Two men charged over suspected GST missing trader fraud involving S$55 million in fictitious sales

Another man was also charged in court for allegedly breaching his director's duties, said the authorities.

File photo of a gavel. (Photo: CNA/Jeremy Long)

SINGAPORE: Two men were accused of perpetrating a Goods and Services Tax (GST) missing trader fraud involving about S$55 million (US$40.4 million) in fictitious sales.

Tan Nuan Seng Francis, 46 and Yeo Soon Teck Kelvin, 41, were charged in court on Wednesday (Sep 6). Another man also allegedly involved in the case, 56-year-old Sia Hock Chuan, was charged on Aug 24 with breaching his director duties.

This is the second prosecution involving such fraud, said the Singapore Police Force (SPF) and Inland Revenue Authority of Singapore (IRAS) in a joint media release on Wednesday.

In 2021, six men were charged for their alleged involvement in another case of GST missing trader fraud involving about S$114 million in fictitious sales.

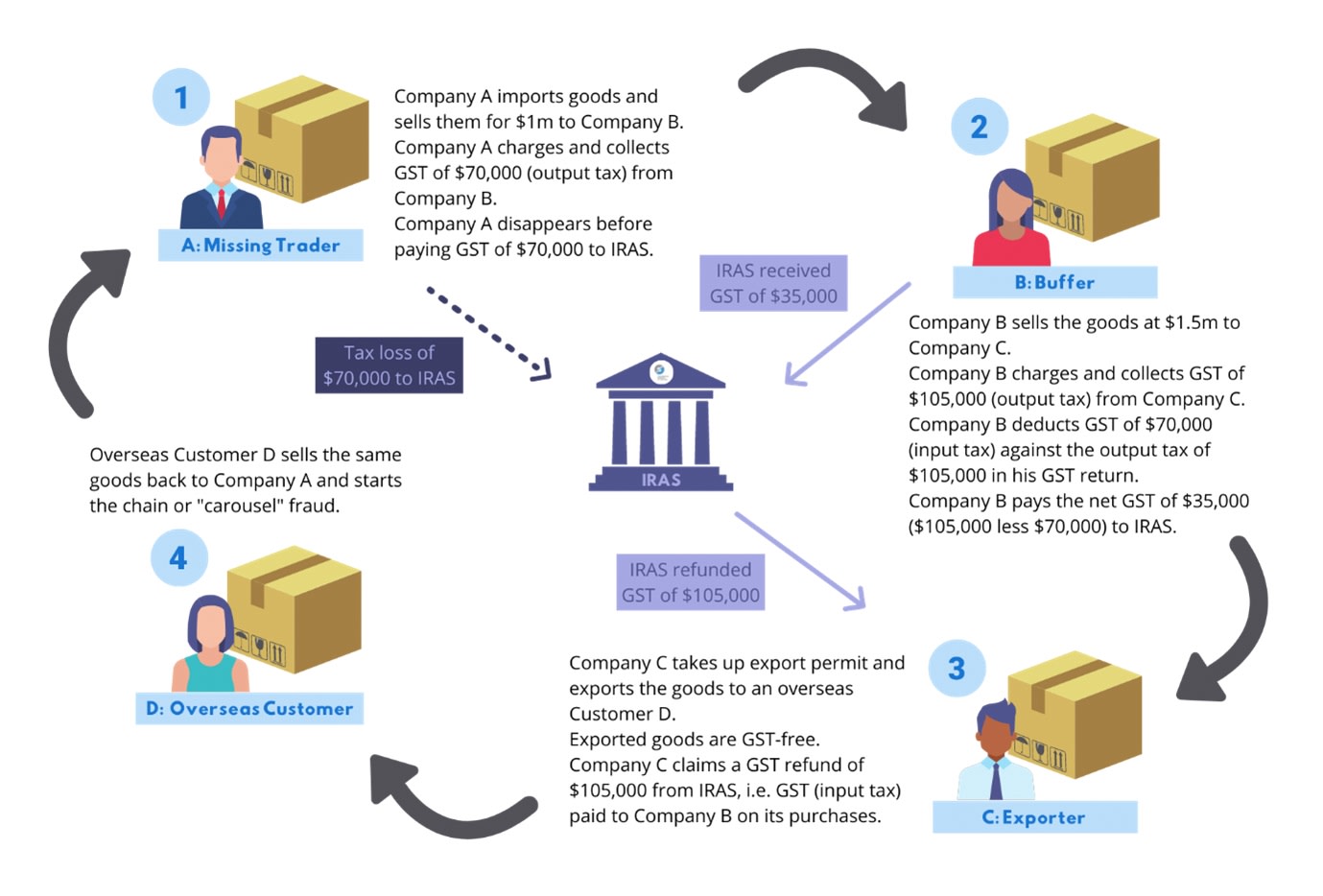

According to IRAS, missing trader fraud happens when a seller collects GST from sales but does not pay the tax to IRAS. The seller is known as the missing trader.

Meanwhile, businesses further down the supply chain continue to claim refunds from IRAS for the GST paid on their purchases.

THE CASE

Between September and December 2015, M_Solution Trading, a Singapore-incorporated company, reportedly sold high-value electronic goods and software amounting to about S$55 million to various businesses, including Crescendo Hardware Trading.

GST was charged on these sales, even though M_Solution Trading was only GST-registered from Dec 1, 2015, said the authorities.

M_Solution Trading was allegedly a shell company with no real business operations. It was believed to have been used to generate purchase orders and sales invoices to support the subsequent GST refund claims by exporters.

Both Yeo and Tan allegedly ran M_Solution Trading's fraudulent operations and conspired to forge its sales invoices and delivery orders.

For their fraudulent operations, Tan and Yeo were each charged under the Companies Act for being a knowing party to a fraudulent business. They were also charged two counts each under the Penal Code for conspiring to forge M_Solution Trading's sales invoices and delivery orders respectively.

If convicted of fraudulent trading, they may be jailed for up to seven years, fined or both. For conspiring to commit forgery, they may be jailed up to four years, fined, or both.

Tan had also allegedly transferred about S$5 million from the company's bank account to another bank account in Hong Kong in December 2015, despite knowing that the money came from criminal conduct.

For this, he was also charged with one count of transferring benefits of criminal conduct under the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act. If found guilty, he may be jailed up to 10 years, fined up to S$500,000, or both.

Meanwhile, Yeo was allegedly in charge of Crescendo Hardware Trading's fraudulent operations between October 2015 and April 2016. According to the police and IRAS, he had forged the company's sales invoices to facilitate the fraud.

He was charged with an additional count of fraudulent trading and another charge of conspiring to commit forgery in relation to Crescendo Hardware Trading, said the authorities.

Related:

During the material time, Sia was the director of M_Solution Trading. He was alleged to have failed to exercise reasonable diligence in performing his duties as a director of the company, with M_Solution Trading being used to perpetrate the fraud, said the police and IRAS.

He faces a single charge for breaching director's duties under the Companies Act, which carries a jail term of up to 12 months or a fine of up to S$5,000.

"The Police and IRAS take a serious stance against GST Missing Trader Fraud offences and will take stern enforcement action against perpetrators of such fraudulent arrangements," the authorities said in the news release.

From Jan 1, 2021, any GST-registered business that claims input tax on any supply made to them which it knew or should have known to be part of a missing trader fraud arrangement, will be denied input tax and subject to a 10 per cent surcharge on the input tax denied.

The authorities strongly advised businesses to perform due diligence checks and take the appropriate actions to address the risk identified, in order to avoid participating in transactions suspected to be part of a missing trader fraud arrangement.