top up the Progressive Wage Credit Scheme fund by S$1 billion.

More support for ITE graduates

To improve wages across professions, Institute of Technical Education (ITE) graduates aged 30 and below who choose to pursue a diploma will be given a new Progression Award.

Under this award, the ITE graduates will get a S$5,000 top-up to their Post-Secondary Education Account, to help offset the costs of the diploma.

When they obtain their diplomas, they will get a further S$10,000 top-up to their CPF Ordinary Account, to give them a headstart in purchasing a home or saving for retirement.

What will such measures mean for companies and workers?

With an impending increase in wages and manpower costs, companies in Singapore need to "take a step back and rethink how to restructure", said Mr Ang Yuit, president of the Association of Small and Medium Enterprises.

“In some cases, relook at the human capital practice, and then maybe double down in certain areas where transformation is going to make a significant impact to their costs and to their productivity,” he said on CNA’s live Budget show last Friday.

OCBC Bank's chief economist Selena Ling pointed out that higher wages would also incentivise workers to reskill and upskill.

"Productivity goes up, that improves the profit margins for businesses, that attracts more investments and more foreign talent to come to Singapore," she added. "In sum you have a vibrant economy with vibrant job creation. And it's going to be a virtuous cycle."

Ms Ling described the Budget measures as "guardrails" and fiscal transfers to help lower the Gini coefficient.

"Singapore (has) a fairly interventionist government in that sense. They don't leave it to market chance."

It's very important that Singapore doesn't have disenfranchised segments of society, she added.

"We see it in some other countries. That creates a sense of disquiet, social unrest, potentially. So I think to build this inclusive society, that is the ambition of the 4G (Fourth Generation) leadership."