‘High level of risk’: Singapore brokerages run customer reviews, display warnings on spot bitcoin ETFs

Requirements to trade include passing a review that determines whether investors have the know-how to trade in more complex and higher-risk products.

Representation of Bitcoin cryptocurrency is seen in this illustration taken on Jan 11, 2024. (File photo: REUTERS/Dado Ruvic)

This audio is generated by an AI tool.

SINGAPORE: Given the “high” level of risks involved, some brokerages in Singapore are allowing only eligible investors who fulfil certain criteria to trade in the United States-listed spot Bitcoin exchange-traded funds (ETFs).

Risk alerts are also published on their websites prominently as additional safeguards.

Meanwhile, at least one brokerage – OCBC Securities – has decided not to offer the new cryptocurrency-linked funds to retail investors for now.

Earlier in January, the US Securities and Exchange Commission approved 11 ETFs that track the price of Bitcoin – a watershed move allowing mainstream investors to trade easily in the world’s largest cryptocurrency, through regular brokerage accounts and without needing to directly purchase these digital currencies.

These new ETFs are available for trading on some local trading platforms, although certain criteria apply.

For example, Interactive Brokers said “only eligible clients who have the requisite knowledge or experience to trade in listed specified investment products may apply for permission” to trade in the Bitcoin ETFs.

Specified investment products are financial products that have structures and features that may be more complex in nature. Brokers are required by the Monetary Authority of Singapore (MAS) to conduct suitability assessments before allowing their customers to trade in these products.

“Bitcoin ETFs are risky investments and clients wishing to trade such products must understand and acknowledge the associated risks involved,” said a spokesperson from Interactive Brokers.

Likewise, at Phillip Securities and DBS Vickers, only investors who comply with rules, such as passing a customer account review and completing a risk warning statement for overseas listed investment products, can go on to trade in the US-listed Bitcoin ETFs.

“As payment token derivatives such as Bitcoin ETFs carry a high level of risk, we have added another layer of safeguard to remind customers of the risks, including the risk of losing all their capital, high price volatility, cyber security risks (and) unregulated status of the products,” said Phillip Securities’ deputy head of global markets and ETF desk Jason Fu.

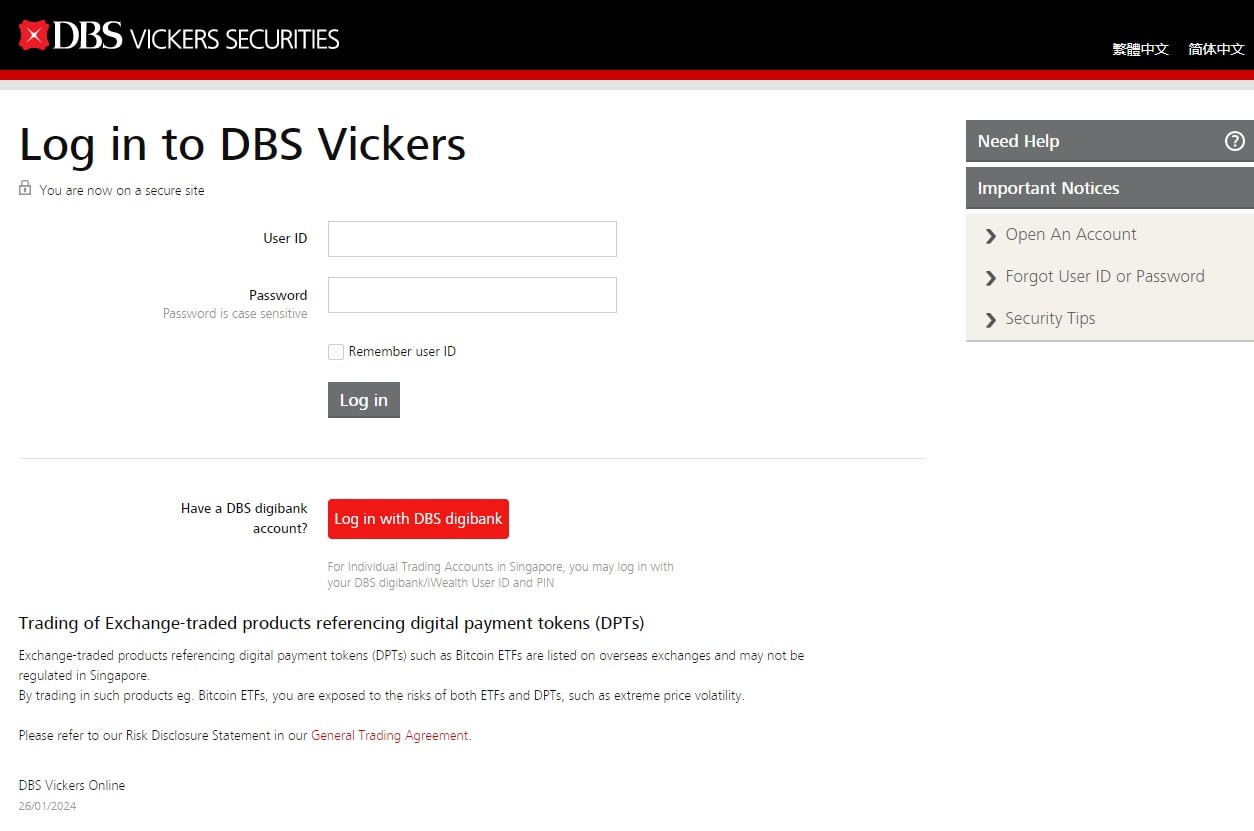

DBS has also put up a reminder on the login page of its trading platform to highlight potential risks, such as extreme price volatility.

“Customers intending to trade in overseas listed ETFs, including spot Bitcoin ETFs, are reminded of the risks associated and should carefully assess their investment objectives, risk appetite, financial situation and particular needs before making any investment decision,” said the bank’s spokesperson.

FSMOne.com, the digital trading platform of iFast Corporation, said it has recently put in place new requirements, such as additional risk statements for investors to acknowledge each time they trade.

Its platform also carries “prominently displayed warnings” to ensure that investors are aware of the risks associated with cryptocurrency and related products.

Still, the brokerages have observed trading activities among local investors.

FSMOne.com noted “some interest” in the new ETFs, although this seems to be “restricted to a smaller group of investors”.

“These investors may be more familiar (with) Bitcoin prospects, or they may simply be speculating on Bitcoin prospects,” said its general manager Jean Paul Wong.

Phillip Securities said the number of customers trading in the spot Bitcoin ETFs tapered after the “initial hype” of the first two days of the listings, with trading activities down by almost 80 per cent in the subsequent week.

This could be due to a combination of factors, including volatility in the underlying Bitcoin price and investors becoming more risk-averse, said Mr Fu from Phillip Securities.

WHAT INVESTORS SHOULD TAKE NOTE OF

The MAS has reiterated that trading in cryptocurrencies is “highly volatile and speculative in nature” and therefore unsuitable for retail investors.

In response to CNA’s queries on Jan 16, the regulator said that spot Bitcoin ETFs were not approved for offer to retail investors in Singapore. Those who still choose to trade the products in overseas markets must exercise extreme caution, it added.

It also asked licensed capital market intermediaries - that offer access to these overseas markets - to ensure adequate risk disclosures and proper customer suitability assessments.

Related:

Financial market observers echoed the risks and warned investors to exercise caution.

Mr Gerald Wong, founder of investment advisory platform Beansprout, said it was important for investors to take note of an ETF’s underlying asset, alongside other factors such as the expense ratio and trading commissions when deciding whether to invest.

“For example, if I am looking at a Straits Times Index (STI) ETF, it will be linked to how the STI performs. For the Bitcoin ETFs, the underlying asset is Bitcoin which is, like what the MAS has said, highly risky,” he said.

Mr Jean Paul Wong of FSMOne.com noted that investors should scrutinise long-term fundamentals – such as future earnings, cashflow situation and yields – underlying any investment they make.

In the case of the new cryptocurrency-linked ETFs, the problem is that "a large majority of cryptos continue to have little to no intrinsic value”, he said.

“Most cryptos lack any underlying earnings or cash flows, and this is a red flag for any prospective investors, as it is hard to derive a reliable intrinsic value of an asset if it cannot generate income,” he added.

“Without fundamental support, we believe crypto is fuelled by sentiment.”

Nearly US$4 billion of funds have flowed into the new spot Bitcoin ETFs, particularly to products operated by BlackRock and Fidelity, according to a Reuters report last week citing data from Deutsche Bank.

But US$2.8 billion of those were accounted for by flows out of Grayscale – a Bitcoin trust that previously dominated the market but has since been converted into an ETF.

The outflows were spurred by Grayscale’s higher management fees – at 1.5 per cent, compared to other Bitcoin ETFs with fees as low as 0.19 per cent to a high of 0.39 per cent, reports have said.

The outflows appeared to have had some pressure on Bitcoin prices, analysts said. A further factor in Bitcoin’s price decline was profit-taking by investors who had previously bought into the cryptocurrency with expectations of the ETF approval.

Bitcoin was last seen trading at around US$43,373 on Jan 30 afternoon, down nearly 13 per cent from around US$49,000 – the three-year peak it hit on Jan 11, spurred by the launch of the spot ETFs.