Commentary: How long will the gold rush last as prices hit record highs?

The price of gold is inextricably linked to world events and the overall economic climate, says OCBC’s Christopher Wong.

This audio is generated by an AI tool.

SINGAPORE: Type “gold” into your search engine browser and you will see headlines shouting about the precious metal’s amazing rally in past months.

Since October 2023, gold has been on a roll, hitting an all-time high of US$2,450 per ounce on May 20. As of Jun 6, gold was trading at around US$2,373 per ounce, quite a bit more than the previous record price of US$2,075 an ounce set in August 2020, when the COVID-19 pandemic boosted demand.

Consumers are buying into the hype. In China, online merchants are selling “gold beans” shaped like peanuts and fruit, at the price of US$90 apiece.

In Korean convenience stores, you can buy tiny gold bars no larger than your fingernail. A 1.87g bar goes for US$170.

Now, the serious investor is not going to be tempted by such knick-knacks. The outlook on gold remains constructive: Central banks have started to ease monetary policies, albeit at different paces, and gold maintains its role as a portfolio diversifier.

However, it is prudent to also consider the pros and cons of gold as an investment, given that the yellow metal has risen so quickly and that it generates no yield.

REASONS BEHIND THE GOLD RUSH

Reasons for gold’s rally can be broken down into what I call the three Gs.

First, geopolitics. When geopolitical tensions rise, the natural response is for investors to trend towards gold, long considered to be a safe-haven asset. Gold’s recent surge has been driven by a re-escalation of geopolitical tensions in the Middle East and Russia’s ongoing war on Ukraine.

The United States presidential elections in November may push the price of gold higher. Should Donald Trump become president again for a second term, he could start a new trade war with China; he recently spoke about plans of imposing tariffs of 60 per cent or higher on China goods. Let us not forget that in 2018 and 2019 when the US-China trade war started and escalated, gold prices also rose significantly.

Second, global easing. One of the key drivers behind the positive outlook for gold is the anticipation of a global easing cycle. Central banks worldwide, including those in Brazil, Canada, Europe, Sweden and Switzerland, have already initiated rate cuts. The US Federal Reserve is likely to follow suit in the coming months of this year.

The prospect for global central banks to enter an era of easing is expected to support gold prices. Historical evidence dating back to 2001 has shown that gold prices strengthen when US Fed rate hike cycles end. If history is a guide, then gold may still have further room to run higher when the actual rate-cut cycle starts.

Third, gold buying spree by central banks. Central banks continue to purchase gold at a record pace - an estimated 1,082 tonnes of gold in 2022, and 1,037 tonnes in 2023.

The momentum has continued into 2024, with China leading the pack. On a country level, China has added 225 tonnes to its reserves in 2023. April 2024 also marks the 18th consecutive month it has added gold to its coffers.

Gold remains attractive to central banks due to its performance during times of crisis and the fact it is an effective portfolio diversifier and highly liquid asset.

While the outlook for gold may be constructive, that is not to say that gold is immune to the fluctuations of a typical asset. It can be affected by market sentiments, monetary policy, economic data and more.

Gold prices can face downside pressure in the event that the Fed delays its rate cut cycle, if it unexpectedly tightens or if there is a sharp de-escalation in geopolitical tensions.

WEIGHING THE PROS AND CONS OF GOLD INVESTING

The price of gold is inextricably linked to world events and the overall economic climate. There are pros and cons to consider before deciding if it has a place in your portfolio.

The first advantage of gold is that it is a stable store of value. Since 2001, gold has outperformed most currencies on average terms each calendar year. Looking at the research to date, the annualised average rate of return of gold was 9.7 per cent since 2001.

The only periods when gold dramatically underperformed were when the Fed signalled it would taper quantitative easing policies or hike rates.

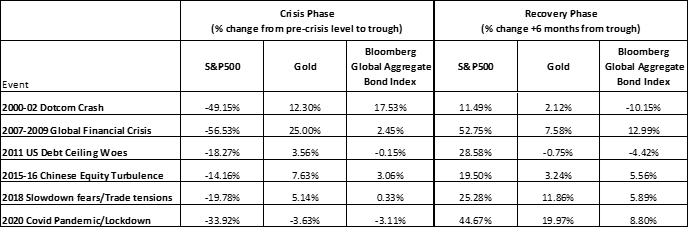

The second advantage is that gold is seen as a steady asset in uncertain times. This is true over crisis periods when returns have largely been positive, even if returns have varied across crisis episodes.

When one examines the major crises over the past 20 years, one can see that gold prices have remained relatively stable as opposed to the stock market, which can experience significant declines. The price of gold surged during the global financial crisis in 2007 to 2008, for instance, even as the stock markets plummeted.

Of course, past performance is never necessarily indicative of future results, and some may argue this comparison is overly generalised. One must also consider the overall economic climate and investor sentiment will influence gold prices, not just specific crises.

Spreading investments across different assets like stocks, bonds and gold helps one reduce overall portfolio risk; if one asset class performs poorly, then others may offset those losses.

Still, there are cons when it comes to holding gold. Consider that gold’s price appreciation tends to be slower than say, that of stocks. You might not see substantial returns on your investment.

Unlike bonds and stocks, gold does not generate income like yield or dividends. Returns from gold depend entirely on a price increase at the time you decide to - or need to - sell what you’re holding, and gold prices can and do fluctuate significantly at times.

Gold is a physical asset, and so one incurs annual storage fees at professional vaults. There are security risks if you decide to store gold at home.

There is a certain opportunity cost, too, when it comes to the liquidity of gold. While it is more liquid than some other investments, selling large quantities of gold quickly can be challenging, especially during downturns.

Ultimately, gold may not be a suitable investment for all investors despite its glittering appeal. As with all investments, each investor has to consider their individual risk tolerance, investment goals and overall portfolio before making a foray into gold.

Christopher Wong is the FX Strategist at OCBC.