Johor’s data centres getting a boost from the Singapore factor; water, power remain bottlenecks

Southern Johor is seeing a boom in data centres thanks to its proximity to Singapore, spillover effects of the US-China trade war, as well as cheaper land, water and power. More tech opportunities beckon, say experts.

This audio is generated by an AI tool.

KULAI: Johor’s Kulai district, some 70 kilometres north of Singapore, is known for its rubber plantations and oil palm estates.

These days, however, you’ll also find hundreds of acres of construction sites with cranes and work crews.

Within three years, the sites will become industrial parks hosting multiple data centres – buildings that house large groups of high-speed computers, servers and routers that store, process as well as distribute vast amounts of data.

The world’s growing reliance on cloud-based technology has fuelled the growth of data centres, and Johor has become one of the hotspots in Malaysia.

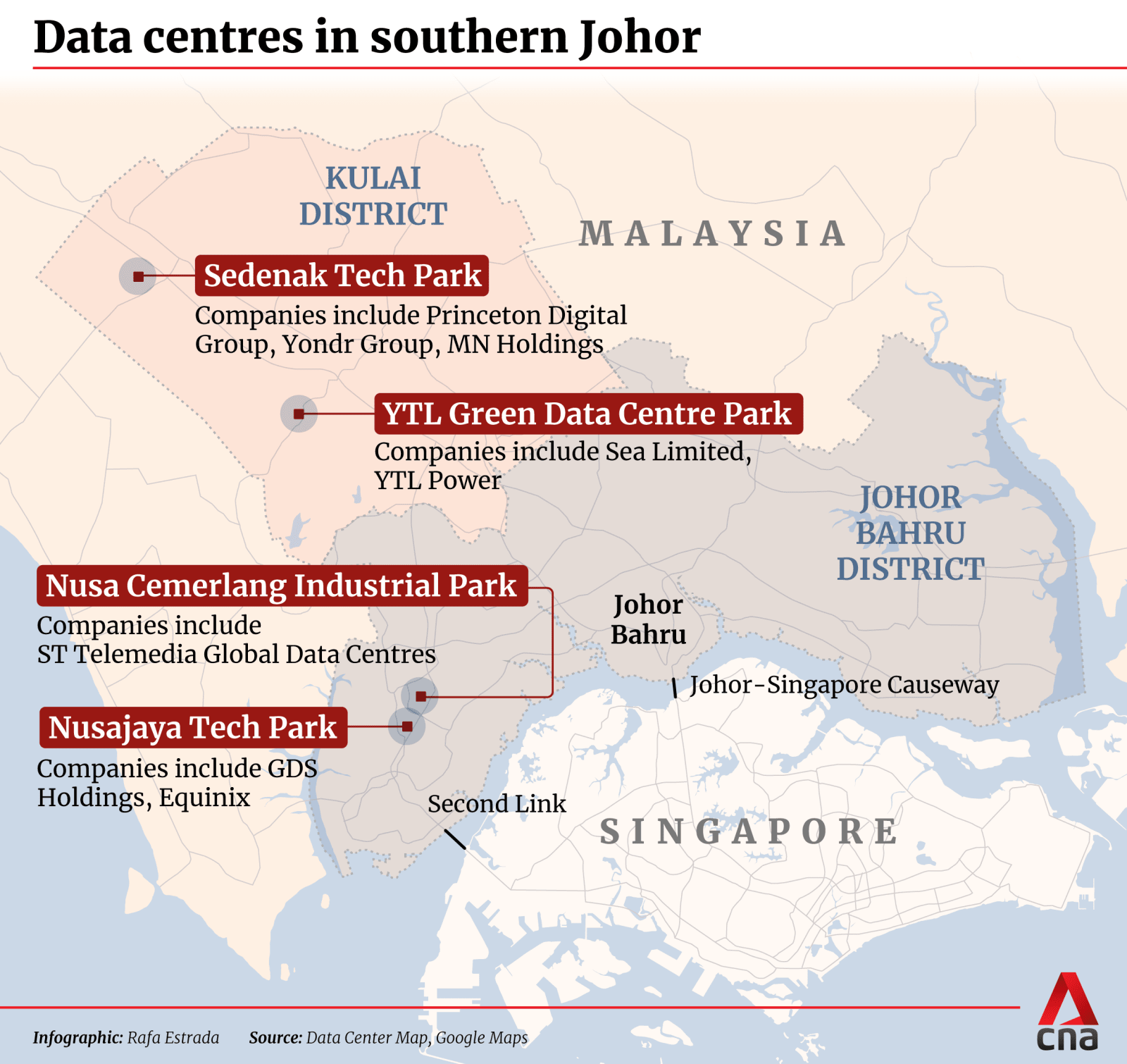

In particular, southern Johor, with its proximity to the Singapore's financial hub and comparative advantages like abundant land and cheaper power, could be well-positioned to be a key regional player, experts say.

Major data centre players like Nvidia, AirTrunk, GDS International, YTL Power as well as Princeton Digital Group have set up operations there, and tech giant Microsoft has reportedly purchased land in Kulai to open a data centre.

According to resource site Baxtel, Johor has 13 data centre facilities across more than 1.65 million square feet of land mass. The state is also ranked as the largest data centre market in Malaysia and ninth-largest in Asia Pacific. Baxtel added that four other data centres are being constructed in Johor.

Johor is expected to pull RM17 billion (US$3.6 billion) in new data centre investments this year, building on RM51.1 billion in investments in 2022, according to Malaysian property agency Zerin Properties.

The Malaysia government has also supported Johor’s data centre ecosystem by building industrial parks with suitable infrastructure. Two of the biggest are the 745-acre Sedenak Tech Park (STeP) and 509-acre Nusajaya Tech Park.

Elsewhere in the country, data centres are spread across the Klang Valley, Penang, Kedah and Sarawak. Cyberjaya, dubbed Malaysia’s tech capital near Kuala Lumpur, reportedly has 13 data centres in operation.

However, it caters to the domestic market while Johor caters to multinational corporations with regional presence, digital economy experts told CNA.

According to a report by real estate agency Knight Frank, the data centre market in Johor is expected to surpass Greater KL in terms of “live capacity”.

JOHOR COULD APPEAL TO US, CHINA FIRMS

Johor’s data centre boom is driven by its proximity to land-scarce Singapore which, between 2019 and 2022, paused new data centre development.

Another factor is United States-China strategic competition, which has spurred corporations from China and the West to diversify and expand in Southeast Asia in the semiconductor and digital infrastructure space.

Malaysia has made international headlines for becoming an unlikely beneficiary of the US-China trade war, which has impacted the global supply chain in crucial sectors like semiconductors and manufacturing.

Various US semiconductor firms have set up shop in Penang, which has a free-trade zone and industrial parks. Cheap labour and its large English-speaking population are additional draws.

US curbs on Chinese technology, especially in higher-value chip activities such as wafer fabrication and integrated circuit design, could lead to a spillover effect on Johor’s data centre industry.

Dr Ong Kian Ming, Malaysia’s former deputy minister of international trade and industry, said the data centre industry in Johor would appeal to both sides of the aisle in the trade war.

“Not only is there demand coming from US-based companies but many Chinese companies are also looking for opportunities to invest in data centres in Johor and other parts of Malaysia,” he said.

“These are not well-covered in the press because many of these companies want to maintain a low profile lest they incur the attention of the US authorities,” added Dr Ong, who is also a board member of the Malaysian Investment Development Authority (MIDA), a government-linked agency which oversees investment initiatives across the country.

If different data centre ecosystems emerge to service Western firms and Chinese companies, this may not be a bad thing for Malaysia as it would be able to groom and recruit talent to serve these markets, he noted.

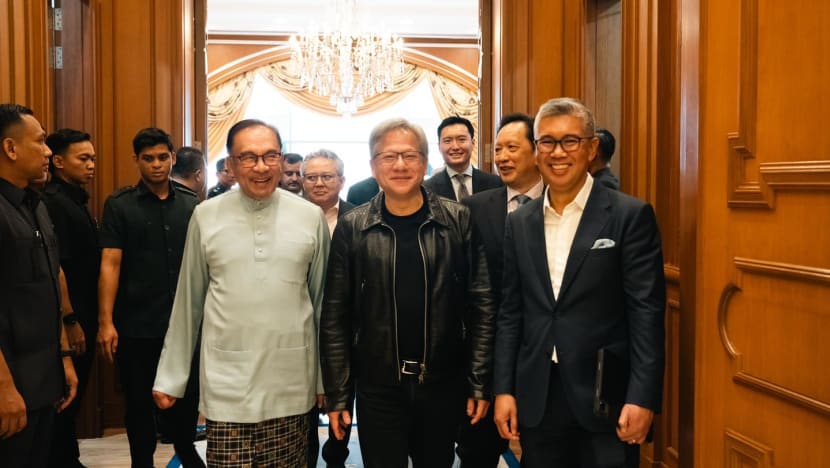

Citing a US$4.3 billion deal between Malaysia utilities conglomerate YTL Power and US technology giant Nvidia announced in late 2023 to develop artificial intelligence (AI) infrastructure in YTL’s data centre facility in Kulai, Dr Ong said it shows how Malaysia could also enjoy a spillover from semiconductors to the data centre industry and AI space.

One of the key selling points of the YTL-Nvidia collaboration is that processing power from the AI infrastructure can be used by certain companies to come up with “new and customised software solutions which are powered by generative AI”, he said.

“With more data centres being built in Malaysia, if there are enough use cases for the deployment of this processing power (including in the generative AI space), then there will be a stronger argument to attract more semiconductor players (including Taiwan semiconductor giant TSMC) to set up in Johor to serve a larger data centre market from a hardware as well as software perspective,” he explained.

Managing director of YTL Power Yeoh Seok Hong said the AI factory will stimulate development of AI capabilities for “the entire region”. Its initial phase is expected to be ready by the first quarter of 2025.

Malaysia has the potential to meet the demand for AI compute power "both locally and as a regional hub", while Johor has "all the necessary elements to attract international players, engendering a natural growth in demand”, he added.

Chinese companies have also made inroads into the Johor data centre market.

Bridge Data Centres, a firm backed by Chinese tech firm ByteDance, announced the opening of its facility in STeP in October in a ceremony attended by Johor chief minister Onn Hafiz Ghazi.

Unlike Dr Ong, Mr Lee Ting Han, chairman of Johor’s state investment, trade and consumer affairs committee, is more hesitant to draw a direct correlation between the US-China trade war and Johor’s data centre growth. He said the southern state is a “net beneficiary” due to an enhanced tech and digital ecosystem.

LOWER COSTS PROMPT SPILLOVER FROM SINGAPORE

Johor’s proximity to Singapore has led many multinationals based in the city state to expand across the Causeway to take advantage of Johor’s cheaper land, construction costs as well as operating expenses, particularly electricity tariffs, for their data centres.

Associate Professor Lee Poh Seng of the National University of Singapore’s (NUS) faculty of engineering said Johor’s location is a “strategic advantage”.

“This proximity facilitates operational coordination and rapid physical access for management and maintenance purposes, ensuring businesses can leverage both locales' benefits,” said Assoc Prof Lee, a data centre expert.

He cited the example of Yondr Group, a Dutch-based firm with an Asia Pacific office in Singapore that has launched a data centre campus with 300MW capacity at STeP.

“It exemplifies how Johor utilises its land resources to attract significant international data operations,” added the academic.

Singapore faces constraints such as availability of land, power supply as well as sustainability concerns, said Nanyang Technological University's (NTU) Dr Wen Yonggang.

The Singapore government's pause on data centres' growth between 2019 and 2022 was in response to their considerable energy consumption, he noted.

“These challenges, including environmental regulations and space limitations, may incentivise corporations to explore alternative locations like Johor, where such constraints are less pronounced,” said Dr Wen.

Singapore’s Economic Development Board has also launched an “SG+” initiative to encourage multinationals to set up headquarters in Singapore to leverage the country’s network of free trade agreements and specialised skills in technology.

At the same time, the initiative encourages these firms to diversify their supply chains and expand their businesses to neighbouring areas like Johor and Batam, which have industrial parks and lower manufacturing costs.

The proposed Johor-Singapore Special Economic Zone (SEZ) should also boost Johor’s data centre investments, said Dr Ong.

A memorandum of understanding (MOU) on the SEZ was signed between Singapore’s Trade and Industry Minister Gan Kim Yong and Malaysia’s Minister of Economy Mohd Rafizi Ramli on Jan 11, with a full-fledged agreement expected by the end of the year.

The deal will see Singapore and Johor work towards boosting the cross-border flow of goods and people. Singapore and Malaysia are also exploring other initiatives leading up to the SEZ, including a passport-free clearance system on both sides of the border.

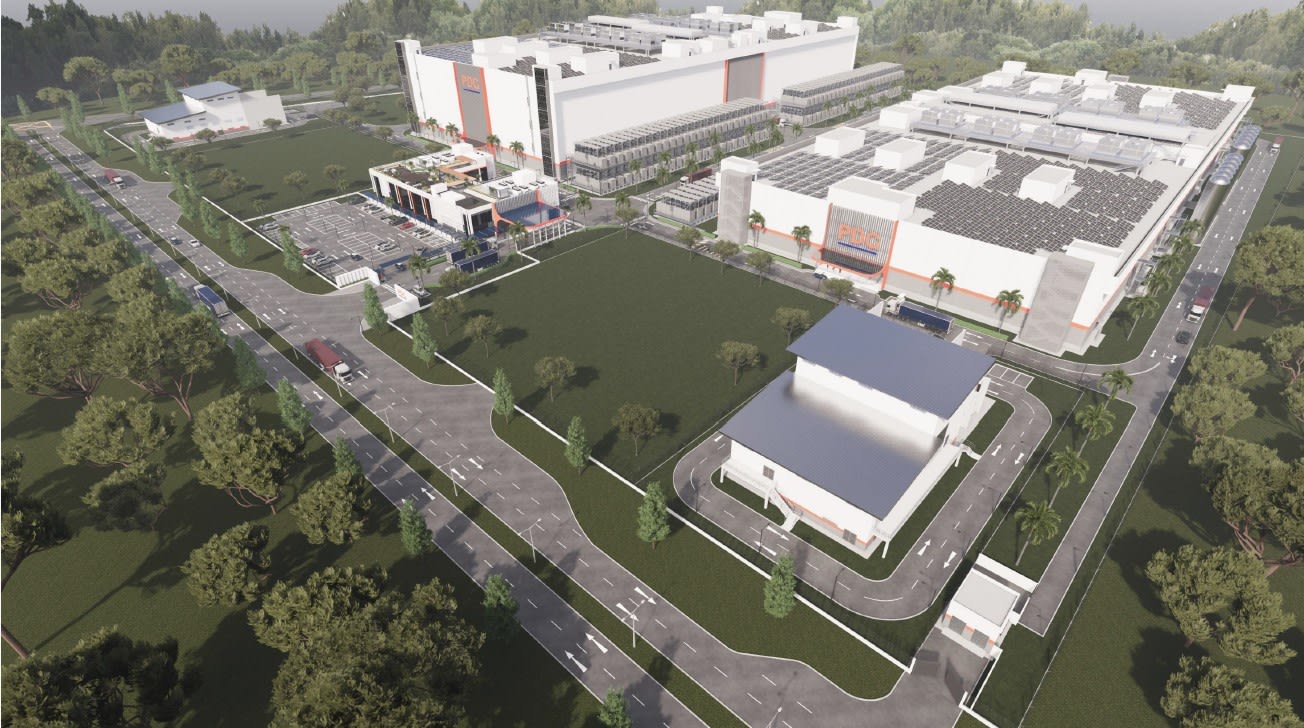

A Singapore firm which has opened data centre operations in STeP is Princeton Digital Group (PDG). The firm’s flagship greenfield facility, with a 150 MW campus, is set to open this year.

Malaysia is PDG’s sixth market after Singapore, China, Indonesia, India and Japan.

Mr Asher Ling, chief technology officer and managing director of PDG, Singapore, told CNA that expanding into Johor is in line with the SG+ strategy. He cited Sedenak’s pull factors such as “distance and connectivity”.

“In addition to its strong power and connectivity infrastructure, the area also offers proximity to high-growth tech markets such as Singapore, which is about 40 minutes away,” he added.

Mr Lee Ting Han stressed that the southern state sees itself not as a competitor to Singapore on this front, but a partner.

The Johor state government is pushing for the SEZ to be in place by the first quarter of 2025 as it hopes to leverage both sides’ “complementary strengths” across sectors including the digital economy and data centres.

TACKLING WATER SHORTAGES AND POWER OUTAGES

While there is optimism about Johor’s potential to be a data-centre hinterland for companies in Singapore, some experts warn that the industry is energy-intensive and requires a copious amount and consistent supply of water and power. Johor has experienced periodic disruptions to both recently.

In April, parts of southern Johor reportedly experienced water shortages during the Hari Raya period, prompting the state government to urge the state’s main water supply company Ranhill SAJ to deploy water tanks at hotspot areas.

Water disruptions also impacted residents as some reportedly complained of not having access to water to drink and shower with.

In 2019, more than 250,000 residents in various parts of Johor including Kulai, Kota Tinggi and Simpang Renggam were hit by water shortages, prompting the state government to impose water rationing.

Parts of Johor have also experienced power outages. In December 2023, Malaysia’s checkpoint building linked to the Woodlands Causeway, known as the Bangunan Sultan Iskandar Customs, Immigration and Quarantine Complex (BSI CIQ), suffered hours-long power cuts.

These incidents are “indeed concerns” for Johor’s data centre industry, but “not necessarily insurmountable obstacles”, said NTU’s Dr Wen.

“Continued efforts to improve water and power infrastructure in Johor, along with proactive measures to address environmental sustainability with emerging technologies (e.g. AI, digital twin) developed in Singapore, can further support the growth of the data centre industry while mitigating potential risks associated with water and power supply,” he said.

Malaysian economist Lee Heng Guie, who is executive director of the Socio-Economic Research Centre (SERC), said four data centre players in Johor – AirTrunk, YTL Power, GDS and Yellowwood Properties – have inked electricity supply agreements with the national utility Tenaga Nasional to ensure sufficient reserve capacity within the installed infrastructure for consistent power supply.

“Tenaga also takes proactive steps to address both the growing demand for electricity and environmental concerns. These include the use of renewable energy such as solar, energy-efficient technologies and collaborating with data centres to promote energy efficiency and environmentally responsible practices,” he added.

Mr Lee Ting Han said both the federal and state authorities have demonstrated political will to overcome these shortcomings.

The state government is building the country's largest substation in Sedenak which could house 1 gigawatt of power. He added that his team has also drafted guidelines for data centre companies to employ technologies to save recycled water or implement liquid cooling systems to reduce water usage.

“At the same time, we are also trying to help the water utilities companies to lay more pipelines and to redirect and channel the resources to the right place,” he said.

Johor’s economy could outpace that of other Malaysian states in the next couple of years, especially with high-impact projects on the horizon, Prime Minister Anwar Ibrahim said last month.

By 2025, the digital economy sector is expected to contribute 25.5 per cent to Malaysia's gross domestic product (GDP). Malaysia is also aiming to increase its GDP per capita from roughly US$12,000 to US$13,000.

Mr Lee Ting Han believes attracting foreign companies to offer quality digital economy jobs is one of the solutions.

“We need that push, that catalyst so that we can move up the value chain and become a higher income nation,” he said.