Commentary: What the end of GrabPay Card could mean for Grab’s super-app ambitions

Is a company’s profitability a matter of interest to anyone besides its shareholders? Grab's recent moves reflect a sector increasingly prioritising sustainable growth over unchecked expansion, says fintech CEO Jonathan Chang.

This audio is generated by an AI tool.

SINGAPORE: Like Google or Zoom, Grab has become one of those verbified brand names in our day-to-day vernacular - notably for ride-hailing and food delivery and, to some extent, as a mobile wallet payment method.

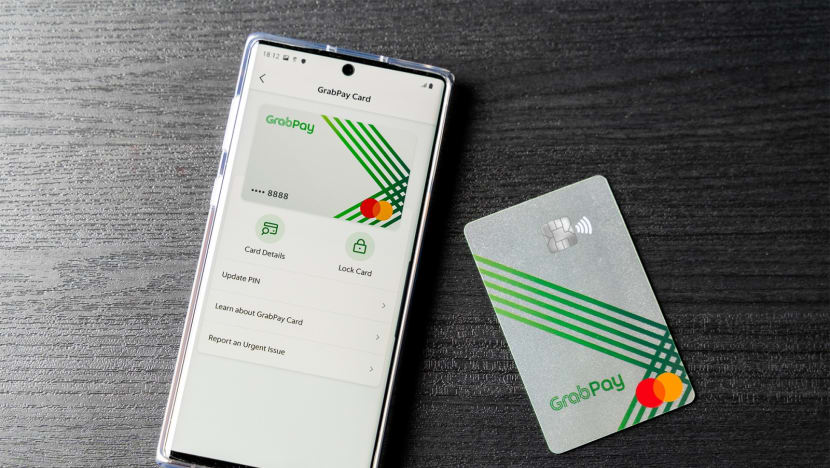

So Grab's recent decision to discontinue its physical and digital GrabPay Card in Singapore from Jun 1 was sure to attract questions and curiosity about what this might signify for its super-app ambitions, particularly in the fiercely competitive financial services arena.

Grab's journey from ride-hailing disruptor to offering a wide array of services - including deliveries, rides and financial services - across Southeast Asia, encapsulates the vision of not just meeting but anticipating consumer needs within a single platform.

The introduction of the GrabPay Card in December 2019, in partnership with Mastercard, was a bold step that pushed the envelope on what users could expect from a digital payment solution. Its numberless card design provided enhanced security by reducing the risk of card details being stolen while a built-in money management app integrated seamless, real-time tracking of transactions.

The decision to phase it out, framed against the backdrop of an ongoing re-evaluation of its financial services, could mark an important moment not only for Grab but also reflect broader trends in Singapore’s digital payments ecosystem.

PAR FOR THE COURSE IN TECH

The best way to look at it is perhaps as an admission that not all ventures will bear fruit in the relentless pursuit of innovation and path to profitability.

Grab saw a significant milestone when it posted a profitable quarter for the first time in February. However, the company cautiously forecasted weak revenue growth for 2024.

The discontinuation of the GrabPay Card might suggest a strategic pivot toward concentrating resources on more profitable or promising segments of Grab’s vast ecosystem. It acknowledged that other financial offerings, such as the GrabPay Wallet and the “Buy Now, Pay Later” service PayLater, have seen higher adoption rates and utility.

But this decision, taken together with the recent pullback from its retail investment products AutoInvest and Earn+, could signal a broader trend in the digital payments sector.

It raises questions about the coherence of the value proposition that these services offered within Grab’s ecosystem: Were digital payment users keen on a physical debit card in the first place? Were loyalty incentives sufficient to drive usage after being “nerfed” (made more difficult to earn or use)?

In this context, the GXS card, a product of the Grab-Singtel digital banking partnership, becomes particularly noteworthy. The GXS card's distinct value propositions and target market segment might suggest a strategic recalibration rather than a direct replacement.

Perhaps the ceased offerings were ahead of their time. Or did they fail to meet the core needs and habits of their target audience? Either way, the fintech landscape is littered with innovative products that promised to revolutionise financial behaviours yet faltered when confronted with the complex realities of user adoption and regulatory landscapes.

Grab's strategic recalibration towards profitability mirrors a wider industry realisation that growth at all costs is unsustainable in the long run.

The tech industry's earlier infatuation with rapid expansion and market capture culminated in 2023’s brutal year of layoffs, giving way to a more measured approach where profitability and sustainability are equally prized.

A MATTER OF PUBLIC INTEREST?

But why would Grab's profitability be a matter of public interest, not just the immediate concerns of its shareholders? It extends beyond the realm of corporate success stories, even if Grab was one of the pioneer unicorns out of Singapore and went public on Nasdaq in 2021.

This shift is not just about healthier balance sheets when Grab has become an integral part of daily life in Southeast Asia. Its financial health directly impacts a vast ecosystem of drivers, merchants, consumers and employees. According to Grab, its advertising platform GrabAds processes over 10 million transactions daily across Southeast Asia, indicating a sizable interest from merchants.

Profitability ensures it can continue to invest in local economies, innovate in response to regional needs and contribute to the digital infrastructure of the communities it serves. Building resilient business models that would provide steady employment and services amid economic uncertainty.

In some markets, Grab's financial services have the potential to enhance financial inclusion, offering accessible, user-friendly solutions to those who might otherwise remain on the margins of the banking system.

However, this path to profitability must be navigated with care. The pursuit of financial sustainability should not come at the expense of the broader societal and economic contributions that have helped cement its position as a tech leader in Southeast Asia.

Grab's recent strategic moves are indicative of the inherent risks and realities of fintech innovation. They should not be viewed in isolation, but as a reflection of a maturing digital payments industry whose aggressive and often unchecked expansion strategies have caught up with reality.

As the digital landscape continues to evolve, the true measure of Grab's super-app ambitions will be its capacity to balance complex, often competing, demands - profit and innovation with the responsibility of being a key player in the region's digital economy.

Dr Jonathan Chang is CEO of Fintopia Indonesia - a digital lending fintech unicorn. He is also a lecturer, public policy advisor and an award-winning researcher.