With zero fees and maximum flexibility, this personal loan is redefining borrowing

GXS FlexiLoan provides support in managing unexpected situations with ease.

Personal loans act as a lifeline for many consumers, says Ms Jenn Ong, head of retail at GXS Bank. Photos: GXS Bank

Amid mounting inflation and rising living expenses, it’s no surprise that some individuals are turning to personal loans to ease their cash flow challenges.

“For many consumers, personal loans can be a lifeline, especially when unexpected crises arise, such as medical emergencies. However, the process of researching, applying for and awaiting loan approval during such times only compounds stress and anxiety,” said Ms Jenn Ong, head of retail at GXS, a digital bank backed by Grab Holdings and Singtel.

In response to the demand for a flexible personal loan solution, GXS has introduced GXS FlexiLoan, a personal credit line offering customers prompt access to cash reserves through a few taps on their smartphones.

A personal loan may seem like a quick fix in a financial pinch, but it entails a certain level of commitment. From maintaining timely repayments to navigating hidden fees, it’s understandable why many individuals harbour reservations about engaging with such products. Ms Ong sheds light on common concerns surrounding personal loans.

“Taking a bank loan entails substantial costs.”

While most people who take on personal loans are mindful of interest rates, it is important to consider the broader spectrum of associated fees. These include a one-time processing fee to cover administrative costs, an annual fee for loan account maintenance and late payment fees imposed when borrowers miss scheduled payments or make only partial repayments by the due date. A fee that often takes borrowers by surprise is the penalty fee imposed for early full repayment as compensation for potential lost interest income for the lenders.

A GXS survey in March 2023 revealed that 77 per cent of respondents expressed a desire to repay their loans ahead of schedule. However, they are put off by obstacles such as early repayment penalties and the absence of interest reductions.

GXS FlexiLoan distinguishes itself by being the first bank product to offer interest savings for early repayments. Borrowers enjoy the benefit of no early repayment fees when settling their instalments ahead of schedule. GXS is also the first bank that does not collect annual fees and processing charges typically associated with maintaining such lines of credit. Furthermore, GXS does not levy late fees, though late interest charges applies in the event of delayed repayments.

“The loan terms offered by banks do not fit my needs.”

In the same survey, at least half of the respondents expressed a preference for loan tenures of under 12 months.

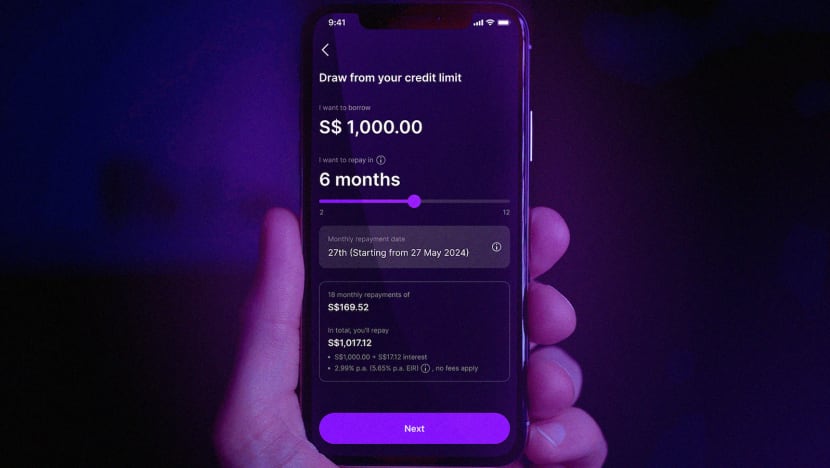

With GXS FlexiLoan, customers have the flexibility to borrow up to 10 instalment loans with loan amounts from as small as S$200. Customers may also tailor the duration of their instalment loan according to their needs – from as low as a two-month tenure – and select the monthly repayment date that best fits their cash flow needs.

This flexibility is especially valuable for individuals seeking short-term financing to address minor expenses. Gig workers and entrepreneurs, whose monthly incomes can fluctuate, may encounter unforeseen circumstances that impact their ability to cover essentials like insurance premiums and their children’s education expenses. Such flexibility is crucial in helping individuals deal with unexpected scenarios while empowering them to manage their finances in a way they see fit.

“I will get saddled with high interest charges.”

GXS FlexiLoan combines the best features of a fixed-term personal loan and a standby revolving credit line. Customers can apply for the line of credit without an immediate need to use it, thereby securing a financial safety net for unexpected expenses.

Upon successful application, GXS will share the personalised interest rate with the applicant. Interest rates start from 2.99 per cent per annum, with effective interest rate (EIR) at 5.65 per cent per annum. EIR incorporates all borrowing costs, including fees and charges, over a year. Interest is only charged on a borrowed instalment loan; if the customer does not draw a loan from their GXS FlexiLoan credit limit, no interest is charged. Interest on the instalment loan is calculated on a daily, non-compounding basis on the outstanding balance. This means that interest accrues only on the exact amount owed each day.

According to Ms Ong, other banks typically charge interest on the outstanding amount monthly. “GXS FlexiLoan uses a daily rest model for interest calculations. Interest is computed based on the outstanding balance at the end of the previous day. If a prepayment is made, the outstanding amount is reduced, which decreases the interest charges the following day, resulting in immediate interest savings.”

“I don’t earn enough to qualify for a loan.”

Ms Ong revealed that about 25 per cent of GXS FlexiLoan customers possess either minimal or no credit bureau history. This could be due to them being early-jobbers or entrepreneurs who do not draw a fixed monthly income.

Said Ms Ong: “These individuals are unlikely to obtain a loan or a loan size that they need because of prevailing market practices that assess creditworthiness based on credit bureau scores.”

GXS FlexiLoan was created in part to address this market gap. “We are able to extend loans to individuals like gig workers without compromising our risk appetite by tapping into additional data points from our ecosystem powered by Grab and Singtel,” shared Ms Ong.

“It’s faster to get the money from other sources.”

During emergencies, the waiting period for loan approval can exacerbate stress. Depending on internal bank procedures and the applicant’s creditworthiness, the review of documents and assessment of credit risk may take several days before approval is granted.

In contrast, drawing down a loan with GXS is seamless. Customers download the app to apply for their GXS FlexiLoan credit line account. Once the application is approved, customers will be granted a credit limit. Customers can then proceed to draw an instalment loan by specifying their desired loan amount, select a repayment tenure ranging from two to 60 months and indicate their preferred monthly repayment date. The customer will then receive the funds in their preferred bank account within minutes.

Access to financial help should not impede your ability to plan for a better future. With zero fees and the flexibility to tailor your personal loan, GXS FlexiLoan redefines what it means to borrow money from a bank.

A loan can be a tool to help you achieve your goals. However, it is important to understand what you are borrowing, the terms and conditions, as well as the monthly repayment schedule and amount so that you can make an informed decision.

Download the GXS app from the Apple App Store or Google Play Store. From now till Jun 30, 2024, sign up for and utilise your GXS FlexiLoan and stand to receive a S$50 Grab voucher and a chance to win prizes in its anniversary giveaway. Prizes include a home makeover, an overseas adventure for two and an iPhone 15 with Singtel mobile bills waived for a year. For the full terms and conditions on GXS FlexiLoan and the campaign, visit gxs.com.sg/flexiloan. All figures in the images are illustrative only.

GXS is a digital bank backed by Grab and Singtel. GXS FlexiLoan is provided by GXS. GXS holds a banking licence and is regulated by the Monetary Authority of Singapore. GXS is a separate entity and is not associated with the businesses of Grab Holdings, Singtel and their entities.