Analysis: Ringgit's record-breaking decline could trigger public unhappiness, spell political trouble for Malaysia PM Anwar

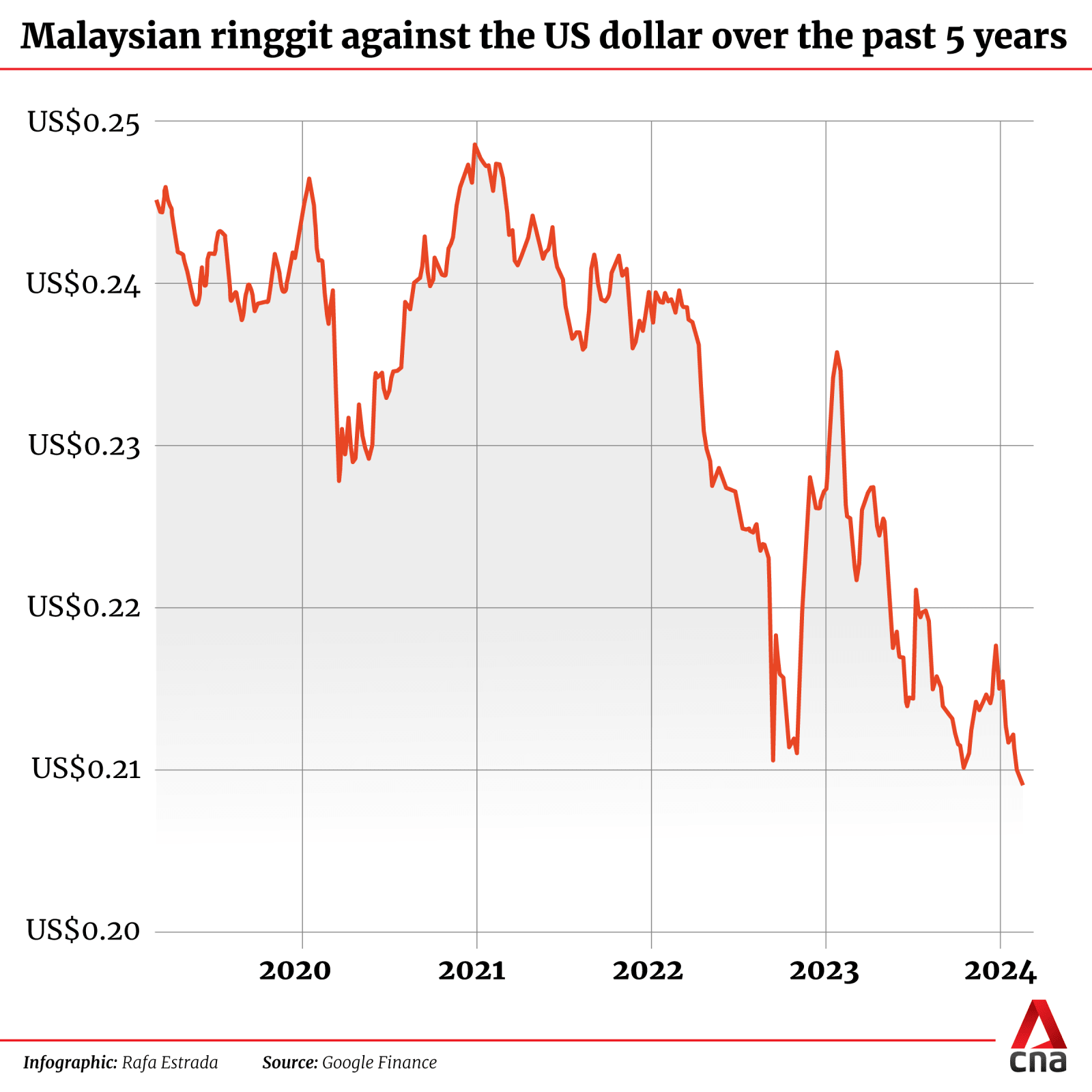

The Malaysian ringgit fell to its lowest level on Tuesday since the Asian Financial Crisis, triggering concerns in the country.

A Malaysian ringgit note is seen in this illustration photo on Jun 1, 2017. (Illustration: Reuters/Thomas White)

This audio is generated by an AI tool.

SINGAPORE: Amid a fall of the Malaysian ringgit to its lowest level in 26 years, analysts have warned that a further slip could have political repercussions for Prime Minister Anwar Ibrahim, especially if the public perceives a lack of action by his administration to tackle the issue.

But an expert has also poured cold water over such a doomsday scenario, noting the “unassailable” majority Mr Anwar currently enjoys in Parliament.

On Tuesday (Feb 20), the ringgit fell to its lowest level since the Asian Financial Crisis of the late 1990s. The currency had also suffered a more than 4 per cent drop this year, partly due to poor export performance and rising US interest rates.

The consistent slip of the ringgit has raised concerns in Malaysia over the country’s economic performance and what it could mean for those residing there. And since last year, the Anwar administration has also faced criticism from members of the opposition claiming that it has failed to manage the country’s economy.

Political expert James Chin of the University of Tasmania warned that a further fall of the ringgit could spell “real political tensions”, especially if the currency slips to RM5 per US dollar.

Currently, US$1 is worth RM4.79.

“Once it hits RM5 per US$1 … a lot of people will have lost confidence not only in the Anwar government but in its ability to deal with the economy,” Dr Chin told CNA.

Beyond that, the Singapore dollar has continued to strengthen against the Malaysian ringgit hitting a record high of S$1 to RM3.57 on Feb 20. The previous record was just a day earlier on Feb 19, S$1 to RM3.56.

Dr Chin warned that a worsening quality of life due to rising prices caused by the falling ringgit would be a “very dangerous thing” for Mr Anwar.

“Malaysia is a trading nation so everything that it imports will automatically be much more expensive,” said Dr Chin, noting that the country could see a more than five per cent increase across the board for everything it imports.

“The cost of living in Malaysia is very high (and) wages are stagnant. (For) the working class and the lower class, (rising costs) will really impact their standard of living. And of course that will translate into political unhappiness.”

He warned that inaction by the government would place Mr Anwar in a precarious position politically.

“If Anwar doesn’t get the economy right, then he is just setting himself up for a fall because there would be a major push to replace him,” said Dr Chin.

Echoing this, Dr Oh Ei Sun - a senior fellow with the Singapore Institute of International Affairs - said that if the issue is not addressed promptly, “it will erode the already sliding political support for the Anwar government”.

He added that the high costs of imported goods - especially for food products - that are caused by the falling ringgit would add to the unaffordability of Malaysians’ daily lives.

In a more rousing sentiment, Dr Shankaran Nambiar - a senior research fellow at the Malaysian Institute of Economic Research (MIER) - told CNA that political instability in the country due to the falling ringgit is unlikely.

“There is political stability like never before and Anwar Ibrahim seems unassailable in parliament, leaving the question of political instability out,” he said.

Mr Anwar currently holds a parliamentary supermajority. This comes after several opposition Members of Parliament from Parti Pribumi Bersatu Malaysia (Bersatu) declared their support for the unity government under his leadership.

Dr Nambiar noted that economic reforms have been undertaken by the Anwar administration and efforts - such as infrastructural development and fiscal measures - will see results in the months to come.

Among the major ongoing infrastructure projects in Malaysia include the East Coast Rail Link (ECRL) which seeks to connect the eastern state of Kelantan and the western state of Selangor, as well as the Johor Bahru-Singapore Rapid Transit System (RTS) Link, a cross-border railway line which aims to improve connectivity between Malaysia and Singapore.

While such developments are expected to positively impact Malaysia, Dr Nambiar said that it would be hard to predict how other factors like the state of China’s economy and the yuan would affect the country.

“It is also a question of debate as to how the tech cycle will play out over the months. There is some uncertainty as to whether the demand for semiconductors will be perky in the months ahead,” he told CNA.

Dr Nambiar further explained that external factors causing the ringgit’s slide include the state of the global economy which “has not been as robust as it could be”, the relatively poor performance of the manufacturing industry, as well as the problems in the Chinese economy.

When asked if the Malaysian ringgit could see a similar fate as the Thai baht did in 1997, Dr Nambiar said that the two situations are completely different.

“Today, Malaysia has deep reserves, a strong regulatory structure, a well-diversified economy and strong fundamentals,” he said.

The Asian Financial Crisis in 1997 began with the collapse of the Thai baht and quickly affected the rest of the region, leading to a period of economic instability across Asia.

Malaysia's central bank governor Abdul Rasheed Ghaffour said on Tuesday that the ringgit's performance had been affected by "external factors" such as US rate hikes, geopolitical concerns and uncertainty about China's economic prospects.

"The current level of the ringgit does not reflect the positive prospects of the Malaysian economy going forward," he said in a statement then. He said expected growth in global trade and Malaysian exports should have a positive impact on the currency this year.

Meanwhile, Malaysia's second finance minister Amir Hamzah Azizan told state news agency Bernama on Monday he expected the currency to strengthen against the dollar after US authorities signalled an end to rate hikes.