Headwinds facing China’s first airliner C919 in muscling into aviation market despite global debut at Singapore Airshow

There’s been plenty of buzz over the made-in-China passenger airliner's maiden show in Singapore, with extensive reports by international news outlets as well as prominent coverage by Chinese media.

China's Comac C919 airplane flies past during the Singapore Airshow in Singapore on Feb 20, 2024. (Photo: AFP/Roslan Rahman)

This audio is generated by an AI tool.

SINGAPORE: China faces major headwinds in getting its global aviation ambitions truly off the ground, analysts say, even as it logs a milestone with the international debut of its first homegrown large passenger jet, the C919.

While observers acknowledge the “opportune” timing of the showcase at Asia’s largest aviation event, the Singapore Airshow, they point out how the C919’s wings are clipped in international skies due to the lack of certification by Western regulators.

“That is a really critical step, because it's impossible to fly this aircraft commercially in any country other than China at this point. So certification is very important,” aviation analyst Brendan Sobie told CNA.

Adding on further turbulence is the C919’s exposure to geopolitical risk and supply chain issues due to current reliance on imported components, observers note.

The C919 is expected to soar higher on the domestic front instead. But the jury is still out on whether it can dislodge Airbus and Boeing in the local arena. The two aviation giants all but own the skies, dominating about 99 per cent of the large plane market.

Airbus has said it doesn’t expect competition from the C919 to “rock the boat in particular”, while Boeing has said it’s ready for competition.

“OPPORTUNE” TIMING FOR GLOBAL DEBUT

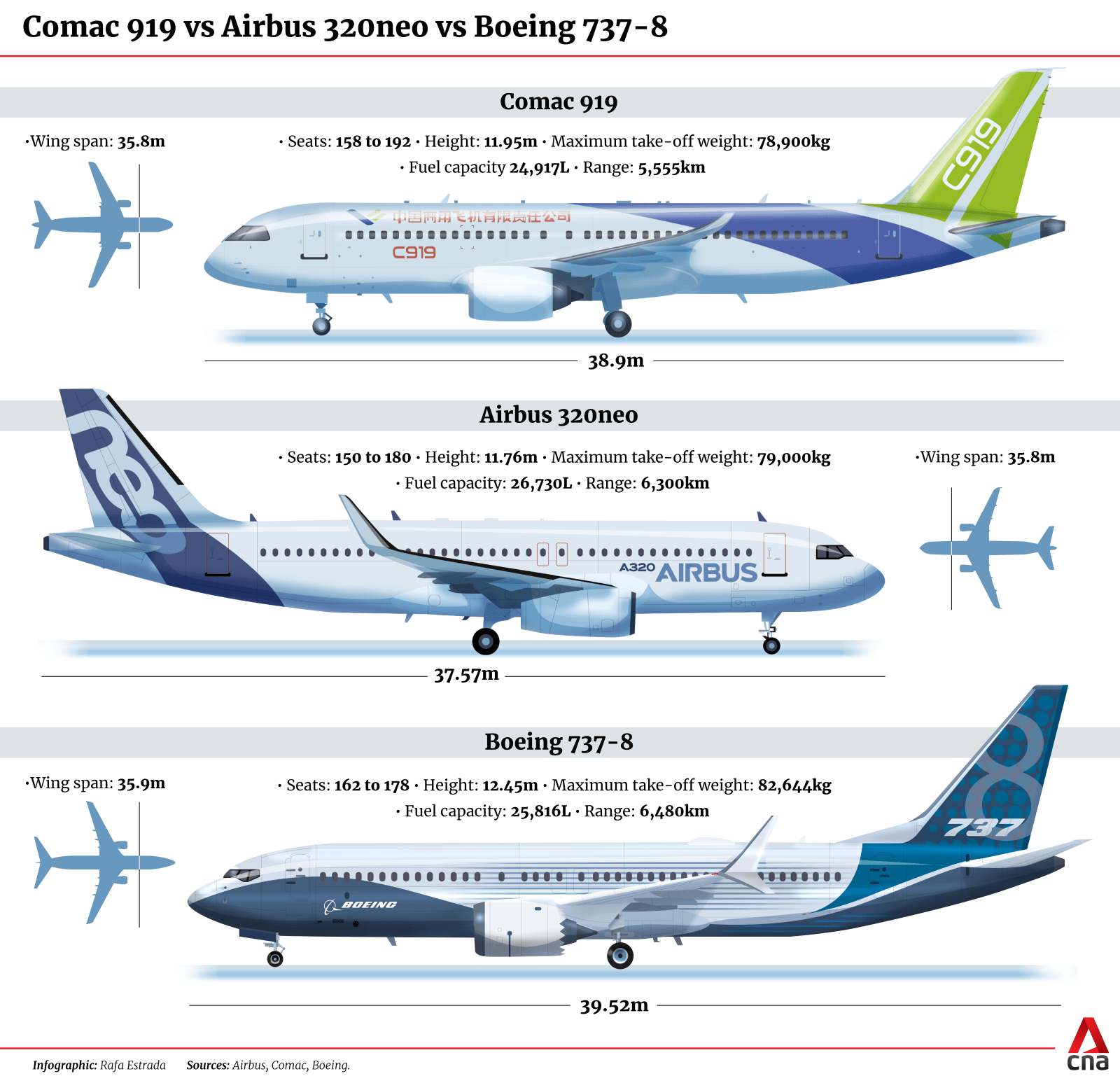

The C919 is manufactured by the state-owned Commercial Aircraft Corporation of China (COMAC). It is locally developed and seats between 158 and 192 passengers, depending on the configuration.

Production of the narrow-body airliner first began in 2011. The C919’s first commercial flight took place in May last year, travelling from Shanghai to Beijing.

Related:

The jet marked its maiden flight outside Chinese territory last week when it flew to Singapore for the airshow. A fly-by was subsequently staged on Sunday (Feb 18).

There’s been plenty of buzz over the made-in-China airliner, with extensive reports by international news outlets as well as prominent coverage by Chinese media.

Aviation, government and investment professionals thronged to the C919’s display at the Singapore Airshow, according to Reuters.

COMAC is positioning the C919 as an alternative to Airbus and Boeing passenger jets as both aviation giants struggle to meet demand for new planes, with the latter grappling with a string of safety issues.

Against this backdrop, analysts agree that the Singapore Airshow is optimal for the C919 to make its international debut.

“The timing is opportune now more than ever as aircraft orders between Airbus and Boeing continue to mount, leading to rapidly increasing order backlog,” said Mr Shantanu Gangakhedkar, a senior consultant at growth advisory firm Frost and Sullivan.

“There have also been certain supply chain challenges leading to delay in order fulfilment,” he told CNA.

Mr Sobie, analyst and consultant at Sobie Aviation, agreed on the “ideal” timing for the C919’s global showcase, while also pointing out how Boeing’s safety woes present an opportunity for COMAC.

Boeing 737 MAX planes were grounded for close to two years in 2019 and 2020 following two crashes that killed a total of 346 people.

More recently, a door plug on a Boeing 737 Max flown by Alaska Airlines blew out soon after taking off. The incident prompted US aviation regulators to temporarily ground scores of Boeing 737 MAX 9 planes for safety inspections.

“From a timing perspective, given Boeing’s situation, airlines around the world are more keen these days to consider a third option when looking at narrow-body aircraft campaigns,” said Mr Sobie.

TURBULENCE IN A GLOBAL TAKE-OFF

That being said, China faces major headwinds in its ambitions to stamp its mark on global passenger aviation.

Regulatory hurdles are the sticking point, say analysts as they point out that COMAC’s C919 has not been certified by US and European aviation regulators. Only Chinese regulators have certified the C919 thus far, giving the green light in September 2022.

Getting approval from regulators like those in the US and Europe is “most crucial” in becoming “widely accepted” and operating globally in international skies, Mr Shantanu told CNA.

According to Reuters, China's aviation authority said last month it would this year pursue European Union Aviation Safety Agency (EASA) validation for the C919, a process which began in 2018.

“The industry is currently in wait and see mode … be it certification or order fulfilment amongst other factors,” said Mr Shantanu.

Another obstacle confronting COMAC is the C919’s exposure to geopolitical risk and supply chain issues, due to its reliance on imported parts and technology.

A 2020 analysis by the Center for Strategic and International Studies, a US think tank, estimated that more than 80 per cent of the C919’s major component suppliers were from the US and Europe.

“All the systems, engines, and avionics that make the C919 fly are Western,” said Mr Richard Aboulafia, managing director of aviation consultancy AeroDynamic Advisory.

“If they want a true (Chinese) aircraft, one that allows them to be self-sufficient for some reason, that will take many more billions of dollars and many more years than they have already invested in the C919,” Mr Aboulafia added.

Frost and Sullivan’s Mr Shantanu pointed out that while COMAC is working on increasing the share of domestically supplied parts, this will “take some time”.

Observers say COMAC also needs to contend with building up a global support and maintenance network for the C919.

“(This) is a long and expensive process that Airbus and Boeing have gone through already,” Aviation Week Network’s Jen Flottau told CNA at the Singapore Airshow.

Echoing this, Mr Aboulafia said it would take “billions of dollars and many years”, adding that COMAC also needs to learn “how to build (the C919) in a consistent fashion”.

“If they do these, it’s possible that the C919 will make inroads against Airbus and Boeing,” he told CNA.

Meanwhile, Chinese state media have struck a tempered tone.

“We position the C919 as a participant in the international market, not a challenger. The C919 is just getting started, and there is still a long way to go,” read a Global Times editorial published on Tuesday.

FLYING HIGH IN DOMESTIC SKIES?

Amid the overcast outlook for international skies, recent data points to the domestic market holding more promise for Chinese aviation.

COMAC entered the Singapore Airshow having already received more than 1,000 C919 orders, mostly from Chinese airlines and lessors, according to Chinese state media.

China’s Tibet Airlines finalised an order for 40 C919 jets and 10 ARJ21 regional jets from COMAC on the sidelines of the Singapore Airshow on Tuesday.

Still, there are currently only four C919 aircraft in active service - all with China Eastern.

“I believe COMAC will be busy for the next two to three years delivering orders placed domestically while the certification aspect evolves,” Frost & Sullivan’s Mr Shantanu told CNA.

COMAC will invest tens of billions of yuan over the next three to five years to expand C919 production capacity, Chinese media reported a COMAC official saying in January.

China will account for 20 per cent of global aircraft deliveries over the next two decades, Boeing forecasted in its commercial market outlook, published in September last year.

According to the outlook, China’s domestic aviation market will become the largest in the world over that time.