Chart a path to financial security in your senior years with Retirement digiPortfolio

DBS, in collaboration with J.P. Morgan Asset Management, introduces Asia’s first age-adaptive retirement investment portfolio designed to complement your retirement income.

Set the stage for retirement with a comprehensive approach by nurturing diverse income streams. Photos: Shutterstock, DBS

This audio is generated by an AI tool.

While retirement might seem distant, it’s essential to start planning early. According to Mr Adrian Low, product manager of DBS digiPortfolio, laying the groundwork ahead of time allows your savings to benefit from compounding returns over an extended period.

However, a recent study by the SMU Centre for Research on Successful Ageing revealed that only 34 per cent of Singaporeans aged 53 to 73 felt good about their retirement readiness. Some 27 per cent lacked a retirement plan altogether.

“While the majority recognise the need for early retirement planning, many struggle to determine the right time or life stage to start,” noted Mr Low.

To ensure you’re retirement-ready, DBS has collaborated with J.P. Morgan Asset Management (JPMAM) to introduce Retirement digiPortfolio. The investment solution aims to grow your retirement savings and facilitate regular drawdowns to complement other funding sources such as CPF Life, traditional annuities and endowment plans, collectively providing a stable income stream when you bid farewell to the daily grind.

MAPPING AN INVESTMENT JOURNEY TO RETIREMENT

Long-term investors would be familiar with the benefits of actively maintained, well-diversified portfolios, which are plentiful in the market. These portfolios are typically managed with a focus on current market perspectives to determine the asset allocation mix.

In a similar vein, Retirement digiPortfolio offers access to a professionally constructed portfolio, providing diversified exposure across various markets.

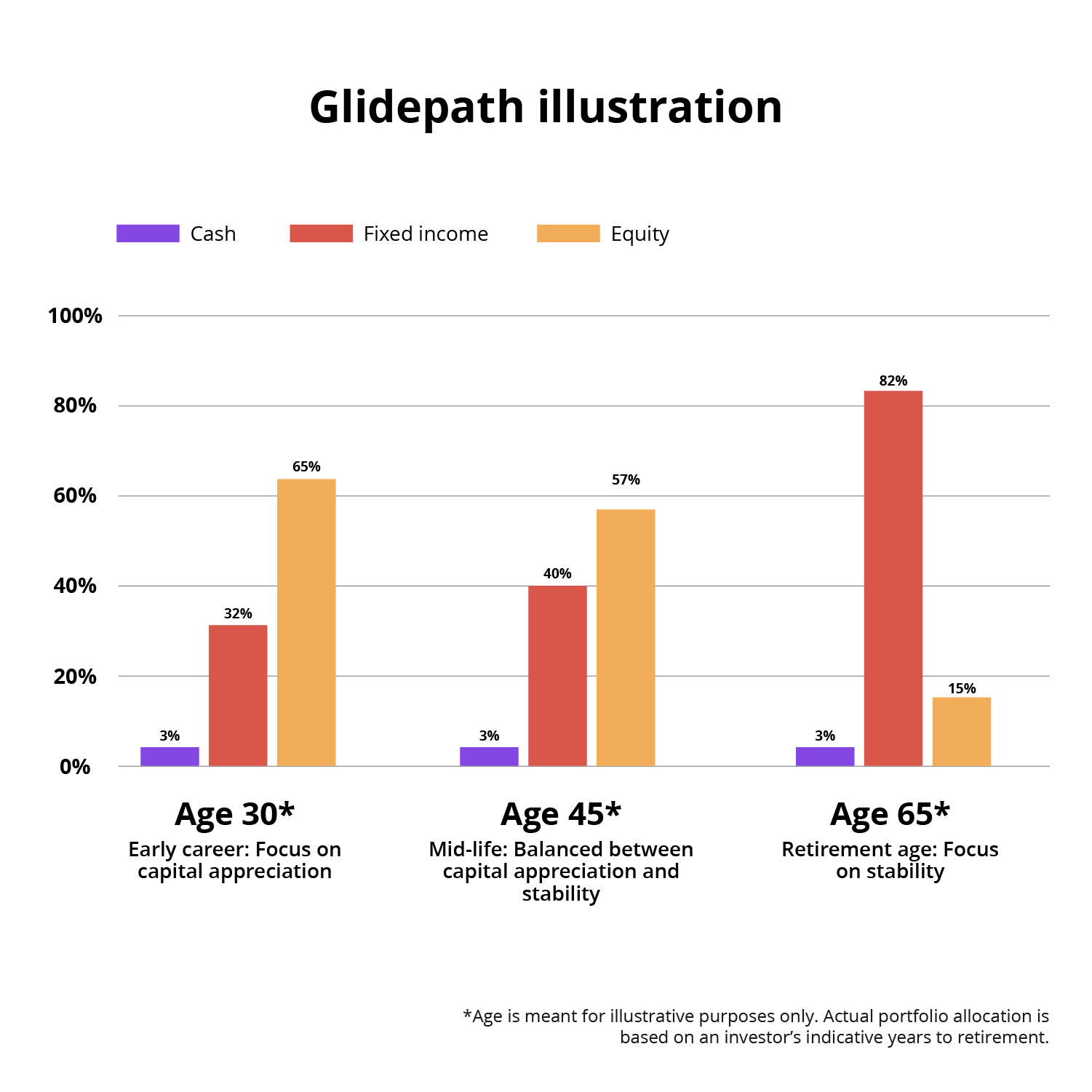

However, the solution goes a step further by considering your time horizon to retirement, presenting a tailored approach that evolves as you journey towards the golden years. Shared Mr Low: “The solution utilises a strategy known as glidepath, which adjusts the portfolio’s mix of assets based on how close you are to retirement.”

For instance, the portfolio for a younger customer would focus on leveraging a longer investment horizon to seek capital appreciation with greater exposure to equities versus fixed income.

As the customer ages, the portfolio will gradually reduce risk by holding more in fixed income, gliding from riskier to more stable assets. The de-risking of each portfolio occurs annually on the investor’s birthday.

“While the glidepath strategy is not new, especially in the United States, the product options available are often based on cohorts that run to a specific year. Retirement digiPortfolio is based on the number of years to retirement rather than an actual end date,” said Mr Low.

One such product is the target date fund, which has a fixed retirement date set at five- or 10-year intervals. This means clients might not find an option that exactly matches their retirement timeline. However, Retirement digiPortfolio leverages technology to overcome this constraint by offering clients a solution that aligns with their retirement age. It also provides the flexibility to adjust the latter as desired, with their portfolio mix adapting accordingly. Crucially, it maintains the same rigorous standards of thorough research and active portfolio management associated with such products.

Additionally, Retirement digiPortfolio offers considerable flexibility, with no lock-ins or penalties for accessing funds when needed. Investors can also track portfolio movements directly from the DBS digibank app.

What’s more, you can begin your retirement journey with just S$1,000. Investors are encouraged to contribute a monthly amount, such as S$100, to the portfolio. This strategy, known as dollar-cost averaging, entails consistently investing a fixed amount regardless of market changes in order to build a solid financial foundation.

Mr Ng Bing Hua, a 34-year-old investor who participated in the pilot run, appreciates how Retirement digiPortfolio does not require extensive monitoring and research, leaving him more time to pursue his passions. He said: “Age-based rebalancing and risk management services are usually only available to ultra-high-net-worth clients. It’s great that I have access to them now through Retirement digiPortfolio.”

TO RETIREMENT AND BEYOND

Ideally, retirement planning should extend beyond the point of retiring. In fact, determining the appropriate withdrawal amounts and longevity of your retirement savings remains a significant consideration.

In a feature slated for launch later this year, Retirement digiPortfolio will allow investors to automate drawdowns from their investment capital. Moreover, investors will have the freedom to amend or pause their recurring drawdown amounts should circumstances change.

More importantly, investors will receive an estimate of how long these drawdowns will last, providing a clear overview of how they synergise with other retirement income sources. This is especially useful given Singapore’s high global ranking in life expectancy.

Furthermore, a DBS financial health report published last year found that increasing expenditures disproportionately affected baby boomers, aged 59 to 77, with their expenses making up 86 per cent of their take-home income, more so than other age demographics. Mr Low highlighted the importance of tackling rising living costs, along with increasing life expectancies. Consequently, the management of Retirement digiPortfolio continues post-retirement to allow customers to remain invested even as they begin drawing down funds.

Said Mr Low: “If markets become volatile as retirement nears, it can put a damper on years of otherwise diligent planning. We can help mitigate this through DBS’ holistic retirement planning proposition, where Retirement digiPortfolio dovetails with other passive income streams, so customers can feel more secure about retiring.”

Ease your retirement jitters by learning more about DBS’ Retirement digiPortfolio.