Solving accountancy’s talent problem through digital transformation

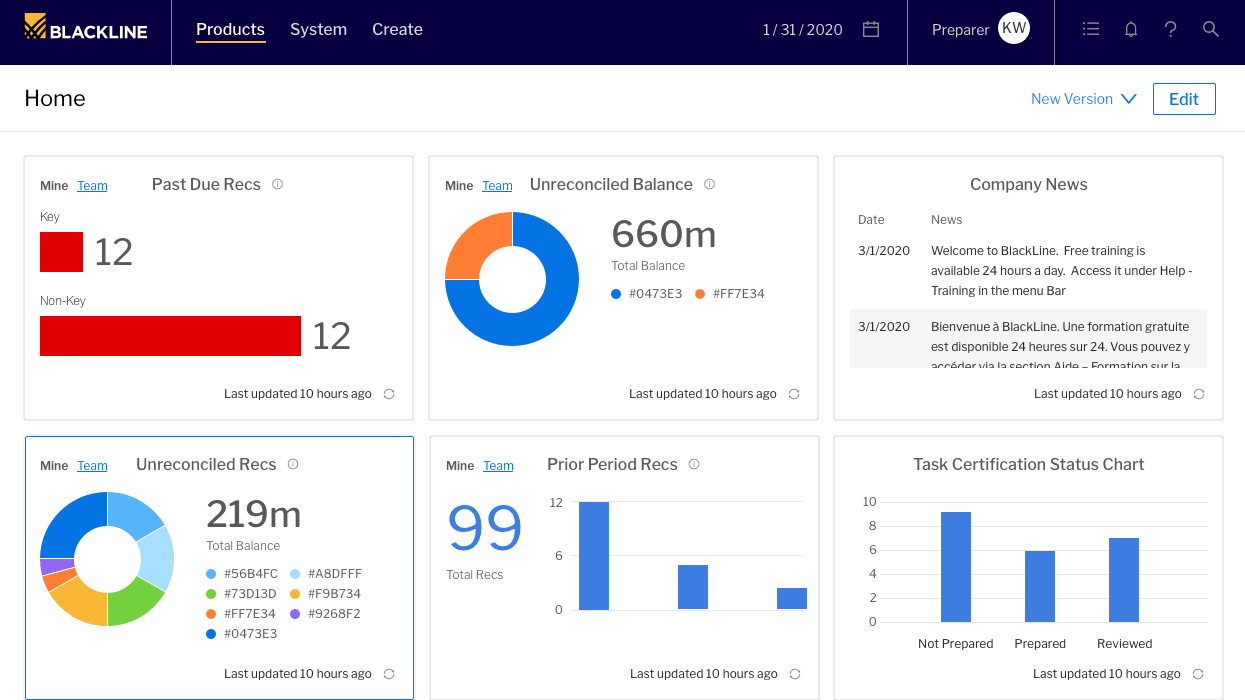

By harnessing the power of cloud-based accounting automation software like BlackLine, organisations can eliminate inefficiencies and tackle the long-standing challenge of talent scarcity in the sector.

Automation will allow accountants to focus on more high-value work. Photos: Shutterstock

Over the past decade, the field of accounting has experienced significant transformations, with the COVID-19 pandemic acting as a catalyst for further change.

During the pandemic, accountants had to perform complex assessments such as mitigating risks associated with disrupted supply chains, remote work environments and financial uncertainties. They also played a pivotal role in evaluating the financial impact stemming from these risks and ensuring compliance with changing regulations.

The demands of these high-level tasks have rendered traditional manual data entry, review and revisions increasingly impractical for accountants. These processes are not only tedious but prone to human error.

“The advancement of computing and technology has revolutionised the traditional accounting function by simplifying and streamlining processes, particularly in auditing, taxation and inventory management,” said Mr Lee Thompson, senior vice president (Asia Pacific and Japan), BlackLine.

He added that the next generation of accounting professionals will need to add digital skills to their toolbox as their roles evolve and diversify: “Besides standard accounting competencies, familiarity in emerging areas such as data analytics and artificial intelligence will be crucial.”

EMPOWERING FINANCE AND ACCOUNTING PROFESSIONALS

According to a 2022 global survey conducted by BlackLine, 37 per cent of Singapore respondents revealed that identifying manual errors in the month-end financial close process was one of the biggest challenges for finance and accounting (F&A) teams.

The process usually involves reconciling vast amounts of transactions across multiple data sources. But with BlackLine’s transaction-matching function, data can be unified in the cloud and business roles matched to transactions in minutes. Automating this process enables accountants to take on more critical work, such as handling exceptions and reviewing open items.

Ms Wong Lai Ping, corporate controller at Maxeon Solar Technologies, said that her organisation has enjoyed significant cost savings and greater efficiencies since implementing BlackLine for transaction matching, account reconciliation and task management.

Speaking at a panel discussion at the recently concluded Finance Transformation Series (FTS) organised by BlackLine, she said: “We are now looking at automating our journal entries with BlackLine. This should lead to even more time and cost savings which will, in turn, result in improved work-life balance for our team members. It will also allow them to take on more value-added work to support the growth of the business.”

Productivity and efficiency aside, automation also has the potential to ignite newfound interest in the sector, said Mr Thompson. He highlighted how universities in Singapore have witnessed a decline in interest among top students to pursue accountancy degrees, resulting in a drop in entry criteria.

“Many of the pain points relating to the F&A talent shortage highlight the need to elevate the sector’s image. For decades, the profession has focused on transactional and manual tasks, leading to the perception that clunky spreadsheets are a defining characteristic,” he said. “But when technology takes over repetitive tasks, F&A professionals can spend their time on work that is more meaningful, such as strategic counsel.”

THE IMPORTANCE OF PROPER CHANGE MANAGEMENT

Investing in the right technology is just the first step. The success of its rollout will also depend heavily on the company’s ability to handle change during the transition period.

“During the initial stages of transformation, teams will have to manage business-as-usual work while grappling with new technology, which can be stressful,” said Mr Tee Ming Jir, vice president (corporate transformation) at Singtel, who was also part of the panel discussion at FTS.

“In the beginning, you may need to invest in external resources or consider deploying additional resources [to the accounting department],” he added. “But once your teams have had that first taste of success, it will be easier to get people on board with the new technology.”

The implementation phase will also need to be well planned out so employees won’t feel alienated from the process.

To that end, BlackLine has developed a framework to help businesses in their digital transformation efforts. “Our modern accounting playbook maps out a step-by-step approach for the adoption of software solutions to help organisations modernise their F&A functions,” Mr Thompson said, adding that new users can also tap on the BlackLine U learning portal for onboarding.

THE FUTURE OF ACCOUNTING

In today’s fast-paced work environment, there is limited room for manual journal entries, reconciliations in spreadsheets, or hunting for paper trails for audit purposes. These outdated and error-prone processes not only erode confidence in the accuracy of companies’ financial data but may also be a factor deterring the next generation of would-be accountants from taking up the mettle.

A cloud-based accounting automation software like BlackLine can help drive efficiencies and empower accountants to do more meaningful work. “It gives accountants more opportunities to exercise their capabilities with tactical tasks, which will help address the talent attraction and retention issue we’ve been seeing for a while,” said Mr Thompson.

Find out how BlackLine can help you automate your accounting processes today.