Digital economy contributed 17.3% to Singapore's GDP, over 200,000 tech jobs in 2022

Local tech workers command a median monthly wage of S$7,376, more than the overall resident median wage of S$4,500.

A man working at a computer. (File photo: iStock)

SINGAPORE: Singapore's digital economy contributed 17.3 per cent to economic growth and more than 200,000 tech jobs in 2022, according to new data released on Friday (Oct 6).

The figures – the first official measure of the size of Singapore's digital economy – were published in a report by the Infocomm Media Development Authority (IMDA) and Lee Kuan Yew School of Public Policy.

Across various metrics, the report shows that Singapore's digital economy expanded over the five-year period between 2017 and 2022.

The digital economy's contribution to gross domestic product growth went up from 13 per cent to 17.3 per cent – in nominal terms, almost doubling from S$58 billion (US$42 billion) to S$106 billion.

This compares "favourably" with other similar open economies like Estonia, Sweden and the United Kingdom, IMDA said in a press release.

The digital economy has grown at a compound annual growth rate of 12.9 per cent per year since 2017, outpacing the overall economy.

The number of tech jobs also increased from about 155,500 to 201,100 over the five-year period. This meant the share of tech professionals out of total employment went up from 4.2 per cent to 5.2 per cent.

The strong demand for tech workers benefits local workers, said IMDA. More than 70 per cent of tech jobs are held by Singaporeans and permanent residents, and they command competitive wages.

Tech professionals earn a resident median monthly wage of S$7,376, excluding employer Central Provident Fund (CPF) contributions and bonuses. This is up from S$5,512 in 2017.

It is significantly higher than the overall resident median monthly wage, which is S$4,500 excluding employer CPF contributions. That figure increased from S$3,749 in 2017.

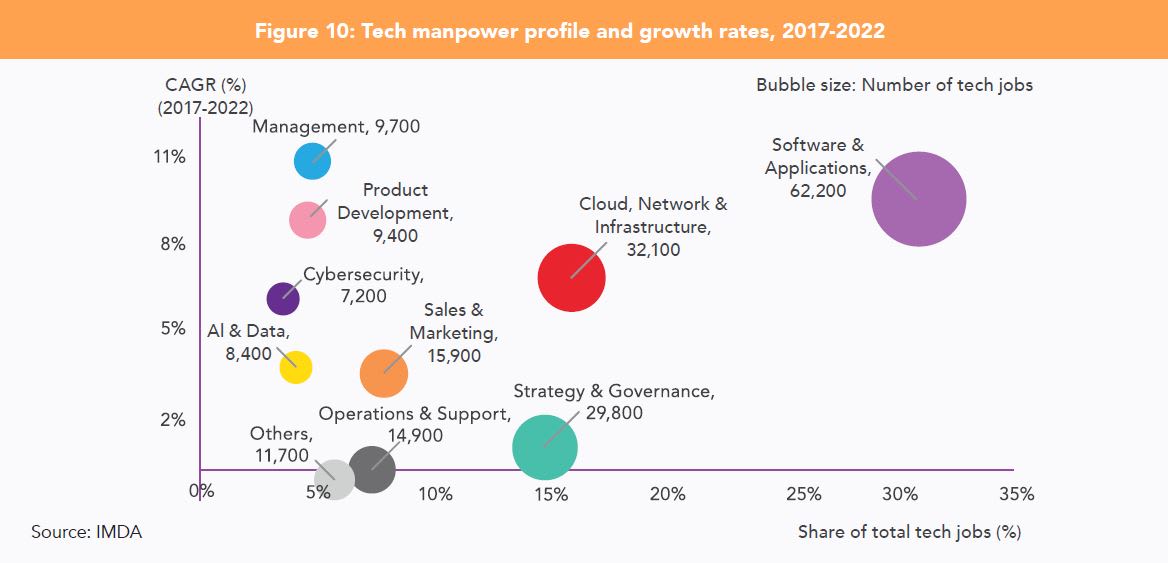

Roles in software and applications, such as software and developer engineers, make up most of the tech jobs with significant growth.

But roles are also growing in cloud computing, network and infrastructure, management and product development.

"Despite the tech layoffs in 2022/2023 which affected Singapore as well as other tech hubs globally, tech professionals will likely remain in demand as the economy digitalises," the report stated.

While there is no international consensus on how to measure the digital economy, it is important to know its value to plan investments for infrastructure and policies to support growth, Minister for Communications and Information Josephine Teo said in a LinkedIn post.

"We must take advantage of the opportunity for growth that the digital economy brings because it is a great equaliser that allows even small countries like ours to punch above our weight and compete against larger countries," she wrote.

"We must also continue to ensure that upskilling opportunities are relevant to industry needs and accessible to those who are keen to acquire them, regardless of their backgrounds."

INFORMATION AND COMMUNICATIONS SECTOR

The digital economy as defined in the report comprises two parts: The value added from the information and communications sector, and the value added from digitalisation across the rest of the economy.

The information and communications sector makes up about one-third of the digital economy, with the remaining two-thirds coming from digitalisation elsewhere.

The sector supplies digital services like telecommunications, computer programming & IT consultancy, cloud computing, software development, and production and distribution of content and media.

It is a key growth engine of Singapore's economy, accounting for S$33 billion or 5.4 per cent of overall GDP, said IMDA. This is up from S$19 billion or 4.3 per cent of GDP in 2017.

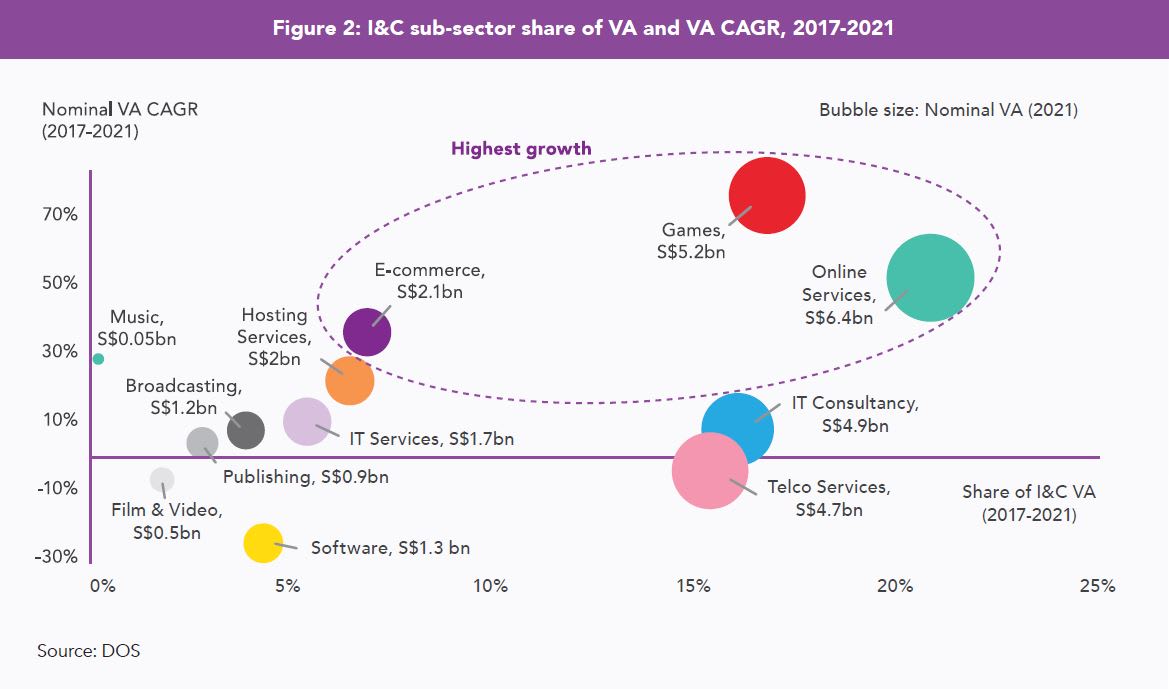

Backed by strong growth in games, online services and e-commerce, information and communications was the fastest-growing sector in Singapore from 2017 to 2022.

Growth in these three sub-sectors was driven by accelerated digitalisation and trends like the shift to cloud computing, especially during the COVID-19 pandemic, the report stated.

DIGITALISATION IN OTHER SECTORS

The value added from investments in digital capital in other sectors increased from S$39 billion in 2017 to S$73 billion in 2022, or 11.9 per cent of Singapore's GDP.

The bulk of that contribution came from the finance and insurance, wholesale trade and manufacturing sectors.

Notably, more than half of the tech jobs in 2022 came from the rest of the economy beyond the information and communications sector.

Firms are taking up technology at higher rates, with 94 per cent adopting at least one digital technology in 2022, compared to 74 per cent in 2018.

Technological adoption intensity – the average number of digital technologies adopted by each firm – increased from 1.7 to 2.1 over the same period.

These technologies span cyber security, cloud computing, e-payment, e-commerce, data analytics, artificial intelligence, internet of things, blockchain and immersive media.

But there are differences in technological adoption by small and medium enterprises and bigger enterprises, the report noted.

Bigger enterprises register higher levels of adoption across a range of technologies like cloud computing, data analytics and artificial intelligence.

Progress in SMEs is more mixed, with substantial improvement in the adoption of e-payment but comparatively lower adoption of the other technologies.

Adoption also varies significantly by sector. Finance and insurance as well as professional services have higher adoption intensity, compared to construction, real estate and transportation and storage.

IMDA chief executive Lew Chuen Hong said the digital economy has seen remarkable growth over the years as efforts to drive Singapore's digital transformation bear fruit.

"In the digital domain where many of the constraints that bind us as a small country do not exist, there is much scope for Singapore to punch above our weight and be a much bigger digital red dot," he said.