Tightening of HDB loan limits will have limited impact on property market in the long run, say analysts

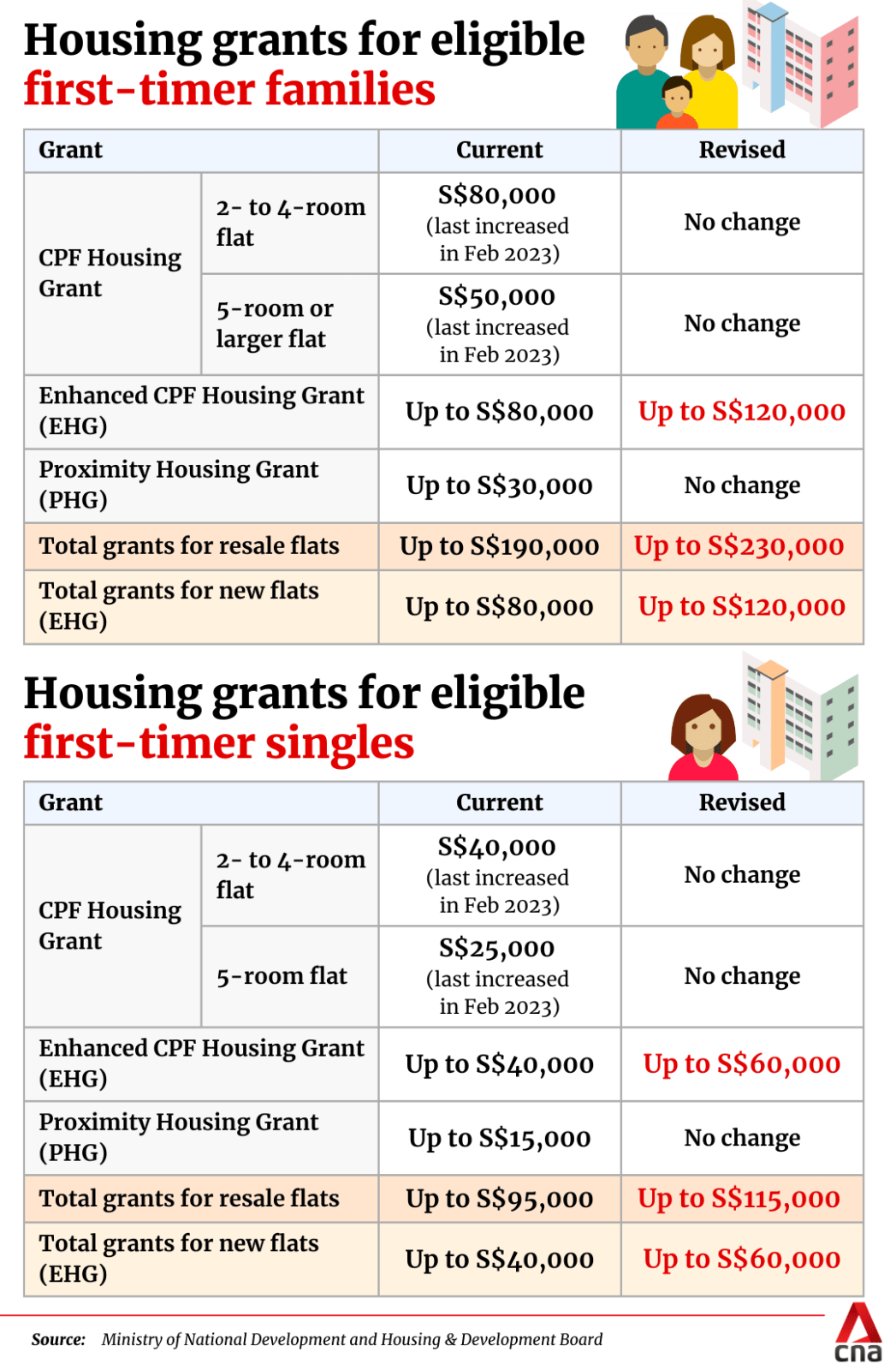

The enhanced CPF Housing Grant, which will see eligible first-timer families get up to S$120,000, up from the current S$80,000 limit, will benefit lower-income groups the most, they added.

File photo of Sengkang GRC HDB flats (Photo: CNA/Javier Lim)

This audio is generated by an AI tool.

SINGAPORE: The tightening of Housing and Development Board (HDB) loan limits may slow down demand in the short term but it will have a limited impact on prices in the long run, according to property analysts CNA spoke to on Tuesday (Aug 20).

HDB and the Ministry of National Development (MND) announced late on Monday that the loan-to-value (LTV) limit for HDB loans will be lowered from 80 per cent to 75 per cent, reducing the maximum amount that home buyers can borrow from HDB.

This is the fourth set of property cooling measures since December 2021 when the LTV for HDB loans was lowered from 90 per cent to 85 per cent. It was further cut to 80 per cent in September 2022.

Mr Lee Sze Teck, senior director of data analytics at Huttons, said the resale demand may slow temporarily in the near term as buyers take stock of the new measures.

However, over time, he said demand will return and prices will continue to rise.

Mr Lee added that an estimated 7,000 flats will reach their minimum occupation period (MOP) next year - lower than this year's estimated 12,000 flats. As such, he said HDB resale prices may continue to rise next year.

There is also a "possibility" that there may be more gains in the prices of two-room and three-room resale flats, according to Mr Lee.

For four-room and larger flats, he said most buyers do not see an increase in grants and utilise a bank loan for their purchase, hence the latest cooling measures are of "no difference to them".

But because of the lower supply of 4-room and 5-room flats that are on the open market after hitting the minimum occupation period (MOP), the prices are likely to continue to increase.

His sentiments were echoed by Mr Nicholas Mak, chief research officer at property technology portal Mogul.sg, who agreed that the measures will have a limited impact on the market.

"It will probably slow down the rising prices of HDB flats but ... this measure cannot be used alone, it has to be used in conjunction with ... a steady, strong supply of Build-to-Order (BTO) flats because this measure only addresses the demand side of the equation, it does not address supply side," said Mr Mak.

He added that the tightening of loan limits will impact those who are currently stretched financially.

"This group will try to max out their loan-to-value ratio, their total debt servicing ratio ... to buy the HDB flat," he said.

FINANCIAL PRUDENCY

In a television interview with CNA presenter Elizabeth Neo, Professor Sing Tien Foo, provost's chair professor in the real estate department at the National University of Singapore's business school, said the reduction in loan-to-value limit can help to boost financial prudency of buyers, especially in the HDB resale market.

He noted that HDB resale property prices had increased by about four per cent in the first two quarters of this year.

"A lot of these are driven by the mature HDB market transactions, especially the more expensive transactions in the first half of the year," said Prof Sing.

"I think this measure is not meant to dampen the property prices especially in the resale market but ... to actually slow down or to stabilise the resale market."

On whether further measures might be taken to also cool the private property sector, he said transaction volume has slowed down even though prices remain high.

"I think it's important to actually continue to monitor the situation without actually making too early an intervention. At the moment, I think this can actually bring uncertainty to the market."

RAISING OF GRANTS COUNTERINTUITIVE?

The enhanced Central Provident Fund (CPF) Housing Grant, which will see eligible first-timer families get up to S$120,000, up from the current S$80,000 limit, will benefit lower-income groups the most, said property analysts.

The amounts are tiered based on household income, with no restrictions on flat type and location.

Depending on the monthly household income, the increase will range from S$5,000 to S$40,000 for families and from S$2,500 to S$20,000 for singles, with higher increases for lower-income households who require more support.

"The cooling measures (tightening of HDB loan limits) is a broad-based measure, regardless of income level, but at least the grants will help to cushion this for the lower income bracket. The lower their income, the bigger the cushion," said Mr Mak.

Ms Christine Sun, chief researcher and strategist at OrangeTee Group, noted the measures seem to be "carefully calibrated".

Those who need financial assistance, such as the lower income groups and eligible first-time buyers, will still be able to afford an HDB flat despite the reduced LTV since they will be receiving more help in the form of the enhanced CPF Housing Grant, she said.

"This is a good move as the measures will likely be more targeted," Ms Sun added.

Mr Lee said this might also, conversely, encourage some buyers to spend more on their house.

"When you increase the grant, there's a possibility that people can take this amount ... and pay more or the seller may ask for more money," he said.