Commentary: China’s COMAC will not rock Airbus-Boeing boat for now, but it’s a matter of time

The COMAC C919 stole the limelight at the Singapore Airshow and went on a demonstration tour of Southeast Asia, but it will still be a hard sell outside of China for now, says Endau Analytics’ Shukor Yusof.

This audio is generated by an AI tool.

SINGAPORE: On the first day of the biennial Singapore Airshow in February, trade visitors waited patiently under the scorching sun for the aerial display. Many had come to see the C919, developed by state-owned Commercial Aircraft Corporation of China (COMAC), making its international debut since entering into service in May 2023.

The first thing one notices is the quietness of the C919, cruising at 1,000m above sea level, and at full thrust, a testament not only of the engines but also the design of the plane.

The COMAC C919 has been touted as China’s first homegrown jet. COMAC itself was set up to realise China’s ambition of having its own aerospace manufacturing eco-system and to wean its reliance on the West for airplanes.

But while the C919 was designed and developed in China, over half of its components are imported, mostly from Europe and North America. Its LEAP engines are made by CFM International, a United States-France joint venture, and earlier engine models are used in the C919’s competitors, the Airbus A320neo and Boeing 737.

But that has not stopped COMAC from creating anxiety and curiosity in an industry dominated by Airbus and Boeing.

COMAC stole the limelight at the Singapore Airshow – marked also by Boeing’s muted presence following a string of high-profile incidents – but will that be enough to secure deals and sell outside of China?

AN EYE ON SOUTHEAST ASIA AVIATION

The short answer is yes, but it will take time and it’s clear which target market COMAC has its eye on.

After the Singapore Airshow, the C919 went on to conduct demonstration flights in Vietnam, Cambodia, Thailand, Malaysia and Indonesia.

Southeast Asia is not just geographically close, but its economies are dependent on a strong and stable China. A significant decline in the number of Chinese visitors post-COVID has dented tourist receipts in ASEAN.

All C919 sales are in China today, but Southeast Asia is one of the world’s fastest-growing aviation markets. With a population of over 700 million, and a growing number of start-up carriers, intra-Southeast Asia travel presents rich opportunities, evinced by Scoot’s recent deployment of 9 Embraer regional jets.

COMAC has two aircraft types inthe market: The ARJ21, a 78- to 97-seater regional jet and the C919, a single-aisle plane suitable for between 150 and 170 passengers. A third, the C929 long-range twin-aisle aircraft is currently in the design phase.

GallopAir, a Brunei start-up with Chinese backers, has reportedly ordered 15 C919 and 15 ARJ21 but many questions remain, as the carrier needs to meet strict regulatory requirements before it can even fly.

One likely candidate for the C919 is Indonesia’s TransNusa, a small family-owned operator currently deploying two ARJ21 (with 30 on order) in its fleet which also includes three Airbus A320.

SHAKING “MADE IN CHINA” LABEL?

The C919’s biggest draw is its price. Officially, COMAC is peddling it at US$100 million, close to what Airbus and Boeing are offering for their planes.

Unofficially, the C919 can be had for half that, people familiar with COMAC told me. “They will even slice several millions more off it if you buy in bulk, 30 or 40 units,” an executive at an aircraft leasing company disclosed.

Other incentives, including export credits (typically up to 85 per cent of a jet’s purchase price), may be extended to airlines willing to punt on the C919. Support in terms of maintenance, repair and overhaul, the construction of hangars and crew training are also included in the package.

That said, the C919 will still a hard sell outside of China’s domestic market. Air travellers may be wary of the “Made in China” label and COMAC has no track record to boost confidence, as a new and relatively unknown player.

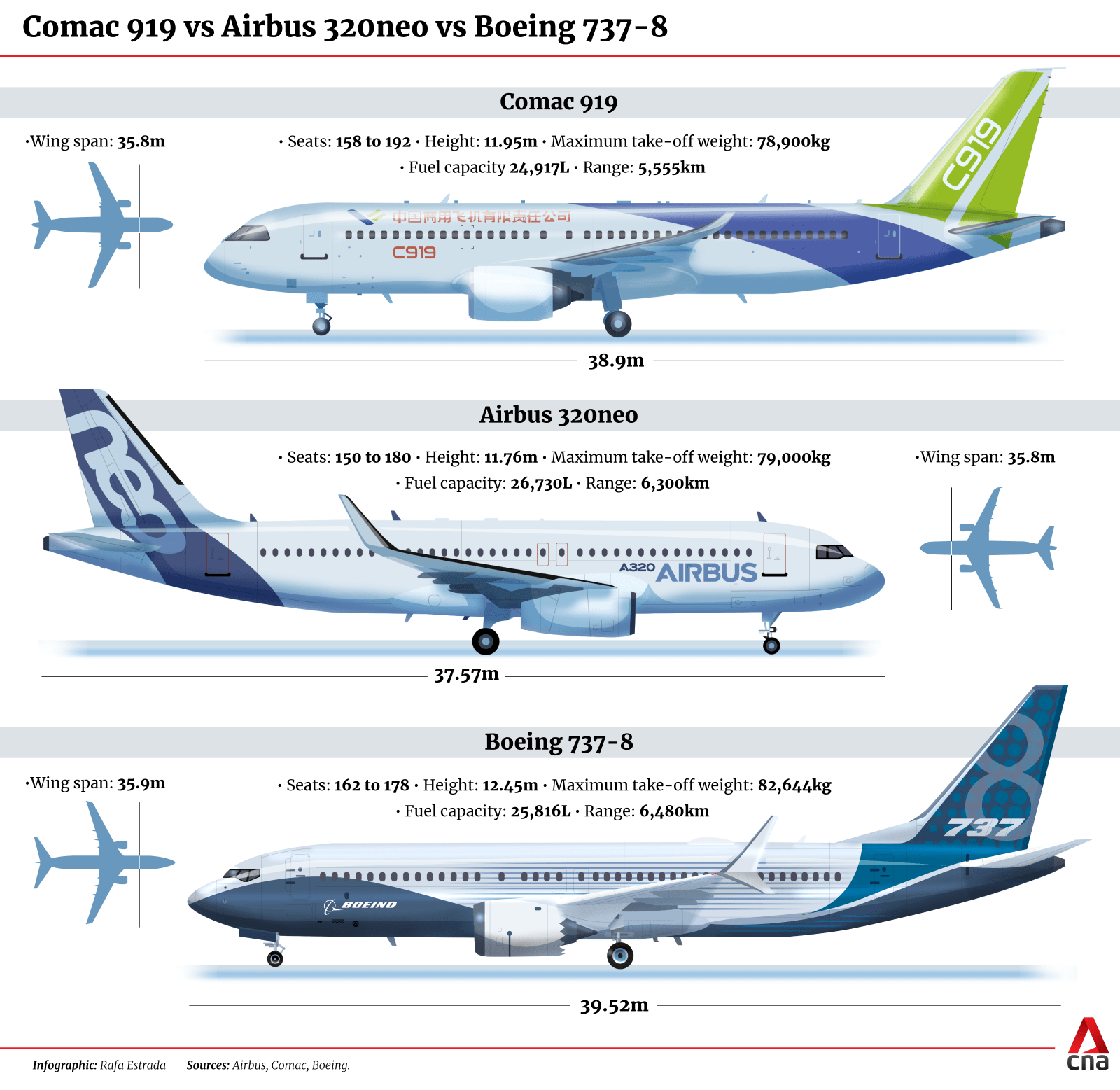

Others say its weight – several tonnes heavier than the Airbus A320 and thus, less fuel-efficient – and limited range (5,500km vs about 6,500km for the A320 and Boeing 737 Max) make the C919 unattractive.

Christian Scherer, Airbus’ top salesman, told journalists after watching the C919 fly in Singapore that it “is not going to rock the boat”.

NOT IN THE GAME FOR MONEY, FOR NOW

But COMAC is not in the game to make money, at least not for now.

Its strategy is simple: Scale up at home, continue refining its planes, develop its own engines and exploit gaps in the market, at a time when Boeing is reeling from self-inflicted wounds.

While the US remains the world’s largest domestic aviation market, China is a close second and is projected to top the global market for aviation services by 2042, according to Airbus.

The success of the C919 and other homegrown jets will be critical to China. The pursuit of aerospace excellence is a bid to secure its global position as an economic giant and to some extent, a military power, without compromising its entrenched socialist model.

With the US and its European partners “decoupling” in the chips and telecommunications sectors, there is a possibility the same could happen in aircraft manufacturing.

Barely a decade ago, nobody would have imagined a Chinese company leading the world in the electric vehicle business.

No one should dismiss COMAC in the aviation space. It can afford to keep on experimenting in its domestic market until it wins the rest of the world over – starting with Southeast Asia.

Shukor Yusof is the founder of Endau Analytics, an independent aviation advisory firm based in Singapore.